Recently, many Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs) are getting Income Tax Notices from the IT department. These notices vary from e-campaign notices to Sec 148A/A48 notices and have caused NRIs/OCIs a concern about understanding such notices and the right steps to respond to them. In this blog, we’ll look at what you need to do when you receive an Income Tax notice (ITR Notice for NRI/OCI) in a detailed guide.

Why are NRIs/OCIs getting Income Tax notices?

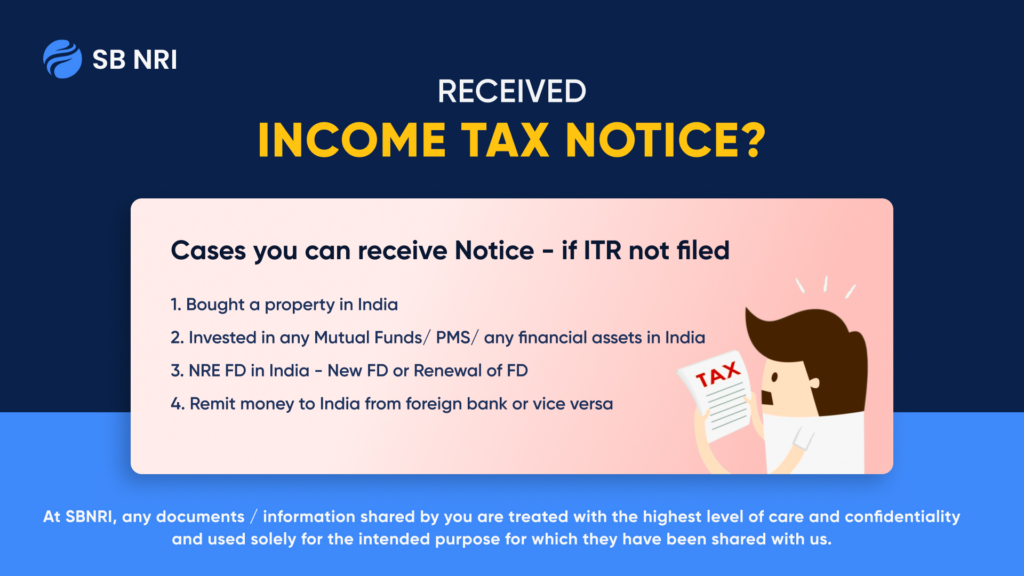

Many NRIs/OCIs do not file their income tax returns in India basis the assumption that their foreign source funds aren’t taxable in India. However, there may be transactions that they have performed in India and those require them to file an ITR. In many cases, NRIs/OCIs with income less than the exemption limit, i.e. Rs 2.5 lacs do not file the returns, again with the assumption that they are exempt from taxation liability.

