Retirement

Non Resident Indians (NRIs) all over the globe find the subject of retirement intriguing. Some look at it as an avenue to travel the world and do things that they couldn’t while they were working, while some look at it as a peaceful time waiting for them to be enjoyed with family cherishing the life they’ve spent. All of this, at a place rather full of content and happiness. Therefore, NRIs often invest in a plethora of Retirement/Pension Plans to help them with their plans and responsibilities such as child’s marriage, education etc. Let’s check out the various types of Retirement Plans for NRIs.

Types of Retirement or Pension Plans in India for NRIs

Retirement Plans in India cater to the needs of a wide range of insurance seekers. These Pension Plans are available in the market with multiple classifications, plan structures and benefits. The entirety of these plans can be simply divided into 11 categories:

Retirement/Pension Plans | Highlights |

Deferred Annuity | -Regular/Single Premium over a policy term; -life coverTax Exemption (one-third of the corpus) |

Immediate Annuity | -Lump Sum payment; no life cover -Immediate pension provided -Premiums are exempt from tax |

Annuity Certain | -Annuity paid for a specific number of years -Period can be chosen; benefit paid to beneficiary in case of death |

With and Without Cover Pension Plans | -With Cover: Has life cover included in policy; although not a very high amount -Without Cover: No life cover; only corpus paid to nominee |

Guaranteed Period Annuity | -Annuity provided for certain periods (5, 10, 15 & 20 years) irrespective of whether he/she survives the period or not |

Life Annuity | -Pension paid until death -Post death the amount given to spouse, if “with spouse” option chosen while taking policy |

National Pension Scheme (NPS) | -Scheme by Government of India -Money invested in equity and debt funds as per the preference of the individual -Can withdraw 60% amount at retirement. 40% used to purchase annuity -Maturity proceeds aren’t tax-free |

Pension Funds | -Managed by only 6 companies allowed by government -Comparative better returns on maturity; long period policy |

Whole Life ULIPs | -Money invested for whole life -Partial withdrawals post retirement; tax free income -Additional withdrawals allowed |

Defined Benefit | -Based on your earnings and the no. of years served under your employer -Both you and your employer can contribute -ensures that you pay a specific amount from the retirement income for life |

Defined Contribution | -Retirement income not guaranteed but contributions are -The sum accessible for your retirement relies upon the all-out contributions made to your record and the investment returns this cash earned -At retirement, you utilize the cash in your record to produce a retirement remuneration |

Financial Planning for Retirement

There are 3 fundamentals of Financial Planning:

- Emergency Fund: Must be 3 times of your salary

- Health Insurance: Necessary to tackle health emergencies

- Investments: To create a corpus

Being an NRI, one must consider the above-mentioned aspects of Financial Planning. Living a life after retirement with the preferable standard of living requires frequent investments for the very purpose. A planned financial approach will award a satisfactory and enlivening life post retirement. For financial advisory, write to us at [email protected].

NRI Retirement: The Need of Planning

Taking into account the necessities of people and the effect of inflation on the finances, NRIs must address the indispensability of retirement plans.

Introspect upon how much time is left till you retire and start planning it efficiently and consider investing in a pension plan to ensure a satisfactory life after you retire. The world is pacing ahead. You can access everything at your fingertips. It is recommended that you stress on the three pillars of financial planning and get a well suited plan for yourself. With easy online processes, getting a good plan has simplified itself.

Envision your requirements and opt for the best suitable plan as per your needs for a happy life after you retire.

