Managing finances as Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs) can be difficult, especially if you are not updated with the laws and regulations. Knowing how crucial a PAN card is for opening a bank account in India, how to invest your money, or for Mutual Fund KYC, are all important things to know. A PAN card is your permanent account number, which simplifies the banking and transaction process in India and is a legal requirement. You may have had a lot of questions about the NRI PAN card, and in this blog, we have tried to cover them. Find out all the top NRI PAN Card FAQs and their answers down below.

Also read: PAN Card for NRI without Aadhaar Card – A Complete Guide

Top NRI PAN Card FAQs & Answers

1. What Is PAN?

- A permanent Account Number (PAN) is a ten-digit made using the English alphabet or a number, issued by the Income Tax Department as a legal document required to do finance-related work in India.

2. What is a NRI Pan Card?

- NRI Pan Card is a legal Document for NRIs involved in financial transactions in India. It is a unique identifier given by the Income Tax Department. For NRIs earning income in India, through investments made in mutual funds, rental Property, and money transactions.

3. Importance of NRI PAN Card for Financial Transactions?

- The NRI PAN card has many importance for financial transactions involving Non-Resident Indians (NRIs):

- To open a bank account.

- To invest in mutual funds.

- To buy or sell a property.

- To take a loan or other financial help from an Indian bank.

4. Can an NRI buy property in India without a PAN card?

- No, NRIs need a PAN card because they will have to file an income tax return if they have rented out the property. Also, if the property is sold later, the profit resulting from the sales would be subject to capital gains tax. Capital gains would be included in the total income while it is being taxed.

5. What is form 49A used for?

- NRIs, or Indian citizens living abroad, can complete Form 49A. Form 49A is available at UTIITSL, Protean eGov Technologies Limited’s official website, and the NSDL e-Governance website

6. Can a person obtain or use more than one PAN?

- No, Obtaining or possessing more than one PAN is against the law. {Section 139A (7)}

7. Why does NRI need a PAN Card?

- Holding a PAN card is very important for various reasons like,

- Opening NRI Bank Accounts.

- Filing Income Tax Return.

- To invest in the Indian markets

- To invest in Commercial Real Estate

8. Can I apply for a PAN card more than once?

- No, you cannot apply for a PAN card more than once if you already have one. However, you can apply for change or correction with your existing PAN card. Available on UTIITSL or NSDL site.

Also read: NRI PAN Card Duplicate, How to Apply for Lost or Damaged PAN Card

9. Is a PAN card mandatory for an NRI bank account?

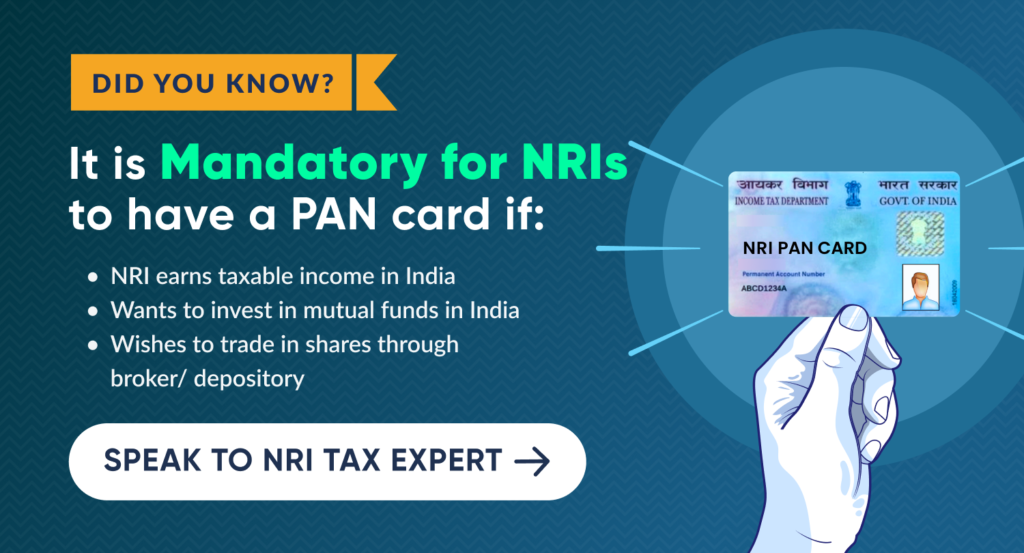

- An NRI needs a PAN Card if that NRI has got a taxable income in India. According to the new rule of SEBI, any NRI not having a PAN Card cannot do share trading by depository or broker. A PAN Card is also mandatory for an NRI if the NRI would like to invest in Mutual Funds.

