NRIs (Non-Resident Indians) who do not possess a PAN card but want to engage in specific transactions mentioned in Rule 114B of the Income-tax Act, 1962 need to file Form 60 as declaration. In this blog, we will delve into the details of Form 60 for NRIs, its purpose, and the process of filing the Form.

Form 60 for NRIs

Under the provisions of Indian income tax, NRIs who have taxable income or those conducting business/profession with a turnover exceeding a specified limit, are required to obtain a PAN. PAN is also required to be quoted in various documents, including income tax returns, correspondence with the income tax department, and documents related to specific transactions like buying or selling assets.

In cases where an NRI individual engages in specific transactions specified in Rule 114B but does not possess a PAN, he/she is required to submit Form 60.

When Should NRIs File Form 60?

NRIs need to file Form 60 when:

- They have not applied for PAN or

- They have applied for PAN but allotment is pending

Note- Form 60 is not permissible if the individual’s total income exceeds the basic exemption limit. In such cases, Form 60 can only be used if the person has applied for a PAN, and the date of application must be mentioned in column 21 of the form.

Also read: PAN Card for NRI without Aadhaar Card – A Complete Guide

Transactions under Rule 114B of IT Rule

Listed below are the transactions, where an NRI should submit Form 60 in absence of PAN card:

- Sale and purchase of motor vehicles, excluding two-wheelers.

- Opening of NRE, NRO, or FCNR accounts.

- Opening of an NRI Demat account with a depository, participant, custodian of securities, etc.

- Purchase of mutual fund units exceeding Rs. 50,000 in cost.

- Payment exceeding Rs. 50,000 to a company or institution for the acquisition of debentures or bonds.

- Cash deposit exceeding Rs. 50,000 in a single day with a bank.

- Time deposit exceeding Rs. 50,000 or aggregating to over Rs. 5 lakh during a financial year in:

- A banking company or co-operative bank

- Post office

- A Nidhi referred to in Section 406 of the Companies Act, 2013

- An NBFC registered under Section 45-IA of the Reserve Bank of India Act, 1934, accepting deposits from the public.

- Payment of more than Rs. 50,000 as life insurance premium to an insurance company within a financial year.

- Contract for sale or purchase of securities (excluding shares) exceeding Rs. 1 lakh per transaction.

- Sale or purchase of unlisted shares exceeding Rs. 1 lakh per transaction.

- Sale or purchase of immovable property valued at more than Rs. 10 lakh or as determined by the stamp valuation authority mentioned in Section 50C of the Act, exceeding Rs. 10 lakh in cost.

Form 60 Download Process

To download Form 60 from the Income Tax Department’s official website, follow the step-by-step instructions provided below:

- Go to the official website of the Income Tax Department.

- Locate and click on the ”Forms/Download” option located on the top navigation menu.

- From the drop-down menu, select ”Income Tax Forms”.

- You will be directed to a page displaying a list of various income tax forms.

- Scroll down the list until you find ”Form No.60”.

- Click on the form, and it will be automatically downloaded to your system.

