RFC or Resident Foreign Currency Account is a type of bank account maintained by Resident Indians in foreign currency. It is specifically essential for NRIs who have returned to settle in India. As we have discussed under NRIs and their Bank Accounts that any income generated abroad for an NRI must be maintained in an Non-Resident External (NRE) Account. Once, the NRI has returned to India, these NRE Accounts need to be converted into RFC Accounts post maturity. The FCNR Deposits can also be converted into RFC Accounts post maturity. In this article, we will discuss this RFC Account and understand the associated aspects.

What is an RFC Account?

The RFC Account can be opened by an NRI, PIO & OCI when they return to settle in India. The highlights of the Resident Foreign Currency Account are as follows:

- An RFC Account can be opened in all the major banks of India

- You can choose between current, savings and fixed deposit (max. tenure is 36 months)

- Permissible Credits include:

- Transfer from balances held in NRE/FCNR (B) Accounts, FCNR (B) deposits can be converted to RFC accounts post maturity of can be closed prematurely

- Fresh remittances from overseas through banking channel (upon realization of sales proceeds of assets or income earned)

- Proceeds of Foreign Currency Notes / Travelers cheques tendered by NRI / PIO, while visiting India. Amounts in excess of USD 5000 (or equivalent) in currency or USD 10,000/- (or equivalent) in Travelers cheques, should be accompanied by a Currency Declaration Form (source: SBI)

- You can operate jointly with other NRI (who has returned to India)

- You can open the RFC Account in any freely convertible foreign currency (USD, GBP, EUR etc). Different banks have different currencies that they accept.

- The amount of foreign currency in the RFC Account is 100% repatriable

- You can also use the amount in your RFC Account for all local payments and investments in India

- You can add a nominee to the RFC Account

Taxation on RFC Account

Note this, the interest earned on RFC Accounts is taxable in India. But, you can avoid paying this tax if you hold the RNOR Status. The taxation on RFC Account is done on the basis of when you receive the interest: either you receive the interest as and when they fall due or you receive it on maturity. Now, in the former case you can intimate the bank about your RNOR status so that they don’t charge the TDS on the interest. In the latter case, if you are not an RNOR by the time you receive the entire interest, it will be taxable.

“The RFC Account is similar to your NRO Account or a Resident Savings Bank Account”

Since, we have mentioned the RNOR Status. It’s important to provide a brief on the same.

RNOR Status

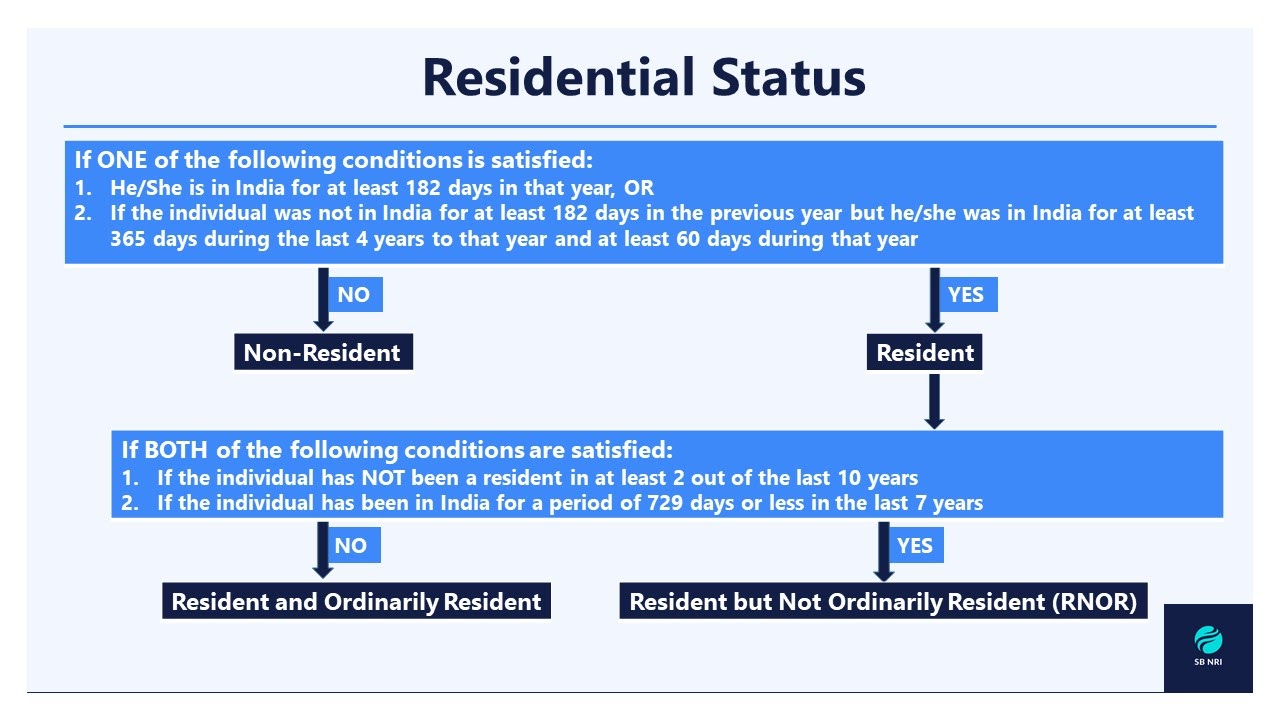

The RNOR or Resident But Not Ordinarily Resident status is given to Indian Residents. There are certain criteria that defines this status, which are:

- If the Individual has NOT been a resident in at least 2 out of the last 10 years

- If the Individual has been in India for a period of 729 days or less during the last 7 years

The flowchart below will help you in understanding the Residential Status of an individual based on his/her stay in India and abroad.

RFC Account Interest Rates

As explained above, you can either receive the interest quarterly as and when they fall due or on maturity. The interest rates are the same that you get on your FCNR Deposits in India (up to 3.05%*) and it is decided by the bank on the basis of the tenure and currency chosen.

Let’s take ICICI Bank for example, and glance through its interest rates on RFC Deposits.

| Currency | USD | GBP | EURO | JPY |

|---|---|---|---|---|

| 30 days to less than 6 months | 0.50 | 0.07 | 0.01 | 0.01 |

| 6 months to less than 1 year | 0.56 | 0.12 | 0.01 | 0.01 |

| >= 12 months < 24 months | 1.00 | 0.59 | 0.01 | 0.01 |

| >= 24 months < 36 months | 0.99 | 0.36 | N.A | 0.01 |

| 36 months | 0.76 | 0.14 | N.A | N.A |

If you have any queries and want to get in touch with an expert at SBNRI for specialized advisory on NRI Bank Accounts, Taxation or Investments. Contact us using the button below. You can also visit our blog and youtube channel for more details.

FAQs

RFC Fixed Deposit gives NRIs who have returned to India a good opportunity to earn high returns on the funds they hold in foreign currency. It is a term deposit that can be held for a maximum of 3 years.

Yes. Resident Indians can open a dollar account in their bank and operate it as they operate their rupee account. They can deposit money in foreign currency and withdraw it to meet their foreign exchange requirements.

RBI has cleared that as long as the foreign exchange is acquired through permissible channels, there will be no overall limit on balances kept in Resident Foreign Currency (Domestic) Account.

A Resident Bank Account is a type of bank account that is maintained by a Resident Indian.

Yes. If you’re a Resident Indian, you can hold foreign currency in your RFC (D) Accounts and if you’re an NRI, the same can be done using a FCNR (B) Account.