Time and again, NRIs all around the globe have encountered this doubt: “Do I need a PAN Card if I am an NRI?”. PAN (Permanent Account Number) Card is a unique alphanumeric code allotted by the Income Tax Department of India as an identification code. The allotment of PAN Cards is done under the supervision of the Central Board of Direct Taxes. There are multiple usages of the PAN Card for NRI and in this article, we will explore these usages, the paperless process of application (completely online), and documentation requirements for PAN.

Why an NRI needs a PAN Card?

A PAN Card has multiple usages. Let’s point them out for you:

- Opening NRI Bank Accounts [NRE, NRO & FCNR (B)]

- Filing Income Tax Return

- Investment in the Indian Market (Shares, Mutual Funds, Real Estate etc.)

- Identity Proof

Process of Application of PAN Card for NRI

Given below are the simple steps to obtain a PAN card:

- Go to the TIN NDSL website and navigate to the “Online PAN Application” tab displayed on the homepage.

- Once you click on this tab, a page with instructions will appear on your screen.

- Carefully read through the instructions before proceeding.

- At the bottom of the page, select your applicant type from the drop-down menu provided. This action will redirect you to an online form that will appear in a new tab.

- Fill in all the necessary details as required and follow the instructions on the form. Once you complete filling the form, you will be given the option to review the information you provided.

- If you have a DSC signature, you can upload the necessary documents. After reviewing your information, click on the “Submit” button.

- To make the processing fee payment, a payment gateway will open. You can pay through a credit card or a cheque/DD from an Indian bank.

- An auto-generated acknowledgement will appear on the screen, which you should print and paste two photographs in the spaces provided.

- Sign the acknowledgement in the designated spaces and attach any necessary documents if you did not upload copies earlier. I

- f you have not paid through net-banking/credit card, attach the cheque/DD and post the acknowledgement along with other documents to the address printed on the acknowledgement.

- Once TIN NDSL receives the acknowledgement, they will post your PAN card to the address mentioned on the form within 21 working days.

Process of Application of PAN Card for NRI with Aadhaar Card

If you have an Aadhaar Card, it is an effortless process to obtain a PAN Card. The entire process would take just 10 minutes.

Process of Application of PAN Card for NRI without Aadhaar Card

Applicants who don’t have an Aadhar Card can fill out either of the forms: 49A (for citizens of India) or PAN Application Form 49AA (for foreign citizens) and carry forward with the paperless process online.

The PAN Card will be delivered to the registered address with the applicable fee, which you can pay online while filling out the form.

A quick recap: Fees for delivery of PAN Card based on the communication address registered by the NRI are as follows:

- Indian Address: Rs.101/-

- Foreign Address: Rs.1,011/-

- e-PAN Card: Rs.66/-

Note: The above mentioned rates are for paperless applications.

Contact Details of PAN Office in India

- Telephone no.: 020-27218080

- FAX: 020-27218081

- Email: [email protected]

Do NRIs Need PAN Card?

NRI Bank Accounts comprise of NRE, NRO, and FCNR(B) Accounts. To understand the importance of PAN Cards w.r.t NRI Banking, we need to briefly explore these 3 accounts, keeping in mind how PAN Cards will come into play.

- NRE: NRE Accounts are maintained for funds earned outside India with both Principal and Interest earned being tax-free. Therefore, NRIs can opt for Form 60, which is a substitute for PAN for opening an NRE Account.

- NRO: NRO Accounts are maintained for the funds generated in India which are mostly liable to taxes. Income such as rent or pension where, in most cases, taxes are not deducted at source are deposited in an NRO Account. Therefore, a PAN Card is mandatory for NRO Accounts as it involves filing a tax return.

- FCNR (B): FCNR (B) Accounts are maintained for foreign currency term deposits from outside India. Again, the principal and interest are tax-free, so usage of a PAN Card is not mandatory and can be substituted with Form 60.

In summary, a PAN card is not mandatory to open a NRI Bank Account or book NRI FD in India. But for other interests such as carrying out investments in Indian Market in asset classes such as Mutual Funds, Real Estate, Stocks, PMS, etc. a PAN Card is mandatory. It is also a mandatory document if you are filing an income tax return in India. Let’s get a clearer image of this doubt in the next segment.

Q. Which Bank NRI can Open an Account without PAN Card?

Answer: In all banks! You don’t need a PAN Card to open your Bank Account. You can use Form 60 alternatively.

The evergreen Doubt: Is PAN Card Mandatory for NRI?

