Do you know that NRIs can apply for a PAN card without an Aadhaar Card? They can simply do so by filling out either of the forms – 49A (for citizens of India) or Form 49AA (for foreign citizens). In this article we will explore how one can apply for a PAN card for NRI without Aadhaar card, NRI PAN card fees and the documents required for the application.

Why Do NRIs Need a PAN Card?

There are multiple uses of a PAN card for NRIs. We have listed some of the benefits that NRIs can enjoy after owning a PAN card.

1. Opening an NRI bank account. [NRE, NRO or FCNR(B)]

2. Investing in Mutual funds, shares and real estate

3. Filing Income Tax Return

4. Applying for a loan

5. Applying for passport or visa

6. Identity proof

How to Apply for PAN Card for NRI without Aadhaar Card Online?

The process for the application of a PAN card is briefly divided into two parts:

PAN Card for NRI with an Aadhaar Card-

For NRIs having an Aadhaar card, the process of obtaining a PAN card is quite simple. The entire process would take just 10 minutes. You will get an OTP after verifying your details and then you can simply download your PAN card in the PDF format from the income tax website.

PAN Card for NRI without Aadhaar Card-

People who hold Indian citizenship and are settled abroad i.e. NRIs can fill out the Form 49A. Whereas OCI card holders or people of Indian origin (PIO) having foreign citizenship or foreigners who are not of Indian origin are required to fill Form 49AA. You can pay the fees online while filling out the form. The PAN Card will be delivered to the registered address.

How can NRIs Apply for PAN Card in India?

NRIs (Non-Resident Indians) can apply for PAN card in India by submitting the Form No. 49A along with the necessary documents and allotted fees at the PAN application center of UTIITSL or Protean. He or she can also make an online application through the website of UTIITSL or Protean.

Documents Required for PAN Card Application

One can apply for a PAN by submitting the form and attaching necessary documents. The documents required for the PAN card application are:

(i) Proof of identity

(ii) proof of address

(iii) any document containing your date of birth.

PAN Card Application Fees

Fees for delivery of PAN Card based on the communication address registered by the NRI are as follows:

1. Indian Address: Rs.101/-

2. Foreign Address: Rs.1,011/-

3. E-PAN Card: Rs.66/-

You can make the payment through credit card, debit card or net banking. You must note that the above mentioned charges are for paperless applications.

PAN Card Correction Form for NRIs

For changes or corrections in your PAN card, you need to fill out an application form wherein you have to attach all the necessary documents and proof in support of changes required.

After the submission of the NRI correction PAN application to the authorities, the applicant will get the changed or corrected PAN card at the address indicated by the applicant in the application form.

Duplicate PAN Card

The process of getting a duplicate PAN card is quite simple. One needs to fill an online application form for a NRI duplicate PAN card and upload scanned copies of the documents and self attested proofs with the application form.r e-validation. You can then pay for the procedure either through a credit card, debit card or net banking.

Wrapping it up

To summarize, one can get an NRI PAN Card without an Aadhaar card. One can apply for the PAN card in online as well as offline mode, that too in an effortless manner. Once an NRI gets the PAN card, he or she can enjoy its benefits.

Contact SBNRI

Due to lack of resources, NRIs may sometimes find it difficult to apply for a new PAN card or correct the information in the existing PAN card. We at SBNRI, understand this struggle and are here to help you out with everything. You can get in touch with our expert directly on WhatsApp using the button below to resolve your doubts and queries. Visit our blog and YouTube Channel for more details.

FAQ

After the submission of the NRI PAN application to the authorities, the applicant will get the PAN card within 15 days of application at the address indicated by the applicant in the form.

An NRI PAN card is the same as a PAN card issued to individuals living in India, except for one thing – the type of Application Form differs with respect to your current Residential Status.

No, it is not possible. NRIs need to have a PAN card because they will be required to file income tax returns if they have rented out the property. Besides, if the property is sold later, the capital gains resulting from the sales would be subject to capital gains tax. Capital gains would be included in the total income while it is being taxed.

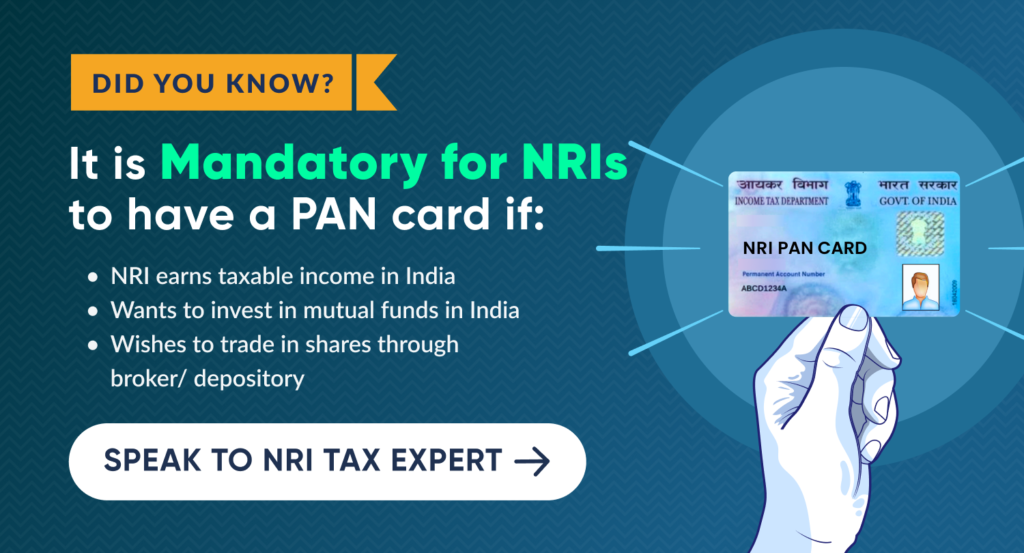

An NRI needs a PAN Card if he/she has got a taxable income in India. According to the new rule of Securities and Exchange Board of India, any NRI without a PAN Card cannot do the share trading by depository or broker. PAN Card is also mandatory for an NRI if the NRI would like to invest in Mutual Funds.

No, it is not necessary for one to be physically present in India to apply for an NRI PAN card. Applicants just need to visit the official websites, fill up the application form and attach necessary documents. Alternatively, they can apply for a PAN card on SBNRI.com or SBNRI app.

There are no direct provisions to change citizenship in a Pan Card as it does not display your citizenship. If you have a PAN Card and later become an NRI/OCI, it is advisable that you continue using the same PAN Card. However, you can apply for a new PAN Card as a foreign citizen by applying for it at the NSDL website.