As per a report by the United Nations, India has the largest diaspora population in the world with around 18 million people from the country living away from their homeland in 2020. Hence, India continues to be the top receiver of remittance in the world. The US, UAE, Saudi Arabia, Canada, Qatar, UK, Kuwait, Oman, Germany, France, Australia, and China are the top countries from where remittance money comes to India. There are several ways to transfer money to India online as well as offline. Here are some of the best ways to send money to India along with transfer charges.

Also Read: NRO to NRE Transfer: A Preview to NRI Remittance

Best Ways to Send Money to India

The following are some of the best ways to send money to India based on the transfer fees, speed and other important features.

Best Ways to Send Money to India: The List

1. Wise (formerly TransferWise) Money Transfer

Wise, formerly known as TransferWise, is the easiest way to transfer money online. It’s simple to set up an account or make a transfer through Wise. Wise also has the best exchange rates and doesn’t add any hidden exchange rate markups.

Cost to Transfer Money to India

Transfer fee: 1.13 USD + 0.6% of the amount being transferred

Exchange rate: The best possible rate as you see on Google

Additional fees: Bank debit (ACH) is the cheapest followed by bank wire transfer, debit card and credit card

How to Transfer Money with Wise?

- Create an online account and log in.

- Type the amount and destination.

- Enter the recipient details.

Key Features and Benefits

- The beneficiary will receive the money in Indian Rupee from the Wise’s local account within 0-1 business days.

- Quick online set-up.

- Best rates online and no hidden charges.

- Easy-to-use app.

2. Remitly Money Transfer

Remitly has no minimum limit and accepts credit cards to send money within minutes. It can come in handy for instant money transfer to India to friends and family. Besides, it is cheaper than Xoom/ PayPal or Western Union for money transfers within minutes.

Cost to transfer money to India

Transfer fees: Zero transfer fees for sending $1000 or more and a fee of $3.99 will be charged if you send less than this.

Exchange rate: Fixed exchange rate for any amount.

How to Transfer Money with Remitly using Debit or Credit Card

- Log in to the Remitly website.

- Type your name, card number, expiry date and card verification details at the time of payment.

- You can use bank transfers and SWIFT payments to send money to India.

Key Features and Benefits

- International money transfer within minutes.

- The funds can be received via bank deposit, cash pick-up, mobile money or home delivery.

- Money back guarantee if the funds are not transferred on time.

- Same-day cancellation requests are possible.

- Easy sign-up and quick money transfer to India.

Also Read: MYR to INR: Convert Malaysian Ringgit to Indian Rupee

3. XE Money Transfer

A trusted and reputed name in foreign exchange, XE could be a good choice to send money to India online. XE doesn’t have any minimum amount limit.

Money Transfer Cost

Transfer fees: Free, but there can be hidden local bank charges.

Exchange rate: The exchange rate will depend on the amount you transfer.

How to Transfer Money with XE

- Set up an account online or using your phone.

- Type the amount, select destination and currency.

- The funds will be transferred to your recipient’s bank account.

Key Features and Benefits

- No minimum amounts for money transfer.

- The recipient will get money into their account in 1-3 business days.

- Better exchange rates for larger amounts.

- One of the best customer care services, business and individual support.

4. Xoom powered by PayPal

Powered by PayPal, Xoom is a convenient way for money transfer to India. However, as compared to other money transfer channels, it is costly.

Cost of Money Transfer

Transfer fee: Varies depending on the amount and mode of payment. Payment through bank transfer is free, but if you transfer money using a card a percent of the amount will be charged.

Exchange rate: A margin is added to the Xoom exchange rate in India when you convert the USD into Indian Rupee (INR).

How to Transfer Money with Xoom

- Sign up for an account and log in.

- Type the amount, select destination and currency.

- Enter the recipient’s details and mode of payment.

Key Features and Benefits

- The recipient will receive the money into their account in 1-2 business days.

- Safe, trustworthy and authorized company.

- One of the best money transfer apps in India.

- Regular status update via text or email.

5. MoneyGram Money Transfer

MoneyGram is a big-market player in international money and remittance transfers. Hundred of thousands of people transfer funds every day using MoneyGram. MoneyGram is very fast; you can send money to India on the same day. However, charges are slightly higher than other services.

Cost of Money Transfer

Transfer fees: Fees vary based on the countries of sender and receiver, and the amount sent.

How Transfer Money with MoneyGram

- Find a MoneyGram agent location in India.

- Share your recipient’s full name, bank’s name and account number, recipient’s location, the amount you wish to send

- Give the agent a completed form with applicable funds.

- Notify your recipient.

Key Features and Benefits

- Very fast transfer – the recipient will get the money within 24 hours.

- More than 70 years of experience in providing the service.

- Higher daily limit.

- Above 300 thousand local MoneyGram agents in 200 countries worldwide.

Also Read: JPY to INR: Convert Japanese Yen to Indian Rupee

6. Western Union money transfer

Western Union is one of the most popular money transfer companies owing to its convenience and reliability. It has branches in almost every country in the world and offers a local withdrawal option.

Cost of Money Transfer

Transfer fees: Fee varies based on the amount being transferred.

How to send money with Western Union

- Create your profile on West Union.

- Provide all personal and residential details.

- Verify your profile.

- Start sending money.

Key Features and Benefits

- More than 145 years of experience in money transfer.

- Has a presence in 200+ countries and territories.

- Western Union money transfer limit to India is up to 5,000 USD.

