The residential status of an individual, as to whether he/she is a resident Indian or a non-resident (NR) or not ordinarily resident depends on the period of a person’s stay in India during the previous year or years preceding the previous year. However, in view of the Covid-19 pandemic and the consequent overstay of an individual who had visited India before 22nd March 2020, the Central Board of Direct Taxes has issued a circular on 3rd March 2021 to determine the NRI Status for Financial Year 2020-21. CBDT clarified that the overstay of NRIs due to the Covid-19 pandemic restrictions shall not be taken into account for the purpose of determining the residential status under Section 6 of the Income Tax Act, 1961. The board clarified that income tax will not be levied on Non-Resident Indians (NRIs) who have exceeded the mandated residency limit.

New tax rules for NRI taxation and determination of NRI status are set each year.

- The relief will be provided till 31st March 2021, which means NRIs will not be taxed for the FY 2021 if they overstayed. It is a big relief for NRIs who got stranded in India due to Covid-19 travel restrictions.

- NRI and foreign nationals stuck in India due to the Covid-19 outbreak and facing double taxation were required to submit details to the income tax department till March 2021.

Also Read: New TDS/ TCS rules for NRIs: Effective from 1st July 2021

Determination of residential/ NRI status for financial year 2020-21 – Sec 6 of the Income Tax Act

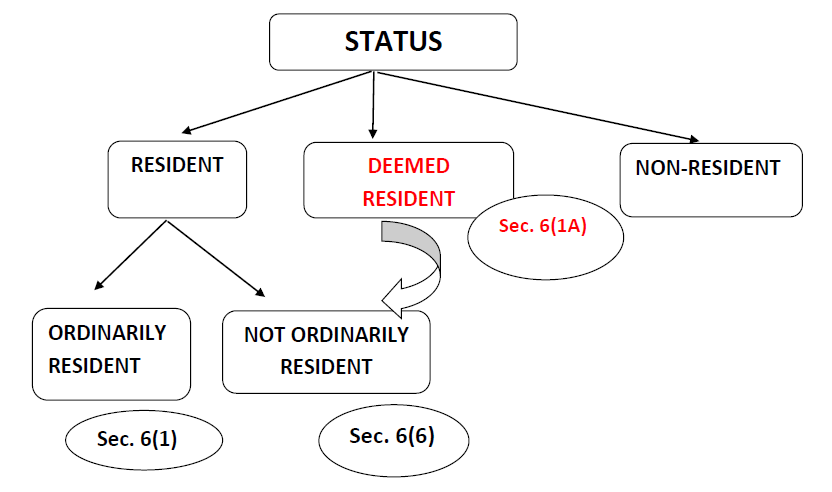

The tax liability of the income of a person depends on his/ her residential status during the relevant financial year. Section 6 of the Income Tax Act, 1961 has provisions to determine the residency of a person, depending on the period an individual stays in India in the previous year and or years preceding the previous year.

Form-NR for determination of NRI status for Financial Year 2020-21

NRIs can fill Form-NR and submit it with the Principal Chief Commissioner of Income Tax (International Taxation) to determine their residential status and avoid double taxation due to the extended stay in India. Based on the information provided, CBDT will decide whether any relaxation can be provided or not. NR-Form for NRI Status

Earlier circular on residential status

Circular no 11 of 2020 dated 8th May 2020 was issued by the Central Board of Direct Taxes under Section 119 of the Act. It provided some relaxation in the determination of residential status for the previous year 2020 – 21 to individuals who had come to India before 22nd March 2020 and couldn’t leave India or quarantined in India on account of the Novel Coronavirus (Covid-19) or due to suspension of international flights. CBT issued the following clarification to determine the residential status U/S 6 of the Income Tax Act.

- Relaxation will be given for NRIs who have come to India on a visit before 22nd March 2020 and couldn’t leave the country before 31st March 2020 due to flight restrictions. His stay in India from 22nd March 2020 to 31st March 2020 should not be considered for determining the residential status.

- If an Individual has been quarantined in India due to the Novel Coronavirus-19 (Covid-19) on or after 1st March 2020 and could not leave India on or before 31st March 2020, his stay in India should not be considered for determination of residential status.

- An individual who has departed on an evacuation flight before 31st March 2020, his stay in India from 22nd March 2020 to the date of his departure shall not be taken into consideration.

Short stay in India

Visiting individuals may become a resident Indian for a year in one of the following situations:

- If the Indian income of visiting individuals during the financial year is more than Rs. 15 lakh and he stays in India for 182 days or more during the PY 2020-2021.

- If the total income from Indian sources is more than Rs. 15 lakh and the individual stays in India for 182 days or more during the financial year, or he stays in the country for 120 days or more and also stays for 365 days or more in the preceding four years.

A non-Indian or a person of Indian origin may become resident in India only in one of the following situations:

- If he/she stays in India during PY 2020-21 for 182 days or more;

- If he/she stays in India during the PY 2020-21 for 60 days or more and also stays for 360 days or more in the preceding four years.

Note: A person may become a resident Indian for the PY 2020-21 only if he/she stays in India for 182 days or more unless he is covered by the exceptions discussed above.

Also Read: 5 Ways to save on the tax NRIs have to pay

Possibilities of dual non-residency in case of general relaxation

Most countries require an individual to stay in the country for 182 days or more for determining residency. Hence, in most cases a person will be resident in only one country as there are only 365 days in a year. If general relaxation for the stay period of 182 days is provided, there may be the case of double non-residency. In such a case, a person may not become a tax resident in either country in the PY 2020-21 and end up not paying tax in any country.

Tie-breaker rule as per DTAA (Double Taxation Avoidance Agreement)

As discussed above, in some cases, a person may become a resident even if he stays for less than 182 days in India. In such situations, there may be a case of dual residency. However, such a person will become a resident of only one country as a result of “Tie-breaker rule” in Double Taxation Avoidance Agreement (DTAA).

CBDT clarified that in cases where a person becomes a resident in India on account of exceptional circumstances, he/she would most likely become a Not Ordinary Resident in India and his foreign-sourced income should not be taxed in India unless it is derived from a business controlled in or set up in India.

Indian citizens who are Bona Fide Workers

The Finance Bill 2020 has proposed that if an Indian citizen is not liable to be taxed in any country or jurisdiction, he shall be deemed to be resident in India. This anti-abuse provision was made because some Indian citizens shift their stay in low or no-tax jurisdiction to avoid payment of tax in India.

Indian citizens who are bona fide workers in other countries shall not be taken into account in the tax net. Indian citizens who are deemed residents of India under this proposed provision, the income earned outside India by them shall not be taxed in India unless it is derived from an Indian business or profession.

Moreover, while conducting transactions in India or applying for services, you must know the difference between residential statuses, such as PIO vs OCI Cardholders, NRIs, etc.

Also Read: Tax for NRI on Indian Income and Investments in 2020-21

Due to a complicated tax system, understanding tax laws can be confusing and NRIs may miss claiming deductions and other benefits. At SBNRI, we understand this struggle. You can download SBNRI App to connect with our NRI Tax Experts and get end-to-end assistance related to NRI tax filing. SBNRI will also help you get a lower TDS Certificate.

You can also click on the button below to ask any questions. Visit our blog and YouTube Channel for more details.