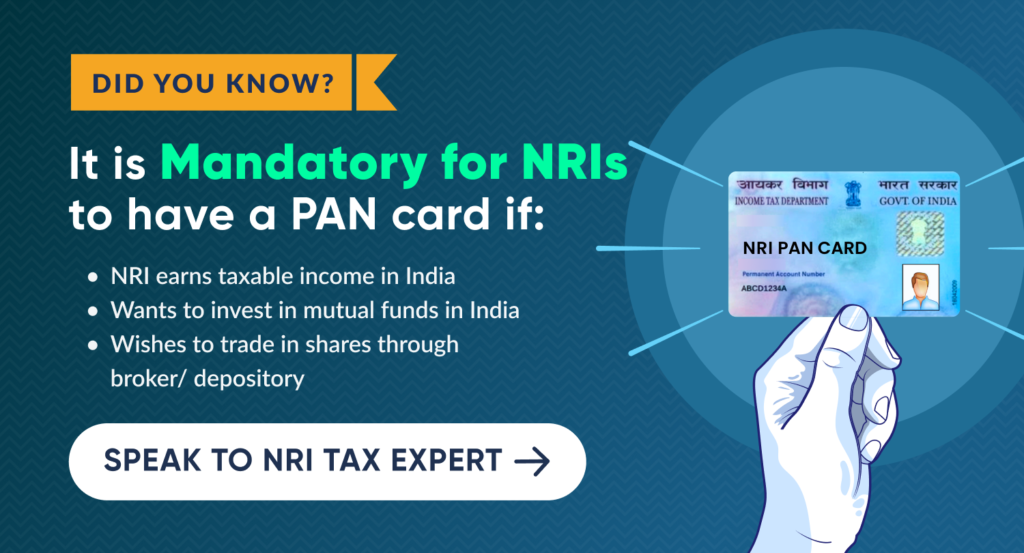

Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs) need a PAN Card (Permanent Account Number) to conduct financial transactions in India, including Banking, investment in mutual funds for NRIs, and property dealing(buying, selling and even inheritance for NRIs), taxation for NRIs and more. In this blog, we look at why PAN card is important for NRIs and how can NRIs apply for it.

Why is it Important for an NRI to Have a PAN card?

PAN card stands for Permanent Account Number. It is a unique identification given to tax-paying individuals and is made up of 10 English letters and numbers. Holding a PAN card will provide you with the following benefits:

- To open an NRE or NRO Account

- To invest in mutual funds, PMS, commercial real estate, and more.

- To purchase or sell property in India.

- For filing of ITR in India

- For claiming the inheritance gift as NRI from parents

- To buy physical gold worth more than Rs. 2 lacs

5 Benefits of the NRI PAN Card

NRI PAN Card has multiple uses and helps NRIs/OCIs to conduct various financial activities in India. Let’s take an example to explain these benefits.

Suppose Ananya is an NRI residing in Australia, but she has inherited property in India from her family and decides to sell this property to invest in a business opportunity back in India itself. Here’s how holding a PAN card would benefit her:

- Open NRI (NRO/NRE) Bank Account: Using a PAN card, Ananya can quickly open an NRO bank account in India to receive the proceeds of the property sale and properly manage her finances. Since her income is going to be from the sale of property, she has to open a NRO bank account to receive the income.

- Lower TDS: Ananya must pay capital gains tax on selling the property in India. She can apply for a Lower TDS certificate to reduce her tax burden. For the same, an active PAN is mandatory to apply for a Lower TDS Certificate, in the absence of which NRIs will have to bear the brunt of higher TDS rates (ranging from 20% to 30%). Having a PAN card not only reduces her tax burden but also helps her be tax-compliant in India.

- Sale of Property: For the sale to be lawful, Ananya needs her PAN card during the transaction. This helps in ownership transfer and paperwork. Your Permanent Account Number (PAN) is a vital document when it comes to property transactions in India. NRIs often face issues with inoperative or inactive PAN cards, which can cause delays and complications during the sale.

- Investments: Ananya chooses to invest a portion of the proceeds from the sale of the property in mutual funds. Getting her Mutual Fund KYC is mandatory to open an account to invest in mutual funds in India irrespective of the investment amount. Once her KYC is done, she can easily invest in domestic and international mutual fund schemes offered by Asset Management Companies (AMCs) and build wealth.

- Avail Exemptions under Sec 54: Ananya can avail exemption on the capital gain from the sale of property. She can avail Sec 54, 54F and 54EC to reduce her tax burden. For this to happen she needs to have her PAN card.

Also read: PAN Card for NRI: The Ultimate Guide 2024

Wrapping Up

Having a PAN card makes banking, investing, and buying and selling real estate in India easier for NRIs/OCIs. For money earned domestically, it makes tax compliance easier. NRIs can also open Bank Accounts in India, and it makes it easier for them to invest in Indian markets. In summary, the PAN card follows legal compliance and improves financial possibilities allowing non-resident Indians (NRIs) to participate in India’s economy with ease.

Contact SBNRI

Due to the lack of resources or right information, NRIs may sometimes find it difficult to apply for a new PAN card or correct the information in the existing PAN. We at SBNRI, understand this struggle and are here to help you out with everything. You can get in touch with our expert directly on WhatsApp using the button below to resolve your doubts and queries. Also visit our blog and YouTube Channel for more details.

FAQS

Do NRIs need a PAN card to invest in mutual funds?

- Yes. NRI can invest in mutual funds in India using their NRE/NRO bank account once they complete their Mutual Fund KYC.

What is an NRI PAN card?

- It is a legal requirement for NRI to conduct Financial transactions in India. Required by the Income Tax Department, it acts as a unique identifier. An NRI PAN Card is necessary for non-resident Indians (NRIs) to comply with income tax laws in India, whether they are making money through:

- Investments

- Salaries

- Property Rents

- Dividend Income

Can non-resident Indians invest in mutual funds in India?

- Yes, NRIs can invest in mutual funds in India. The Reserve Bank of India allows NRIs to invest in mutual funds through the Foreign Exchange Management Act (FEMA) regulations.

Can an NRI buy property in India without a PAN card?

- NRIs need a PAN card because they will be required to file income tax returns if they have rented out the property. Besides, if the property is sold later, the capital gains resulting from the sales would be subject to capital gains tax. Capital gains would be included in the total income while it is being taxed.

Can OCI holders get PAN cards?

- People who hold Indian citizenship and settled abroad should use the Form 49A available for Indian citizens. Whereas NRIs who hold foreign citizenship, such as OCI holders or people of Indian origin who possess foreign citizenship or foreigners who are not of Indian origin are required to fill Form 49AA.