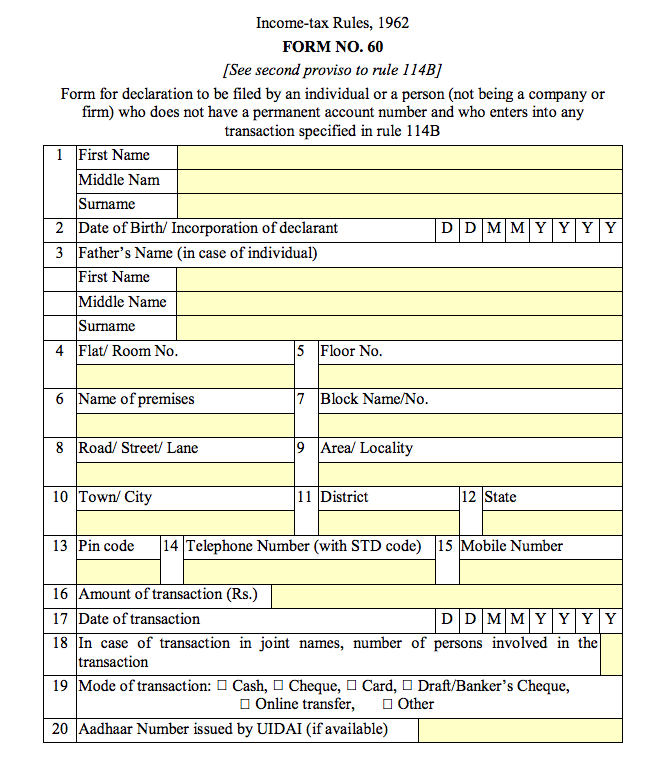

Information Required to be Filled by NRIs in Form 60

The following details need to be provided in Form 60:

- Applicant’s details like full name, address, date of birth, etc.

- Specifics related to the transaction for which Form 60 is being filled. For instance, if the transaction involves opening a savings account at a bank, you must mention the bank’s name and the transaction amount. If not applicable, write N.A.

- If you have been assessed for income tax, include details of the range, circle, or ward where you filed your last income tax return.

- You also need to mention the reason for not possessing a PAN card. If you have applied for a PAN card and are awaiting its receipt, indicate the same in the form.

Documents Required with Form 60

The following documents need to be submitted along with Form 60:

- Aadhar card

- Driving License

- Passport

- Ration Card

- ID proof from an accredited institution

- Copy of the electricity bill or telephone bill

- Any document issued by the Central Government, State Government, or local bodies.

- Any documentary proof related to the address mentioned in the form.

If a PAN application is pending, only the date of application is required.

Note: Any discrepancy between the provided details and the accompanying supporting documents will result in the cancellation of the form, requiring resubmission.

Why is PAN Important for NRIs?

Listed below are some of the uses of PAN card for NRIs:

- NRIs having taxable income in India must possess a PAN card.

- NRIs require a PAN card to invest in securities or mutual funds, as well as to buy property or vehicles in India.

- A PAN card is also mandatory for depositing amounts above a specific threshold.

- The PAN card helps in simplifying the KYC (Know Your Customer) process for NRIs in most banks.

- It is also required to file income tax returns in India.

Note: In case, an NRI does not have a PAN card, alternatively he/she can submit Form 60.

Calculate your TDS Refund with SBNRI’s TDS Refund Calculator

A TDS refund is the process of reclaiming the excess tax deducted at source by the payer if the actual tax liability of the taxpayer is lower than the TDS deducted. This situation typically arises when the income tax calculated on the total income is less than the TDS already deducted. To claim a TDS refund, taxpayers need to file an income tax return (ITR). The Income Tax Department processes the ITR and verifies the details. If the tax department finds that the TDS paid is more than the actual tax liability, the excess amount is refunded to the taxpayer.

You can easily find out how much tax refund you can get by calculating your TDS Refund from this TDS Refund Calculator.

Access SBNRI’s Exclusive NRI Taxation Guide

NRIs and OCIs can now access SBNRI’s exclusive NRI Taxation Guide covering in-depth information about DTAA, Gift Tax, Rental Income Tax, ITR Filing, Types of ITR Forms for NRIs, Capital Gain Tax, Income Tax, and more. The report will help you understand India taxation on mutual funds, other asset classes and how you can comply with the regulations.

Access NRI Taxation report here

Contact SBNRI

Due to the lack of resources or right information, NRIs may sometimes find it difficult to apply for a new PAN card or correct the information in the existing PAN. We at SBNRI, understand this struggle and are here to help you out with everything. You can get in touch with our expert directly on WhatsApp using the button below to resolve your doubts and queries. Also visit our blog and YouTube Channel for more details.