TDS stands for Tax Deducted at Source. Find the table of revised TDS Rates for Residents as well as Non-Resident Indians (NRIs) in India post the Union Budget of 2022 in this article.

TDS is either deducted at source by the companies through which you invest your money in India, while the returns are received calculated on stipulated TDS Rates, or by institutions providing salaries to you or directly by people paying the income to you and it needs to be deposited within a stipulated time to the government.

COVID-19 and TDS Rates

After the government of India provided relief to the Resident Indians concerning the TDS Rates for the period 14.05.2020 to 31.03.2021 as a result of the pandemic and the associated lockdowns affecting all the sectors of the country’s economy. The relief, however is limited to the TDS Rates only.

Note: The benefits have been provided only to the Resident Indians, NRIs can’t claim the benefits under this TDS Rates relief package of the government.

TDS Rates for NRIs for the FY 2022

| Section | Transaction Type | Threshold Limit | TDS for NRIs |

|---|---|---|---|

| 192 | Salaries | Basic exemption limit of employee | Normal NRI Slab Rate |

| 192A | Premature withdrawal from EPF | Rs. 50,000 | 10% |

| 194B | Income from games like lottery winnings, card games, crossword puzzles, etc. | Rs. 10,000 | 30% |

| 194BB | Income from horse race winning | Rs. 10,000 | 30% |

| 194E | Payment to Non-Resident sports person/ association | No limit | 20% |

| 194EE | Payment of amount standing to the credit of a person under National Savings Scheme (NSS) | 2,500 | 10% |

| 194F | Payment for the purchase of mutual fund units or UTI | No Limit | 20% |

| 194G | Payments, commission, etc., on the sale of lottery tickets | 15,000 | 5% |

| 194LB | Payment of interest on infrastructure debt fund to NRI | No Limit | 5% |

| 194LC | Payment of interest for the loan borrowed in foreign currency against loan agreement or the issue of long-term bonds | No Limit | 5% |

| 194LC | Payment of interest for the loan borrowed in foreign currency against the issue of long-term bonds listed in IFSC | No Limit | 4% |

| 194LD | Payment of interest on bond (rupee-denominated) to FII or a QFI | No Limit | 5% |

| 194LBA(2) | Interest income of a business trust from SPV distribution to its unitholders | No Limit | 5% |

| 194LBA(2) | Dividend income of a business trust from SPV | No Limit | 10% |

| 194LBA(3) | Rental income payment of assets owned by the business trust to the unitholders | No Limit | 30% |

| 194LBB | Income paid to a unitholder for units of an investment fund | No Limit | 10% |

| 194LBC | Income from investment in securitisation fund received to Non-Resident Indians | No Limit | 10% |

| 194N | Cash withdrawal in excess of a certain amount | Rs. 1 crore | 2% |

| 194N | Cash withdrawal in case person has not filed ITR for last three years and the original ITR filing due date passed | – Rs. 20 lakh to Rs. 1 Cr – Rs. 1 Cr | – 2% – 5% |

| 195 | Income from investment made by NRIs | No Limit | 20% |

| 195 | Long-term capital gain (LTCG) referred to in Section 115E | No Limit | 10% |

| 195 | Income by way of LTCG under section 112(1) (c) (iii) | No Limit | 10% |

| 195 | Income by way of LTCG U/S 112A | No Limit | 10% |

| 195 | Income by way of STCG U/S 111A | No Limit | 15% |

| 195 | Any other income by way of LTCG | No Limit | 20% |

| 195 | Income from royalty payable by the Indian concern for for the copyright in a subject referred in the first proviso of section 115A | No Limit | 10% |

| 195 | Income from royalty payable by government or Indian concern to pursue an agreement on matters mentioned in the industrial policy | No Limit | 10% |

| 195 | Income in the form of technical fees payable by government or Indian concern to pursue an agreement on matters related to industrial policy | No Limit | 10% |

| 195 | Any other income | No Limit | 30% |

| 196B | Income (including LTCG) from units of offshore funds | No Limit | 10% |

| 196C | Income (including LTCG) from foreign currency bonds/ GDR of an Indian company | No Limit | 10% |

| 196D | Income (excluding dividend and capital gain) from Foreign Institutional Investors | No Limit | 20% |

* TDS rate shall be increased by applicable surcharge and Health & Education Cess.

Note: In case of non-furnishing of PAN/Aadhaar by deductee, TDS will be charged at normal rate or 20% (5% in case of section 194-O), whichever is higher.

Also Watch: TCS on Outward Remittances for NRI (2020 Budget)

TDS Rates and NRI: The Inevitable Bond

NRIs and TDS Rates in India have a very unique bond. From income to investments, everything invites a certain percentage of tax and you can always find a tds chart assigned to NRIs almost everywhere. Tax for NRI on Indian Income and Investments is a very complex topic and to get to the crux of it, you need to dig deep. We, at SBNRI understand your struggle and provide simple solutions to these complex problems.

GREAT NEWS! You can now connect with our experts directly on WhatsApp using the button below.

TDS Rate Chart for NRI: FAQs

Yes, TDS is applicable for NRIs. The TDS Rates for NRI is different for different types of income and asset classes for investments in India.

The TDS rate under Section 195 ( Income in respect of investment made by a NRI) is 20%. However, there are other particulars under this section with different rates of TDS. You can browse through all the TDS Rates on our blog

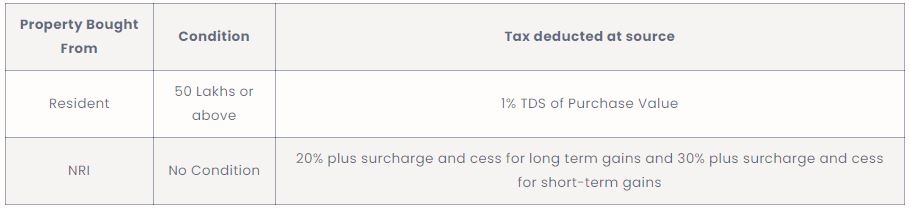

Deduct TDS as per the table below while buying property in India keeping in mind the associated conditions.

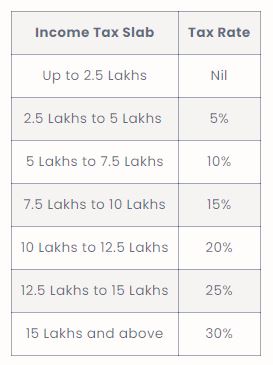

Yes, As an NRI, if your tax liability is less than the TDS deducted from your income, you can file an income tax return to claim a refund. Here’s a list of NRI Income tax slabs for your reference.