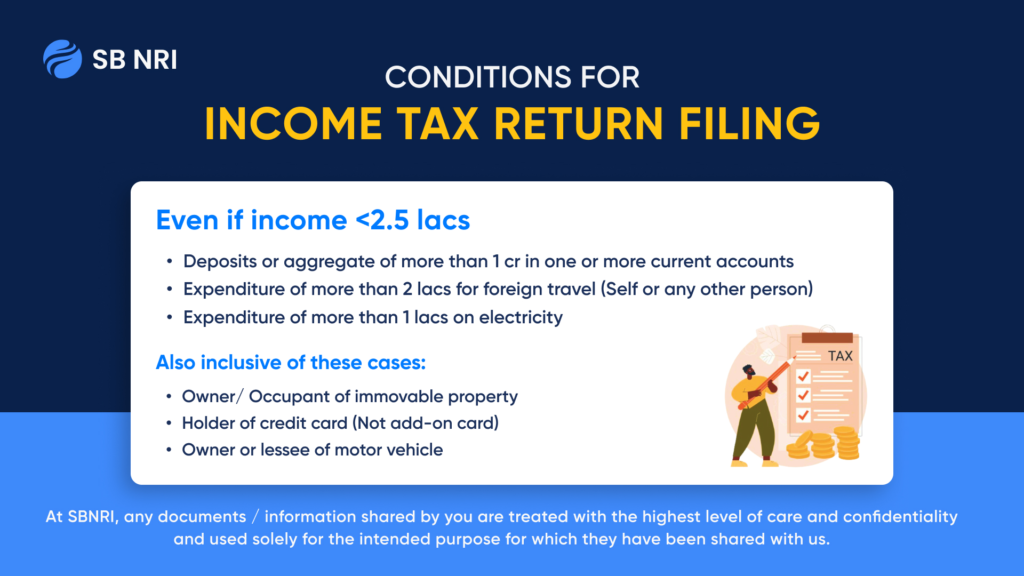

But there are conditions where an NRI/OCI needs to file an ITR even if the income is less than Rs 2.5 lacs in India. Here are those:

- If you have deposits or aggregate of more than 1 cr in one or more current accounts

- If you spend more than 2 lacs on foreign travel

- If you spend more than 1 lacs on electricity expenditure

Also read: ITR Filing for NRIs AY 2024-25: Step-by-Step ITR Filing Process

Furthermore, there are three additional cases where they need to file ITR in India as:

- Occupant of immovable property

- Holder of credit card (Not add-on card)

- Owner or lessee of motor vehicle

Due to these discrepancies and cases where NRIs/OCIs have missed their ITR returns, Income Tax department may issue a notice or intimation to the user to verify the tax evasion and liability.

Also read: Lower TDS Certificate for NRI Property Sale in India

What are the ITR notice for NRI/OCI that are sent by Income Tax Department?

The Income Tax Department can send four different types of notices to NRIs/OCIs:

- e-campaign notices: This kind of notice is issued when any NRI/OCI performs a significant financial transaction (SFT), i.e. high-value deals or transactions and they’ve not filed an ITR. In this case, IT department sends users an e-Campaign – Non-filing of Income Tax Return (ITR) notice. You can check these notices online on the IT portal by going to the e-compliance section.

- Notices under Section 148A: This is a show cause notice and is sent by the IT department to enquire about the financial transactions performed by NRI/OCI and were captured in the IT department’s database system. This is generally a first level of scrutiny and users are required to reply with an appropriate response. In the absence of a satisfactory revert, the IT department can issue further scrutiny proceedings to the users.

- Notices under Section 148: This is a scrutiny proceeding notice or Assessment Proceeding initiated by the Income Tax Department. This kind of notice is sent to the user by the IT department to NRIs/OCIs for the year when they had conducted significant financial transactions and ITR was not filed for the year. The notice comes with a time-limit to comply and non-compliance of the same will lead to penalty and tax liability for the user.

- Scrutiny and Detailed Questionnaire Notice under Section 142(1): This kind of notice is meant for cases when the Income Tax department has initiated a Scrutiny Proceeding or Assessment Proceeding against the user. During this process, the tax authorities issue a detailed questionnaire to the user which should be responded to within a limited time frame. Any non-compliance on the part of the user will mean the levying of hefty taxes and penalties for the transactions conducted by the NRIs/OCIs.

What are the financial transactions conducted by NRIs/OCIs that the Income Tax Department records in its database?

As we discussed above in the paragraph the Income tax department records transactions performed by NRIs/OCIs in their database and if any anomaly is found in the transactions and filed ITR or non-filling of returns, IT department may issue notices to the users. But what are those transactions that the IT department records in their database? Here’s a list of them:

- Purchase or sale of mutual funds in India

- Purchase or sale of shares/equity in India

- Purchase or sale of immovable property in India

- NRE/NRO Deposits Interest Income in India

- NRE/NRO Fixed Deposits in India

- Dividend Income

- Remittance/Repatriation of money

Also read: NRI Income Tax Slab Rates for FY 2023-24 (AY 2024-25)

Why do NRIs/OCIs miss ITR Notice?

