Moving back to India is a huge step. Many NRIs have been contemplating the effects of moving back to India from UAE given the present situation in the gulf. There has been an upsurge of job losses, international travel guidelines have strengthened and many other factors are contributing to the uncertainties around a continuous stay abroad.

In this article, we will cover:

- Moving Back to India from UAE: The Factors

- Moving back to India from UAE: The Checklist

- Moving Back to India from UAE: The Sentiment

Also Read: NRI Quota: Eligibility | List of Colleges | Documents Required

Moving Back to India from UAE: The Factors

Amid such times, it is essential to evaluate certain factors before you make up your mind to retire in India for good. These factors are:

- Residential Status: Evaluating the changes in your residential status post your return and the associated effects.

- Financial Changes: Changes regarding your bank accounts, taxation and investments in India.

- Sustainability Factors: Sorting your Job, Necessary documentation, planning your insurances and education for your children.

In this article we will explore these factors and make a checklist to prepare you well before you book your return flights to India from the UAE. Let’s begin!

Moving back to India from UAE: The Checklist

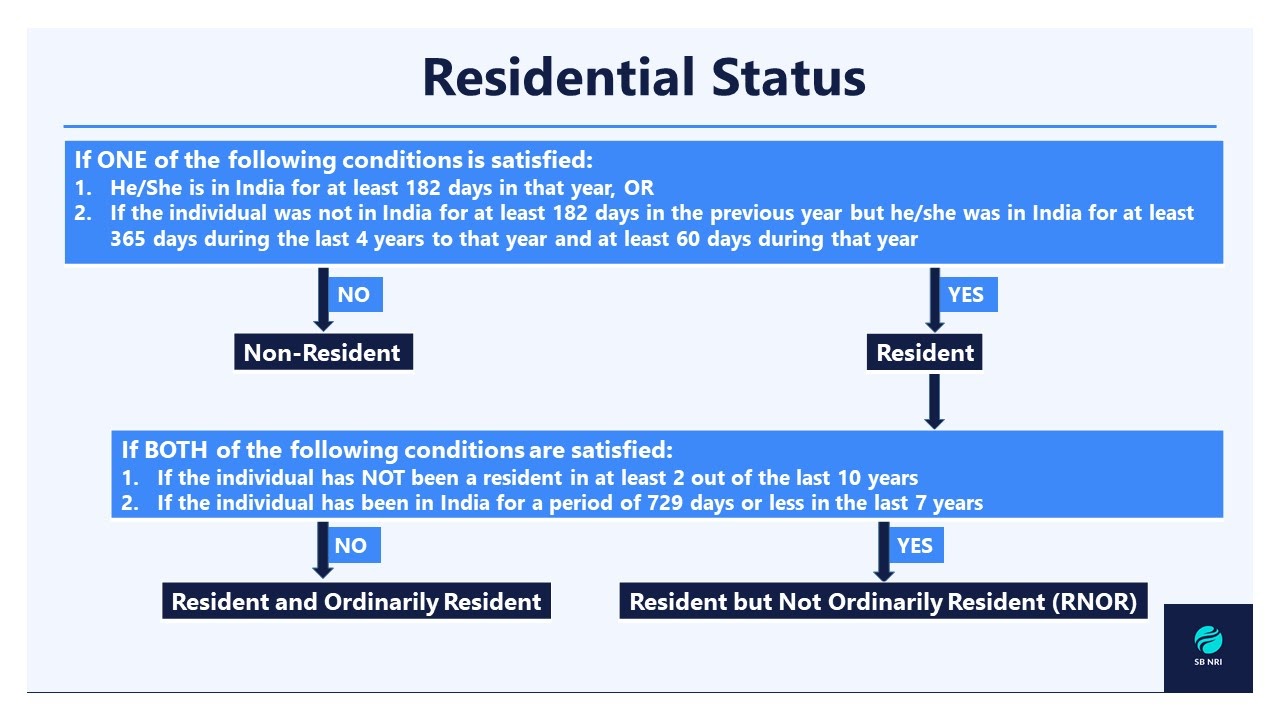

- Sorting your Residential Status: NRI Status after returning to India can help you reap the benefits related to banking and taxation for a considerable amount of time given you know about the different criteria and fit in. The most useful status will be the Resident but not Ordinarily Resident (RNOR). The criteria that defines this status are:

- If the Individual has NOT been a resident in at least 2 out of the last 10 years

- If the Individual has been in India for a period of 729 days or less during the last 7 years

The benefits associated with the RNOR Status are:

- The income generated abroad is not taxable in India. Taxes are only paid on the income generated in India.

- They don’t have to pay taxes on the interest earned on Foreign Currency Non Resident (FCNR ) and Non Resident External (NRE) Deposits after converting them into Resident Foreign Currency (RFC) Accounts

- No taxes paid on withdrawals from offshore retirement accounts

- No taxes on rent and capital gains from abroad

- No taxes on interest on dividends received from investments done abroad

How long can you hold the RNOR Status?

