Stock markets are affected largely by international and domestic events. One such major domestic event is the Indian elections. With India undergoing its Lok Sabha Elections 2024, all of the eyes are on the outcome of the result and the perceived notion around how the market will perform after the elections. So why are markets dependent on Indian elections and how has it historically fared in the previous aftermath of the elections? Let’s find out in this blog about the Indian elections impact on stock market, historical market trends, and how it bodes for the future.

What is a Stock Market?

The stock market is a centralized platform where shares of publicly traded companies are bought and sold. Companies list their stocks on exchanges, such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), two major stock exchanges in India. Investors, ranging from individuals to large institutions, purchase shares to gain ownership stakes and potential profits through dividends and price appreciation. Stock markets facilitate liquidity, enabling the quick buying and selling of securities, and they operate under regulations to ensure fair and transparent trading practices.

Also read: How understanding the Rule of 8-4-3 can turn your Rs 30,000 monthly into Rs 1.5 cr?

How does the Stock Market work?

A stock market functions as a platform where buyers and sellers can negotiate prices and conduct transactions via a stock exchange. Companies looking to raise public capital list their shares on the stock exchange through an Initial Public Offering (IPO). Once listed, these shares are available for trading among investors, facilitating capital raising for the company.

Also read: What is the Rule of 72 and How to use it to Double your Wealth?

How are Stock Prices determined?

The forces of supply and demand drive stock prices in the market. When the demand for a stock (i.e., the number of buyers) exceeds its supply (i.e., the number of sellers), the price of the stock rises. Conversely, if the supply of a stock (i.e., the number of sellers) surpasses its demand (i.e., the number of buyers), the stock price falls.

Also read: 10 Mutual Funds That Doubled Wealth In 5 Years

How do Investors make Buying and Selling decisions?

Investors make buying and selling decisions based on recent news and events. Positive news about a company can create optimistic market sentiments, encouraging investors to buy the stock, which can drive up its price. For example, approval of thermal plants for a power generation company can suggest business growth for the company and can boost the demand for its shares, ultimately raising the price of the stock. On the other hand, adverse news like SEBI inquiry on a company can lead to negative publicity about the company and cause stock prices to drop.

Also read: Step-by-Step Guide for NRIs to Pick a Winning Mutual Fund

Indian Elections Impact on Stock Market

Every five years, the Indian stock market undergoes significant volatility during election seasons. Historical data shows that major indices like Nifty and Sensex often reach their all-time highs, leading to substantial rallies. As the 2024 general elections approach, similar patterns are emerging, influenced by various political factors and government agendas.

Why do the Indian Elections Impact Stock Market?

The stock market’s reaction to elections is largely due to policy changes and political actions taken by parties to secure their positions. Political parties often implement rapid economic stimulation strategies to increase their re-election chances. This pre-election period sees heightened market activity and volatility, which tends to stabilize post-elections, depending on the results and subsequent political stability.

Historical Market Trends in the run-up to the Lok Sabha Election

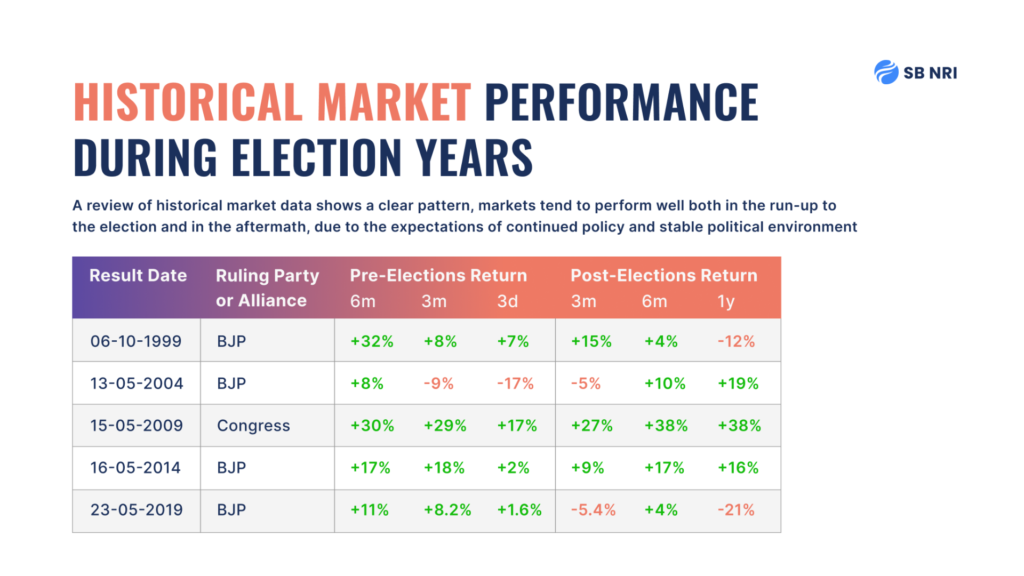

India’s election years have consistently attracted heightened investor interest and market activity, reflecting the anticipation and uncertainty surrounding potential policy shifts and government stability. Historical market data reveals a clear pattern: markets generally perform well both before and after elections, driven by expectations of stable political conditions and the continuation of economic policies.

