When you move abroad and become a Non-Resident Indian(NRI), or Overseas Citizen of India (OCI) you often need clarification about whether to file an ITR in India or not. For starters, even when you become an NRI, you need to file an ITR in India for incomes earned in India. Many NRIs have taxable income in India like rent, dividends, capital gain, etc. Since these incomes are deemed to be accrued and arised in India, they must file ITR for NRIs to comply with the regulations. Here are 5 tips for NRIs filing Income Tax Returns in India.

Do NRIs need to file an ITR in India?

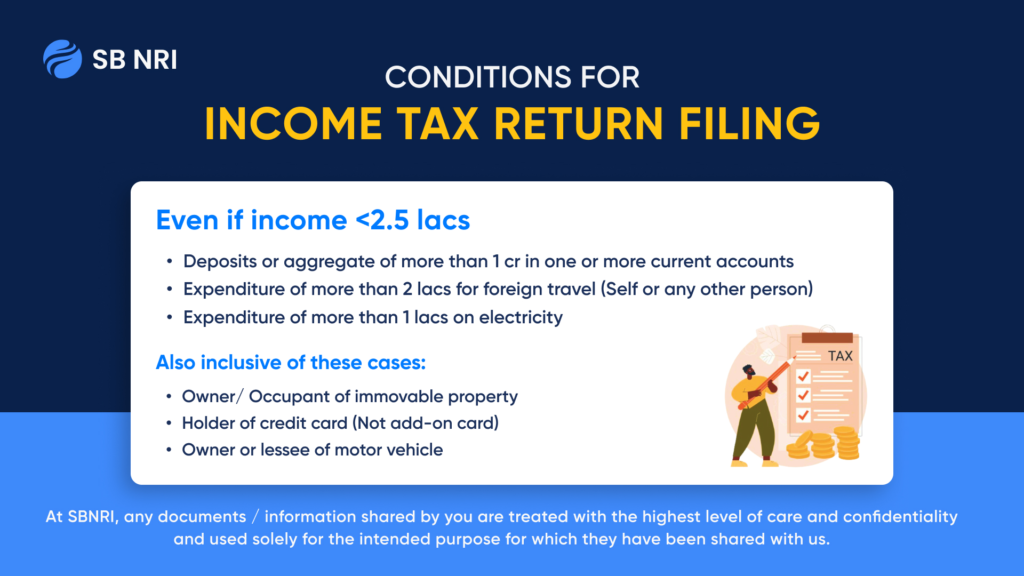

Many NRIs/OCIs do not file their income tax returns in India basis the assumption that their foreign source funds aren’t taxable in India. However, there may be transactions that they have performed in India those require them to file an NRI Income Tax Return. In many cases, NRIs/OCIs with income less than the exemption limit, i.e. Rs 2.5 lacs do not file the returns, again with the assumption that they are exempt from taxation liability.

Also read: ITR Filing for NRIs AY 2024-25: Step-by-Step ITR Filing Process

But there are conditions where an NRI/OCI needs to file an ITR even if the income is less than Rs 2.5 lacs in India. Here are those:

- If you have deposits or aggregate of more than 1 cr in one or more current accounts

- If you spend more than 2 lacs on foreign travel

- If you spend more than 1 lacs on electricity expenditure

Furthermore, there are three additional cases where they need to file NRI ITR in India:

- Occupant of immovable property

- Holder of credit card (Not add-on card)

- Owner or lessee of motor vehicle

Due to these discrepancies and cases where NRIs/OCIs have missed their ITR returns, Income Tax department may issue a notice or intimation to the user to verify the tax evasion and liability. It is advised that NRIs file ITR returns to abide by the compliance and avoid any notices.

Also read: Getting ITR Notice as NRI/OCI? Here’s what you need to know

5 Tips for NRIs Filling ITR Returns in India

1. Identify Residential Category:

The first step in the process for NRIs filing Income Tax Returns is to establish your residential status for the financial year. According to the Income Tax Act, your tax liabilities are directly linked to whether you are considered a Resident, Non-Resident Indian (NRI), or Resident but Not Ordinarily Resident (RNOR). Here’s how you can determine that:

- Resident: If you spend 182 days or more in India during the financial year.