NRI Returning to India: Top 3 Tips 2024

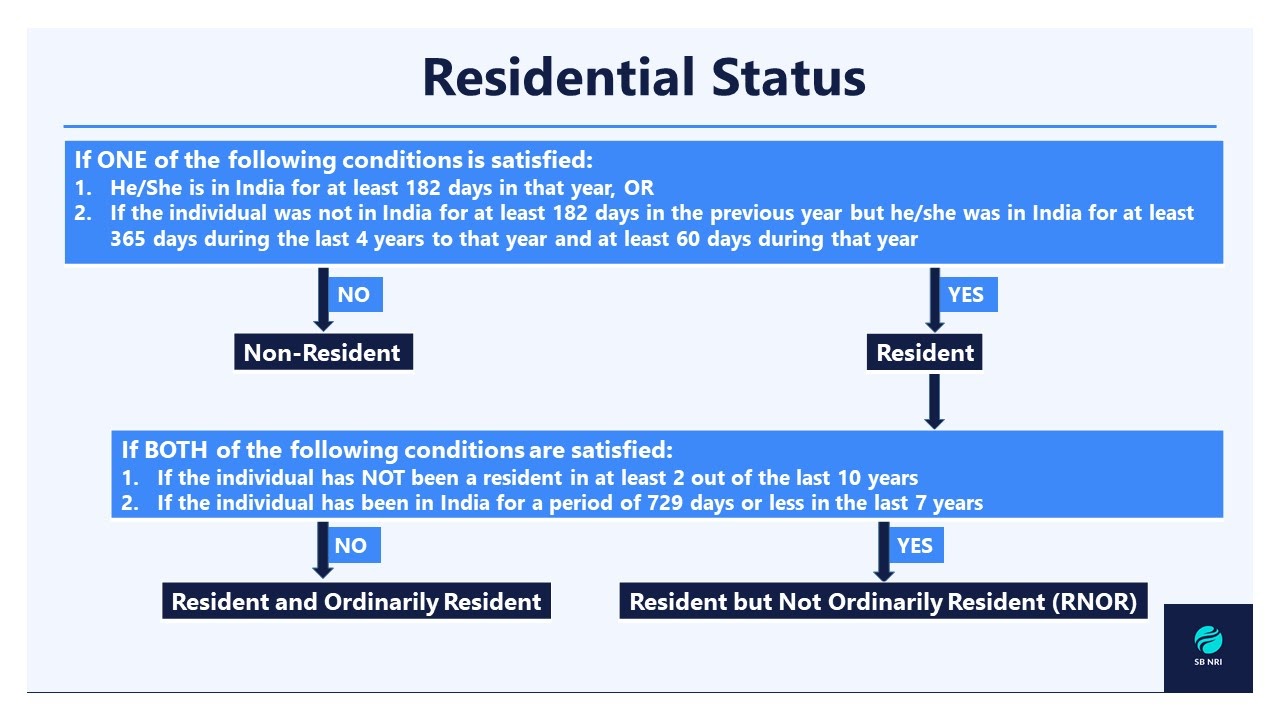

If you are an NRI returning to India permanently, this article is for you. We have assorted the top tips for NRI returning to India in 2020. In this article, we will understand the basics of how an NRI can smoothly transition to a Resident Indian and what are the various criteria that affect their NRI Status.

What is an Individual Retirement Account (IRA)?

An Individual retirement account (IRA) is a form of an individual retirement plan that helps customers save for retirement with tax advantages. Four popular types of IRAs include traditional IRA, Roth IRA, SEP and SIMPLE IRAs, provided by many financial institutions such as banks, Robo-advisors and brokers. Your contributions to the IRA may be tax-deductible, or withdrawals may be tax-free.

401(k) Rollover to IRA: 4 simple steps guide

When you leave a job to start a new one, you can either cash out your 401(k) retirement plan or transfer it into your new 401(k) account, or roll it over into an individual retirement account (IRA). For most employees, it is a smart choice to roll over a 401(k) into an IRA. A 401(k) rollover allows you to transfer money from an old (401k) account to an Individual retirement account or another 401(k) plan. Key reasons for a 401(k) rollover to IRA are more investment choices, lower fees, and the potential to open a Roth account, etc.

Top 10 Places to retire in India for NRI in 2023

Retirement is a sentiment. It’s the admiration and satisfaction of having worked for a life-time and the excitement to spend the rest of your days in peace and content. NRIs all around the globe dream of retiring comfortably in India, preferably in their hometowns, relishing the bygones of their childhood, while some of them plan to select a small town to settle in, perhaps by the hillside or the shore. Many dreams! Many Preferences!

NPS for NRI 2023: Indian National Pension Scheme

In the wake of the current situation globally, many NRIs are moving back to India planning to retire here with family and friends. For many, it had been a long term goal before they moved abroad. NPS for NRI comes out as one of the best investment options for NRIs as it helps in creating a retirement corpus that provides both financial independence and taxation benefits. In this article we’ll explore these aspects of the National Pension Scheme (NPS).

Withdrawing 401k from India and the associated tax implications

With the recent good news in the Union Budget of 2021-22 concerning no double taxation on retirement accounts for NRIs, withdrawing 401k from India has become easier now. Many tax difficulties and struggles have been eased out. NRIs in the United States of America are often worried about what to do with their 401k if they move back to India, especially focusing on how to withdraw 401k from India keeping in check that they don’t end up paying double taxes. In this article, we will focus on the aspect of 401k withdrawal from India while understanding the tax implications in all the possible cases once you cross the threshold age of 59 and a half (59½).

Moving Back to India from UAE: Checklist 2023

Moving back to India is a huge step. Many NRIs have been contemplating the effects of moving back to India from UAE given the present situation in the gulf. There has been an upsurge of job losses, international travel guidelines have strengthened and many other factors are contributing to the uncertainties around a continuous stay abroad.

Admission Process in CBSE Schools for NRIs Moving to India

Child’s education is one of the major concerns for NRIs returning to India for good. The shift in curriculum from an abroad based education system to the Indian education system isn’t easy. Being parents, you need to assure a proper education for your children and the CBSE School Admission process for NRIs moving to India needs to be understood thoroughly in order to ensure that. Admissions aren’t easy. Especially in a country with approximately 1.33 billion people.