Also Read: SAR to INR: Convert Saudi Riyal to Indian Rupee

7. Money Orders

Money orders are considered the safest and most affordable option for transferring a small amount of money. Most banks offer this service at a little cost.

Cost of Money Orders

Transfer fees: Small cost, differs based on banks and the amount being transferred.

How to send money through money orders

- You need to deposit the international money order into your bank account.

- Some sort of ID is required for cashing the checks sent in the local currency.

Key Features of Money Orders

- Economical, especially when a bank where you have an account waives off fees.

- Added security, the full amount can be recovered when lost.

- ID required and can be traced.

Best Ways to Send Money to India: RECAP

- WISE

- Remitly

- XE Money

- Xoom (Paypal)

- MoneyGram

- Western Union

- Money Orders

Also Read: Time taken to send money to India from Australia?

Best Ways to Send Money to India: How to send money to India?

Send money to India effortlessly with the SBNRI App! Download the app now and experience the smoothest remittances to India. Send money to India to your family and friends whenever you want.

Best Way to send money to India: Money Transfer to India with SBNRI

At SBNRI, redefine your remittances by choosing the easiest way. In the SBNRI App, use our services integrated with Wise and simplify your transfers to India. Money Transfer to India was never this easy. 3 easy steps exemplifying the best way to send money to India :

- Download SBNRI App

- Link your NRI Bank Account (Apply in just 5 minutes)

- Start sending Money

Transfer Money to India: Online Money Transfer to India with SBNRI

Remember, you need to weigh in all the factors to select the best time for sending money online. SBNRI has made online money transfer to India easier for you by evaluating every factor and creating the perfect channel for all your remittances to India.

You can download the SBNRI App from the Google Play Store or App store to send money to India, open an NRI account, invest in the Indian market and enjoy many other NRI services. You can also click on the button below to instantly remit/transfer money to India. Visit our blog and Youtube Channel for more NRI specific solutions.

Send Money to your loved ones Now

Best Ways to Send Money to India: FAQs

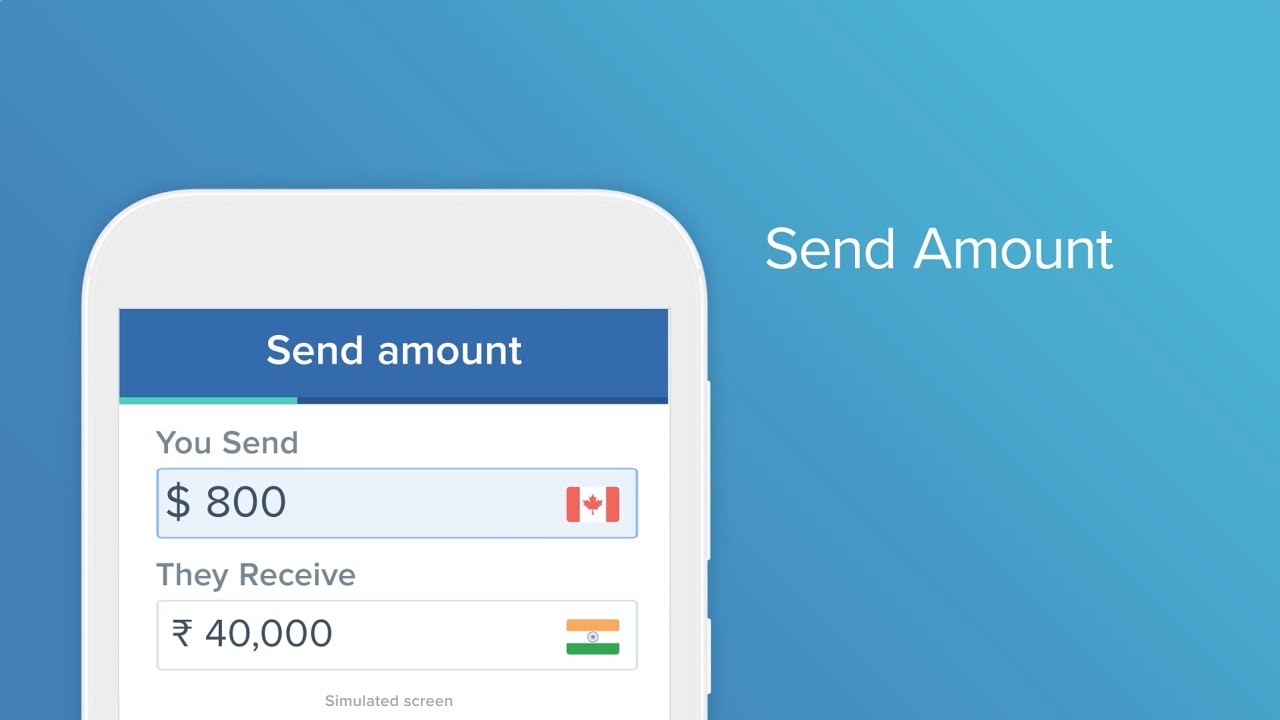

Here are the top ways of sending money to India from Canada

– Wise

– Western Union Money

– Remitly

– ICICI Bank Money2India

Top three companies offering competitive exchange rates are – (Remitmoney, 19.77), (ICICI, 19.36) and (Wise, 19.16).

You can choose any of the following options:

– Wise

– Remitly

– XE Money

– Xoom, powered by PayPal

The time varies based on the mode of payment:

– Online: 1 hour to 2 working days

– Offline: 1 hour to (3-5) working days through agents

– Via bank branch: 2 to 3 weeks via foreign currency DD and 24 – 48 hours through swift transfer