- NRI: If you spend less than 182 days in India.

- RNOR: A transitional status that applies if you have been an NRI in nine out of the ten preceding years, or have stayed in India for a total of 729 days or less in the preceding seven years.

Understanding your status is crucial as it determines your taxable income and the deductions you are eligible for. If you stayed over 182 days, you’re a resident and taxed on global income. Less than 182 days, you’re a non-resident, taxed only on Indian income. Again, taking another example, if you stay in India for 200 days in a year, you’re a resident and must pay tax on all income worldwide. If you stay for 150 days, you’re a non-resident, taxed only on income earned in India.

Also read: Lower TDS Certificate for NRI Property Sale in India

2. Know Your Taxable Income in India

As an NRI, you are only taxed on income that is earned or accrued in India. This can include:

- Salary: If received in India or for services rendered in India.

- Rental Income: From property situated in India.

- Interest Income: From savings accounts, fixed deposits, and other investments in India.

- Capital Gains: From the sale of assets like property, shares, etc., located in India.

Income earned outside India is not taxable for NRIs. However, ensuring you correctly report and calculate your income earned within India is vital to avoid any legal issues.

Also read: TDS on Sale of Property by NRI in India [New Rates for 2024]

3. Choose the right ITR form:

Choosing the correct ITR form for NRIs filing Income Tax Returns is crucial. For NRIs, the appropriate forms are:

- ITR-2: For individuals and HUFs not having income from business or profession.

- ITR-3: For individuals and HUFs having income from a proprietary business or profession.

Using the correct form ensures that all your income sources and applicable deductions are accurately reported, minimizing the risk of discrepancies and subsequent notices from the tax department.

Also Read: Income Tax e-filing: Top 10 NRI Income Tax Filing Benefits

4. Claim Relevant Deductions and Exemptions

NRIs are eligible for various deductions under the Indian Income Tax Act. Some common deductions include:

- Section 80C: Up to INR 1.5 lakh for investments in specific instruments like PPF, ELSS, and life insurance premiums.

- Section 80D: For health insurance premiums paid for self, spouse, children, and parents.

- Section 24: Deduction on home loan interest for property in India.

Additionally, exemptions on income such as interest on NRE (Non-Resident External) accounts and certain specific investments can also help reduce your taxable income.

5. Understand Compliance and Documentation

Maintaining proper documentation and staying compliant with tax regulations is essential for a hassle-free tax filing experience. Ensure you:

- Keep Records: Maintain records of all income sources, investments, and deductions claimed.

- Form 67: File Form 67 if you are claiming Foreign Tax Credit (FTC) to avoid double taxation.

- Repatriation Certificates: For income repatriated to your country of residence, maintain the necessary certificates to avoid any issues during tax assessment.

Calculate your TDS Refund with SBNRI’s TDS Refund Calculator

A TDS refund is the process of reclaiming the excess tax deducted at source by the payer if the actual tax liability of the taxpayer is lower than the TDS deducted. This situation typically arises when the income tax calculated on the total income is less than the TDS already deducted. To claim a TDS refund, taxpayers need to file an income tax return (ITR). The Income Tax Department processes the ITR and verifies the details. If the tax department finds that the TDS paid is more than the actual tax liability, the excess amount is refunded to the taxpayer.

You can easily find out how much tax refund you can get by calculating your TDS Refund from this TDS Refund Calculator.

Access SBNRI’s Exclusive NRI Taxation Guide

NRIs and OCIs can now access SBNRI’s exclusive NRI Taxation Guide covering in-depth information about DTAA, Gift Tax, Rental Income Tax, ITR Filing, Types of ITR Forms for NRIs, Capital Gain Tax, Income Tax, and more. The report will help you understand India taxation on mutual funds, other asset classes and how you can comply with the regulations.