Many NRIs/OCIs may miss the income tax notices due to the non-updation of communication addresses in the income tax portal. As such, the notices are delivered to their old Indian local address, and NRIs/OCIs aren’t aware of it. NRIs/OCIs are advised to update their communication address, email address, and latest phone number in the income tax portal so they do not miss any intimation from the IT department.

Calculate your TDS Refund with SBNRI’s TDS Refund Calculator

A TDS refund is the process of reclaiming the excess tax deducted at source by the payer if the actual tax liability of the taxpayer is lower than the TDS deducted. This situation typically arises when the income tax calculated on the total income is less than the TDS already deducted. To claim a TDS refund, taxpayers need to file an income tax return (ITR). The Income Tax Department processes the ITR and verifies the details. If the tax department finds that the TDS paid is more than the actual tax liability, the excess amount is refunded to the taxpayer.

You can easily find out how much tax refund you can get by calculating your TDS Refund from this TDS Refund Calculator.

Access SBNRI’s Exclusive NRI Taxation Guide

NRIs and OCIs can now access SBNRI’s exclusive NRI Taxation Guide covering in-depth information about DTAA, Gift Tax, Rental Income Tax, ITR Filing, Types of ITR Forms for NRIs, Capital Gain Tax, Income Tax, and more. The report will help you understand India taxation on mutual funds, other asset classes and how you can comply with the regulations.

Access NRI Taxation report here

What to do when you get a notice from Income Tax as NRI/OCI?

The complexity of ITR forms and unintentional errors in filing the details can prompt the issuance of notices. But getting an ITR notice for NRI doesn’t mean you should panic. You can respond to the notice within the stipulated time frame. You should also make sure to attach adequate documentation along with your response to clarify the income tax department about the case and your understanding of the same. Seeking professional help can ease your case and help you in proper handling of the situation.

At SBNRI, we have tax experts to resolve any queries that NRIs may have related to NRI income tax and ITR notices. You can download SBNRI App to connect with our NRI Income Tax Experts and get end-to-end assistance related to NRI tax filing. SBNRI will also help you get a lower TDS Certificate.

You can also click on the button below to ask any questions. Visit our blog and YouTube Channel for more details.

FAQs

Why NRIs are getting notice from Income Tax Department?

Many NRIs/OCIs are getting ITR notice for NRI from the Income Tax department due to discrepancies in the ITR filing and the financial transactions recorded in the database of the IT department or non-filing of ITR and more. It may also be due to the reason of receiving dividend income which is taxable in India but was not paid by the NRIs.

What should I do if I get my ITR notice?

Login to the IT portal with your credentials and check the notice. Then you can respond to the notice within the stipulated time frame. You should also make sure to attach adequate documentation along with your response to clarify the income tax department about the case and your understanding of the same. If further required, you can seek professional help to help resolve the situation.

What is the rule for NRI in ITR?

If the annual returns for NRIs cross the basic exemption limit of Rs 2.5 lakh, NRIs should file their return. However, there are cases where the NRIs/OCIs need to file their return even if their income is less than Rs 2.5 lakh. Here are those cases:

- If you have deposits or aggregate of more than 1 cr in one or more current accounts

- If you spend more than 2 lacs on foreign travel

- If you spend more than 1 lacs on electricity expenditure

What is the penalty for not declaring NRI status?

There is no penalty for not declaring NRI status. However, we advise you to update your NRI status on the IT portal and also close your resident savings account. This will help you to avoid any discrepancies from the IT department and also help you comply with the regulations.

What is NRIs under scrutiny?

Recently, Income Tax Authority of India has sent notices and further asked NRIs to give statements on the exact number of days spent in the country to stop the tax violation and evasion. This recent crackdown was seen as NRIs under scrutiny.

How can I avoid notice of income tax department?

It is advised that you should file your returns and make sure that the details provided to the IT department are correct. Also make sure that if you perform any financial transactions in India that need to be reported, do file a return to avoid any notices.