In the six months leading up to elections, market indices often rise as investors adjust their portfolios based on anticipated outcomes. Past election cycles have shown increased average market returns during this period, indicating positive investor sentiment fueled by the prospect of a stable government and potential reformative measures. This upward trend typically extends post-election, as established policies and new governmental frameworks provide clearer direction for market movements.

Historical Analysis of the Indian Elections Impact on Stock Market

Here’s an overview of some notable election years and the Indian elections impact on stock market:

- 1999 General Elections:

- The 1999 elections, held after the Kargil War, resulted in a clear victory for the Bharatiya Janata Party (BJP)-led National Democratic Alliance (NDA). The stock market responded positively due to the perceived political stability and pro-business stance of the NDA.

- 2004 General Elections:

- The unexpected victory of the Indian National Congress (INC)-led United Progressive Alliance (UPA) led to a significant drop in the stock market. The Bombay Stock Exchange (BSE) Sensex fell by over 11% in a single day due to concerns over economic policies and stability.

- 2014 General Elections:

- The decisive victory of Narendra Modi and the BJP was met with an overwhelmingly positive reaction from the stock market. The Sensex soared, reflecting investor optimism about Modi’s promises of economic reforms and pro-business policies.

- 2019 General Elections:

- The re-election of Narendra Modi saw the Sensex hitting new highs. The market responded positively to the continuity and stability provided by the incumbent government, coupled with expectations of continued economic reforms.

Also read: NRI Income Tax Slab Rates for FY 2023-24 (AY 2024-25)

Case Studies of Significant Elections and Subsequent Market Performance

- 2014 Elections:

- The 2014 elections were a turning point for the Indian stock market. The BJP’s promise of economic reforms and a business-friendly environment led to a sense of renewed optimism among investors. The Sensex rose by approximately 25% in the months leading up to and following the election results.

- 2019 Elections:

- The market’s reaction to the 2019 elections was a testament to the confidence in the incumbent government. The Sensex surged by over 1,000 points (around 3%) on the day the results were announced, reflecting investor relief and optimism about policy continuity and economic growth.

Long-Term Historical Market Trends during Different Political Regimes

Different political regimes have influenced long-term market trends through their policies and governance. Here’s an analysis of how various administrations have impacted the market:

- NDA (1999-2004, 2014-present):

- The NDA’s policies have generally been favorable to the market, with a focus on liberalization, economic reforms, and infrastructure development. The market has shown robust growth during NDA tenures, driven by investor confidence in the government’s pro-business stance.

- UPA (2004-2014):

- The UPA era witnessed a mixed response from the stock market. Initial years saw growth driven by global economic conditions and domestic reforms. However, later years were marred by policy paralysis, corruption scandals, and slowing economic growth, leading to market stagnation.

Also read: Highest NRI deposit in India in the last 8 years, Know more

Policy Changes and its Economic Impacts

- Economic Liberalization:

- Policies promoting economic liberalization, such as the Goods and Services Tax (GST) implementation and the Make in India initiative, have had positive long-term effects on the market. These reforms have improved the business environment, attracting both domestic and foreign investment.

- Regulatory Reforms:

- Regulatory changes aimed at improving corporate governance, increasing transparency, and streamlining business processes have boosted investor confidence. For instance, the introduction of the Insolvency and Bankruptcy Code (IBC) has strengthened the financial sector by addressing bad loans and improving creditor recovery rates.

Lok Sabha 2024 Election Result Impact Scenario on Indian Markets

- BJP Retains Single-Party Majority: The continuation of the existing government often portrays an image of policy continuity and stability. If the BJP retains a single-party majority, market movement may showcase positive momentum.

- BJP Forms Government with NDA Majority: Should the BJP fail to obtain a single-party majority and form a government with the NDA (> 272 seats), markets may showcase neutral sentiment in the immediate future.

- Change in Government: A new coalition, INDIA, securing a majority could showcase a different take on the market and policies. However historically, even with changes in government, the market tends to stabilize in the near future (3-6 months).

Also read: India Solidifies Its Position as the Most Preferred Emerging Market: Morgan Stanley

Factors Influencing Investor Decisions During Elections

- Political Developments: Investors closely monitor political developments, as elections can lead to significant policy changes impacting various sectors. Continuous updates on political events, party manifestos, and opinion polls help investors gauge the potential direction of government policies. For instance, an anticipated shift towards a pro-business administration can boost investor confidence, leading to increased market activity.

- Financial Reports: Evaluating company performance through financial reports is crucial for investors. During election periods, investors scrutinize quarterly earnings, revenue growth, and other key financial metrics to forecast future prospects. Companies that demonstrate strong fundamentals and resilience are often favored, as they are perceived to withstand potential post-election policy shifts better.

