How frustrating can it be to give away most of your hard earned money as tax? Especially for NRIs who can be subject to double taxation. You might be working abroad and have to pay taxes both in India and abroad. That’s infuriating, right? Well, not if you keep a track of DTAA which is the Double Taxation Avoidance Agreement enabling you to avoid double taxation in India and abroad. In this article, we will try to cut down your taxes to a minimum. How? Let’s explore.

In this article:

- How NRIs can claim benefits under DTAA

- What is DTAA?

- DTAA Rates

- DTAA Methods

- DTAA Documents

- Countries that India has DTAA with

- Income Types under DTAA

- Double Taxation in India: FAQs

How NRIs can claim benefits under DTAA

Non-Resident Indians (NRIs) living abroad and having an income in India might be subject to double taxation as the income earned from India can attract taxes both in India as well as in the NRI’s country of residence. DTAA (Double Tax Avoidance Agreement) is a tool to avoid this double taxation.

What is DTAA?

DTAA (Double Tax Avoidance Agreement) is a treaty between two or more countries to avoid paying double taxes. It doesn’t however mean that an individual can evade taxes but ensures that no NRI pays higher taxes in both countries. The Double Tax Avoidance Agreement makes the listed countries an attractive destination promising lower tax implications on income generated in India.

DTAA Rates

Under DTAA (Double Tax Avoidance Agreement), there is a fixed tax rate set between the countries signing the agreement on which the tax is deducted from the income earned in India. This deduction is done in the format of Tax Deducted at Source (TDS)

If you have already paid the taxes in India then you don’t need to pay taxes in your country of residence. There are various methods to claim the DTAA benefit in your country of residence.

DTAA Methods

- Tax Exemption: You can claim a tax exemption in either of the two countries

- Tax Credit: You can claim a tax credit in your country of residence

There can be a difference in tax slabs though. Under such conditions, you pay the residual taxes in your country of residence. For example: If you had to pay 20% tax in the USA and the same income was taxed at 15% in India in the form of TDS defined under DTAA with the USA, then you have to pay the remaining 5% tax in the USA. Also, people generating income from countries in the Gulf region where no income taxes are applicable, don’t have to pay any taxes in India.

DTAA Documents

There are various documents required to avail the benefits under DTAA (Double Tax Avoidance Agreement), which are:

- Self-declaration cum indemnity format

- Self-attested PAN card copy

- Self-attested visa and passport copy

- PIO proof copy (if applicable)

- Tax Residency Certificate (TRC)

Note: According to the Finance Act 2013, an individual will not be entitled to claim any benefit of relief under Double Taxation Avoidance Agreement unless he or she provides a Tax Residency Certificate to the deductor. To receive a Tax Residency Certificate, an application has to be made in Form 10FA (Application for Certificate of residence for the purposes of an agreement under section 90 and 90A of the Income-tax Act, 1961) to the income tax authorities. Once the application is successfully processed, the certificate will be issued in Form 10FB.

Countries that India has DTAA with

India has signed the Double Tax Avoidance Agreement with more than 85+ countries all around the globe including USA, UK, and UAE. Some prominent countries and the respective TDS Rates are listed below:

| Country | TDS Rate under DTAA |

|---|---|

| USA | 15% |

| UK | 15% |

| Canada | 15% |

| Australia | 15% |

| Germany | 10% |

| South Africa | 10% |

| New Zealand | 10% |

| Singapore | 15% |

| Mauritius | 7.5% to 10% |

| Malaysia | 10% |

| UAE | 12.5% |

| Qatar | 10% |

| Oman | 10% |

| Thailand | 25% |

| Sri Lanka | 10% |

| Russia | 10% |

| Kenya | 10% |

There are several types of income on which these TDS rates are stipulated. In the next segment, let us glance through the basic income types these rates are applicable to.

Income Types under DTAA

The payment of double taxes can be avoided under DTAA on the income types listed below:

- Salary in India

- Services provided in India

- Capital Gains on transfer/sale of assets in India

- Real Estate Property in India

- Savings Bank Accounts in India

- Fixed Deposits in India

Note: If any of the above mentioned income types attract any tax implication in the NRI’s country of residence then they can avoid paying taxes in India by availing of the benefits of DTAA.

Double Taxation in India: FAQs

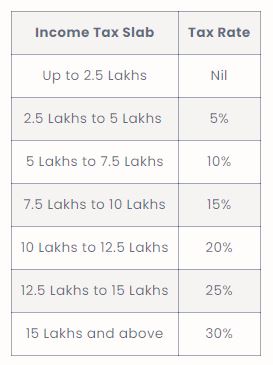

Yes. NRIs can claim a TDS refund according to their tax slab. If an NRI falls in the 10% taxation slab and a 15% TDS has been deducted then he/she can claim a 5% refund while filing his/her taxes. The NRI tax slab rates are as follows:

There are various documents required to avail the benefits under DTAA, which are:

– Self-declaration cum indemnity format

– Self-attested PAN card copy

– Self-attested visa and passport copy

– PIO proof copy (if applicable)

– Tax Residency Certificate (TRC)

According to the Finance Act 2013, an individual will not be entitled to claim any benefit of relief under Double Taxation Avoidance Agreement unless he or she provides a Tax Residency Certificate to the deductor. To receive a Tax Residency Certificate, an application has to be made in Form 10FA (Application for Certificate of residence for the purposes of an agreement under section 90 and 90A of the Income-tax Act, 1961) to the income tax authorities. Once the application is successfully processed, the certificate will be issued in Form 10FB.

DTAA (Double Tax Avoidance Agreement) is a treaty between countries to avoid paying double taxes. If you have already paid the taxes in India then you don’t need to pay taxes in your country of residence. There can be a difference in tax slabs though. Under such conditions, you pay the residual taxes in your country of residence.

For example: If you had to pay 20% tax in the USA and the same income was taxed at 15% in India in the form of TDS defined under DTAA with the USA, then you have to pay the remaining 5% tax in the USA. Also, people generating income from countries in the Gulf region where no income taxes are applicable, don’t have to pay any taxes in India.

Yes. A DTAA has been signed between India and USA stipulating a 15% TDS for NRIs on the income earned in India.