No! A Pan Card is not a mandatory document for opening an NRI account. The basic use of a PAN Card can be associated with taxes. A PAN Card is a mandatory document to file taxes and carry on investments from these Accounts. In the absence of the Pan Card, NRIs can sign Form 60 [Form 60 is a declaration to be filed by an individual or a person (not being a company or firm) who does not have a Permanent Account Number (PAN) and who in involved in any transaction] to open an NRI Account.

The basic difference between a PAN Card and Form 60 is that you can only sign and use the Form 60 to open a bank account but to file taxes and carry out investments from that account, a Pan Card is mandatory.

To get documentation, investment and taxation advisory from experts at SBNRI, Contact us using the button below.

PAN Card for NRI: PAN-Aadhar Card Linking Conundrum

There are many questions and doubts around the PAN Card and Aadhar Card linking for NRIs. The simple answer is that NRIs need not be bothered by the latest rules and amendments as technically an NRI doesn’t need to link their PAN and Aadhar Card. There are cases/scenarios you need to understand. To know more about PAN Aadhar Card linking for NRI, head over to our article or watch the video using the respective links below.

Read for Insights: PAN Aadhaar Linking for NRI: Is it Mandatory? (New Deadline 30/09/2021)

Download the SBNRI App to experience the one-stop platform for NRIs. Also visit our blog and Youtube Channel for more details. Click on the button below to get in touch with SBNRI Tax Expert.

FAQs

A PAN is mandatory when filing Income-Tax return, TDS or any transaction that attracts tax. PAN works completely the same way for both NRI and Resident Indian except for one factor – the type of Application Form alone changes with respect to your current Residential Status.

Yes. You can apply for a PAN Card from the USA. The easiest and most convenient way to apply for a PAN card from the USA is online. Watch the video to know about the process in detail.

If you have an Aadhar Card:

-Download your PAN Card in pdf format from the income tax website in just 10 minutes by verifying details and OTP

If you don’t have an Aadhar Card:

(Form 49A: For Citizens of India) or (Form 49AA: For Non-Citizens)

-Submit your details on NSDL

-Upload the documents through paperless modes (e-KYC & e-Sign / e-Sign scanned based / DSC scanned based)

-Wait for the card to be processed

-Get your PAN Card delivered to your registered address and email (e-PAN)

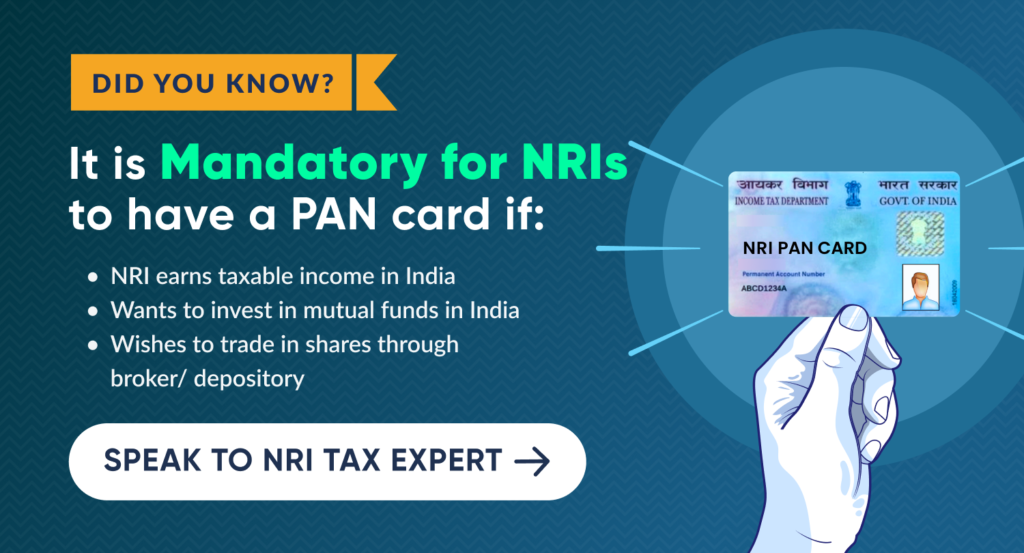

An NRI needs a PAN Card if that NRI has got a taxable income in India. According to the new rule of SEBI, any NRI not having PAN Card cannot do the share trading by depository or broker. PAN Card is also mandatory for an NRI if the NRI would like to invest in Mutual Funds.

People who hold Indian citizenship and settled abroad should use the Form 49A available for Indian citizens. Whereas NRIs who hold foreign citizenship, such as OCI holders or people of Indian origin who possess foreign citizenship or foreigners who are not of Indian origin are required to fill Form 49AA.

NRIs need a PAN card because they will be required to file income tax returns if they have rented out the property. Besides, if the property is sold later, the capital gains resulting from the sales would be subject to capital gains tax. Capital gains would be included in the total income while it is being taxed.