- Key Events: Investors time their trades around significant domestic or global events that might influence market movements. Events such as election debates, policy announcements, or geopolitical developments can cause market volatility. By anticipating and reacting to these events, investors aim to optimize their portfolio performance.

- Market Indicators: Monitoring market indicators like the Price-to-Earnings (PE) ratio, moving averages, and volatility indices helps investors make informed decisions. These metrics provide insights into market sentiment and valuation, guiding investors on whether to buy or sell securities. For example, a low PE ratio might indicate undervalued stocks, while high volatility could suggest caution.

Also read: Best Mutual Funds for NRI in India 2024

Post-Election Market Dynamics

- New Policies: The implementation of new policies by the elected government significantly affects the stock market. Sectors directly impacted by these policies, such as infrastructure, healthcare, or renewable energy, may experience heightened activity. Investors adjust their portfolios to align with the anticipated benefits or drawbacks of these policies.

- Sectoral Focus: Election outcomes can shift the focus towards certain sectors, leading to varying market performances. For instance, a government emphasizing digital transformation might boost technology stocks, while one prioritizing manufacturing could drive industrial sector growth. Investors reposition their holdings to capitalize on these sectoral trends.

- Investor Sentiment: Market sentiment is heavily influenced by public perception of the election results. A decisive victory for a pro-reform government can uplift market sentiment, encouraging investment and driving up stock prices. Conversely, a hung parliament or political instability can lead to market uncertainty and cautious investor behavior.

Also read: Top 5 Reasons to Invest in India Now

Wrapping Up

Major elections such as those in 2014 and 2019 have shown that clear and decisive victories, particularly for parties perceived as pro-business, often lead to market optimism and rallies. Conversely, unexpected results or political instability can cause market downturns.

Understanding these patterns is essential for investors. Historical trends on Indian elections impact indicate that markets generally react positively to perceived stability and clear policy direction. This knowledge can help investors make informed decisions, mitigating risks associated with the uncertainty surrounding election periods.

As the 2024 Lok Sabha elections result approach, investors must stay informed about political developments and potential policy shifts. The outcome of Indian elections impact will likely be similar to previous election cycles.

Start your Investing Journey as an NRI in India with SBNRI

NRIs can now download the SBNRI App and choose to invest in different investment options in India with ease. You can also get detailed investment advice and portfolio review of your existing investments from experts at SBNRI. Also, visit our blog and YouTube channel for more details.

SBNRI is an authorized Mutual Fund Distributor platform & registered with the Association of Mutual Funds in India (AMFI). ARN No. 246671. NRIs willing to invest in mutual funds in India can download the SBNRI App to choose from 2,000+ mutual fund schemes or can connect with the SBNRI wealth team to better understand Mutual Fund investments.

FAQs

How do Indian elections impact the stock market?

- Indian elections often lead to increased market volatility as investors react to potential policy changes and political stability. Election outcomes can drive market sentiment, influencing stock prices and investment strategies.

What was the impact of the 2014 Indian general elections on the stock market?

- The 2014 general elections led to a significant rally in the stock market. The victory of Narendra Modi and the BJP boosted investor confidence due to expectations of economic reforms and a pro-business environment, resulting in a substantial rise in the Sensex.

How did the 2019 elections influence the Indian stock market?

- The re-election of Narendra Modi in 2019 saw the Sensex hitting new highs. The market responded positively to the continuity and stability provided by the incumbent government, along with expectations of continued economic reforms.

Why are elections important for stock market investors in India?

- Elections are crucial for stock market investors as they can lead to policy changes that affect various sectors. Understanding election outcomes helps investors anticipate market movements and make informed investment decisions.

What sectors are most impacted by Indian elections?

- Sectors like infrastructure, finance, healthcare, and energy are often significantly impacted by election outcomes due to potential policy changes. Investors closely monitor these sectors for any shifts in government priorities.

How can investors prepare for the volatility during Indian elections?

- Investors can prepare by diversifying their portfolios, staying informed about political developments, and understanding historical market reactions to similar events. This helps in mitigating risks and capitalizing on potential opportunities.

What are the long-term trends in the Indian stock market during different political regimes?

- Long-term trends show that pro-business regimes, like the BJP-led NDA, often result in robust market growth due to economic reforms and liberalization policies. Conversely, periods of policy paralysis and political instability can lead to market stagnation.

How do policy changes post-elections impact the stock market in India?

- Post-election policy changes can have significant economic impacts. Reforms such as the implementation of the Goods and Services Tax (GST) and the Insolvency and Bankruptcy Code (IBC) have historically boosted investor confidence and market performance.

What should investors focus on during the 2024 Indian general elections?

- During the 2024 general elections, investors should focus on political developments, potential policy shifts, and historical market trends. Staying informed and understanding the implications of different electoral outcomes can help in making strategic investment decisions.