Access NRI Taxation report here

Wrapping Up

NRIs need to be updated with the new rules and regulations related to tax. NRIs filing income tax returns is important to avoid penalties and stay legally compliant. Ensure timely and accurate filing involves determining residential status, reconciling income, calculating tax liabilities, and utilizing applicable tax reliefs. Choosing the correct ITR form and providing necessary details about assets and liabilities, if required, are key steps. It’s important to stay informed about current rules and deadlines to make the process smoother and stress-free.

Looking for NRI ITR Filing? Connect with SBNRI NRI Tax Expert CA Today!

At SBNRI, we have simplified ITR filing for NRIs/OCIs through a smooth digital journey. Be it Basic Filing, Advanced Filing (includes Capital Gain, etc.), or Premium Filing (Foreign Income), we can help you assess the right computation and lower your tax liability.

“We’ve helped over 500+ NRIs/OCIs file ITR returns and more than 25,000+ across other taxation services last financial year and we’d love to help you out too”

You can download SBNRI App or connect with NRI Tax Expert team directly via the button below.

FAQs

How to save on taxes in India by NRI?

NRIs can save on taxes in India by utilizing several deductions and benefits. They can claim a standard deduction of 30% and deduct property taxes and interest from a home loan.

Should NRIs file tax returns in India?

NRIs should file income tax returns in India if they earned income in India during the financial year. Their tax liability depends on their residential status.

What are 120 days rules for NRIs?

The 120 days rule for NRIs states that if they spend more than 120 days but less than 182 days in India and their total income from India is ₹15 lakh or more, they are considered “resident but not ordinary resident” (RNOR).

How to avoid TDS for NRI?

- One way is by opening a specific bank account like:

- A Non-Resident Ordinary Rupee Account (NRO)

- A Foreign Currency Non-Resident Account (FCNR)

- A Non-Resident External Account (NRE)

What is the rule for NRI in ITR?

If the annual returns for NRIs cross the basic exemption limit of Rs 2.5 lakh, NRIs should file their return. However, there are cases where the NRIs/OCIs need to file their return even if their income is less than Rs 2.5 lakh. Here are those cases:

- If you have deposits or aggregate of more than 1 cr in one or more current accounts

- If you spend more than 2 lacs on foreign travel

- If you spend more than 1 lacs on electricity expenditure

What is the penalty for not declaring NRI status?

There is no penalty for not declaring NRI status. However, we advise you to update your NRI status on the IT portal and also close your resident savings account. This will help you to avoid any discrepancies from the IT department and also help you comply with the regulations.

Do NRIs pay capital gains tax?

Yes, capital gains tax provisions for an NRI are similar to those for a resident individual except for the applicability of TDS provisions. Like resident investors, capital gains tax for an NRI depends on the holding period and the type of property sold.

How long can I maintain NRI status after returning to India?

For RNORs returning to India, they can retain their RNOR status for up to 3 years after their return. During this period, any income earned in India will be taxable, while income earned abroad will not be taxable, similar to the tax treatment for NRIs, for those 3 years post-return.

What is the 4 year rule of NRI?

An individual is considered an NRI under the Income Tax Act if they have been in India for fewer than 182 days in the preceding financial year, or if they have been in India for fewer than 60 days during the previous year and 365 days or less over the past four years.

What is the 182 days rule for NRI?

NRI can stay in India for more than 182 days during a financial year. However, doing so will change their residential status from NRI to resident. In other words, to retain NRI status, an individual must stay in India for fewer than 182 days in a financial year.

What is the 240 days rule for NRI?

The 240 days rule for NRI refers to a provision introduced in the Finance Act 2020. According to this rule, an individual will be considered an NRI if they stay in India for 240 days or less during a financial year, provided they also meet certain other conditions related to previous years’ stays in India. This amendment was made to provide more clarity and flexibility for determining NRI status, ensuring that individuals who spend a significant portion of the year outside India are not taxed as residents.