10. Can I fill out the form in my native or regional language?

- No, you cannot do so. The PAN Application form must only be filled in English and not in any other language.

11. Can NRIs use their foreign address on the PAN card?

- Yes, NRIs can use their foreign address for PAN registration, so that their PAN card is delivered to their current overseas address.

12. Who is eligible to apply for an NRI PAN card?

- NRI non-resident Indians, PIOs Persons of Indian Origin, and OCIs Overseas Citizens of India are eligible to apply for an NRI PAN card if they have taxable income in India or engage in financial transactions in the country.

13. How much time does it take to get an NRI PAN card?

- After the submission of the NRI PAN application to the authorities, the applicant will get the PAN card within 15 days of application at the address indicated by the applicant in the form.

14. Is it important to have a PAN card to open a bank account?

- NRI needs a PAN card if they have taxable income in India. According to the new rule of the Securities and Exchange Board of India, any NRI without a PAN Card cannot do the share trading by depository or broker. A PAN Card is also mandatory for an NRI if the NRI would like to invest in Mutual Funds.

15. How to get an NRI PAN card without an Aadhaar card?

- One needs to fill out an online application form for an NRI duplicate PAN card and upload scanned copies of the documents and self-attested proofs with the application form.r e-validation. You can then pay for the procedure either through a credit card, debit card, or net banking. That means one can get an NRI PAN Card without an Aadhaar card.

16. Is there any difference between the PAN card for NRIs and resident Indians?

- An NRI PAN card is the same as a PAN card issued to individuals living in India, except for one thing – the type of Application Form differs for your current Residential Status.

17. Documents required to apply for a PAN card for NRI?

- Here is the list of documents required for the NRI PAN card application:

- Copy of your passport

- A proof of address: a copy of a bank account statement where you live or a copy of an NRE bank account statement with at least 2 transactions in the past 6 months attested by the Indian embassy.

- PAN card application

- Proof of Date of Birth

- Passport sized photographs

18. Should one be present in India to apply for an NRI PAN card?

- No, it is not necessary for one to be physically present in India to apply for an NRI PAN card. Applicants can visit the official websites, fill up the application form, and attach the necessary documents. Alternatively, they can apply for a PAN card on SBNRI.com or SBNRI app.

19. What is the eligibility to get an NRI PAN card?

- NRIs earn income that is taxable in India.

- The ones who wish to Invest in the Indian markets through mutual funds.

- Wants to buy or sell property in India.

- NRIs who want to do any kind of Bank transaction in India.

20. What is the application fee for an NRI PAN card application?

- If you are applying for a PAN card outside India in that case the application fee is around Rs.994 and you can pay this amount using the following mode of payment.

- Credit card

- Debit card

- Demand draft

- Net banking

21. Who should apply for a duplicate NRI PAN Card?

- NRIS who were allocated PAN Card previously but have lost it or damaged it can apply for a duplicate NRI PAN Card.

22. Can a minor apply for an NRI PAN Card?

- Yes, a minor can apply for NRI PAN Card provided they are represented by a Representative Assessee.

23. Who can apply for a change or correction in NRI PAN Card?

- NRI users who want to change or correct the following things can apply for a change or correction in their NRI PAN Card:

- Change in applicant name, due to spelling mistake or on account of marriage

- Change in Father’s Name

- Change in DOB

24. Can a person have more than one NRI PAN Card?

- Obtaining or possessing more than one PAN Card regardless of whether being a resident or NRI is against the law.

25. How much time does it take to get an NRI PAN card?

- After the submission of the NRI PAN application to the authorities, the applicant will get the PAN card within 15 days of application at the address indicated by the applicant in the form.

Is a PAN card different for the NRIs?

- An NRI PAN card is the same as a PAN card issued to individuals living in India, except for one thing – the type of Application Form differs concerning your current Residential Status.

Wrapping Up

Getting an NRI PAN card is important for NRIs to manage finances and taxes in India. This NRI PAN Card FAQs provides clear answers to common questions, helping NRIs find the application process confidently. With clarity on importance, required documents, and uses from this NRI PAN Card FAQs, NRIs can handle their financial affairs smoothly.

SBNRI is the one-stop solution for all your NRI PAN, taxation, repatriation, and investment. We at SBNRI, understand this struggle and are here to help you out with everything. Connect today and get your NRI PAN Card without any hassle.

You can get in touch with our expert using the button below to resolve your doubts and queries. Also, visit our blog and YouTube channel for more details.