- If the NRI has been outside of India for 9 out of the last 10 years, he/she can be an RNOR for 1 year.

- If the NRI has been in India for 729 days or less in the last 7 financial years, he/she can be an RNOR for 3 years.

- Understanding the Financial Changes: Post your return to India, many factors come into play. The way your bank accounts operate, your investments in India as well as the taxation on these bank accounts and investments change. Let’s explore this particular aspect.

- Bank Accounts: As an NRI, you held the NRE, NRO or FCNR Bank Account. But post return you need to make substantial changes to these bank accounts. You can capitalize on the benefits till you hold the RNOR status but once you convert permanently into a resident you need to switch back to Resident Individual Bank Accounts in India. Here are some points that will help you understand the benefits of being an NRI returning to India from UAE:

- The NRE Savings Accounts need not be converted to resident accounts after your return to India. NRE Deposits can remain as-is till maturity.

- Withdrawals can only be done in Indian Rupees.

- For NRE FDs broken before maturity, interest is calculated on the number of days the FD was held with the bank. The minimum holding period of NRE Deposit is 1 year.

- Premature breaking of NRE FDs are subject to penalties that vary from bank to bank.

- Post maturity, NRE Deposit Accounts and FCNR Accounts can be converted into Resident Foreign Currency (RFC) Accounts. All freely convertible currencies are allowed for RFC Accounts such as US Dollar, British Pound, Euro, Yen, etc.

- The interest earned on NRE Deposits that have been converted to RFC Accounts will be exempt from tax if the status of the returning NRI is RNOR (Resident but Nor Ordinarily Resident)

- Investments: The investments done abroad as well as in India will have to be addressed while returning to India. The investments done abroad need to be dealt with efficiently. For example, if you have a real estate investment in UAE, you have multiple options such as renting out the place, selling it or letting it be. Pension plans, if any can be continued.

As far as investments in India is concerned, you might already have some investments in various asset classes such as mutual funds, real estate etc. Here are some key pointers on what to do after returning to India from UAE:

- Update your c-kyc form for informing the fund houses and the other parties involved about the change in your Residential Status.

- If hunting for a new property, look around first and then decide for a suitable place if you don’t have any predestined city to settle in. You can also check out the top 10 places to retire in India.

- Taxation: Once you become a Resident India, Taxation will be a very important factor to consider for NRIs moving back to India from UAE. Since there are no taxes in the UAE, understanding the taxes in India on your foreign income can be tricky.

For a Resident Indian, his/her global income is taxable in India. Therefore, you can enjoy the benefit of not paying taxes on the income generated abroad only till you hold the RNOR Status. Once you have successfully converted into a Resident Indian, your global income becomes taxable in India.

- Sustainability Factors: After returning to India, you need to sustain yourself with regards to the necessary documentation and other requirements. This segment involves sorting out your basic concerns that will enable you to plan ahead your stay in India and enjoy your retirement. The factors that needs to be looked after are:

- Finding a new Job/ Fixed Source of Income: Once you have decided to move back from UAE to India, it is essential that you look for new job opportunities to create a fixed source of income till you retire permanently. It will enable you to fuel your other expenses in India and create a decent retirement corpus. Selecting a good Retirement Plan will also ensure fixed pension post retirement for sustaining the lifestyle you desire.

- Documentation: Documents that provide proof of Identity and help you manage your tax returns in India need to be in place. The Aadhar Card and the PAN Card are two of the most important documents you need to possess to make sure that everything becomes smooth for you in terms of having valid proofs that will be required at multiple stages in India.

- Life & Health Insurance: Having both Life and Health Insurance are essential. A life insurance ensures financial security post your demise to your family and also provides the benefit of having an independent retirement life. A Health Insurance on the other hand prepares you for emergencies with a financial backup.

- Sorting your Child’s Education in India: For NRIs returning to India from UAE, it is necessary that they pre-plan the education of their children and select the best schools keeping in mind the admission process in the various CBSE Schools in the country.

Also Read: Moving Back to India from USA: Checklist 2020 | Moving to India: The Land of Myriad Emotions

Moving Back to India from UAE: The Sentiment

Moving back to India is a very big step. It will change your lifestyle, your priorities, your planning and your outlook. Nevertheless, coming back home is always special.

At SBNRI, we understand your struggle and are with you at every step to ensure a convenient and seamless transition. Providing a checklist isn’t enough. What matters more is that we help you plan each and every step of this massive shift.

For further assistance with calculating your Residential Status and its associated benefits, sorting out your financial changes and keeping up with all your sustainability factors such as finding new jobs, managing your documentation and insurance and looking after your child’s education in India, just click on the button below. Doing that will instantly connect you with our expert who will be there at every step to guide you through and make the transition effortless. Also, visit our blog and Youtube Channel for more details.