Gilt funds are popular among conservative investors due to their safety and stability. These funds are one of the best bonds mutual funds that invest in government securities, making them a low-risk option for those looking to earn consistent returns without investing in assets with default risk. For Non-Resident Indians (NRIs), gilt funds are a safe and attractive way to invest in India, especially if they want to invest in safe assets.

In this article, we will explore what gilt funds are, their benefits, how NRIs can invest in them, and some of the best gilt funds to consider in 2024.

What are Gilt Funds?

Gilt funds are mutual funds that invest at least 80% of their assets in government securities. Government mutual funds are issued by the Reserve Bank of India (RBI) on behalf of the government, and the maturity of these funds vary. Along with having different maturity periods, these assets are almost risk-free since they are issued by the government.

What Makes Gilt Funds Attractive?

Considered as one of the best government bonds mutual funds, gilt funds are highly popular among NRIs for these reasons:

- Safety: Gilt funds are one of the safest investment options as they are backed by the government.

- Diversification: They provide the opportunity for investors to diversify their portfolio by adding a secure asset to the portfolio.

- Low Risk: Since these funds invest in government securities, the risk of default is almost none.

- Favorable Taxation: Gains from gilt funds held for over three years are taxed with indexation benefits, which can reduce the tax burden.

- Hedge Against Currency Risk: Investing in INR-denominated assets can be a good investment if the Indian rupee increases against foreign currencies.

- Long-Term Focus: Suitable for long-term investors since they offer stable and consistent returns over time.

How can NRIs Invest in Gilt Funds?

- NRE or NRO Account: NRIs must open an NRE (Non-Resident External) or NRO (Non-Resident Ordinary) account to invest in Indian mutual funds.

- KYC Compliance: Completing the KYC is mandatory. This includes submitting documents such as passport, visa, and overseas address proof.

- Direct or Through Advisors: NRIs can invest directly through fund houses or talk to investment experts for assistance.

- Repatriation Benefits: Investments made through NRE accounts are fully repatriable, allowing easy transfer of funds back to the resident country.

Alternatively, NRIs can connect with an SBNRI investment expert to open their bank account, complete their KYC and start investing!

Top Gilt Funds for NRIs in 2024

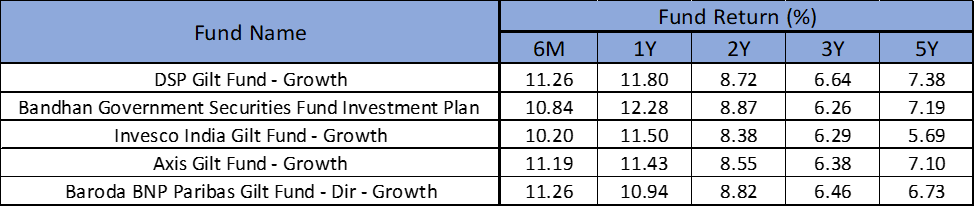

Here’s the table of some of the best gilt funds for NRIs to consider in 2024 based on their historical performance:

Things to Remember While Investing

- Interest Rates: Gilt fund returns are opposite to interest rates. Falling rates benefit these funds, while rising rates may reduce returns.

- Investment Horizon: These funds are best for a horizon of three years or more to take advantage of tax benefits.

- Expense Ratio: Check the fund’s expense ratio, as it directly impacts your returns.

- Risk Tolerance: While gilt funds have almost no chances of default, they can still face short-term fluctuations due to interest rate changes.

Why Gilt Funds are a Smart Choice for NRIs?

GILT funds can be an attractive investment option for NRIs, and some of the factors that makes it an attractive choice are:

- Safe Investment: Bond investments in India are ideal for conservative investors who cannot take much risk and look for stability in India.

- Low Risk: Government guarantee ensures the safety of principal money in India.

- Portfolio Diversification: Helps balance the risk-return profile by adding a low-risk asset to their Indian or global portfolio.

- Tax Efficiency: No long-term capital gains tax if held for more than three years.

Conclusion

For NRIs looking for a safe, stable, and tax-efficient investment in India, gilt funds are an excellent option. They offer the perfect combination of security, predictable returns and hedge against currency fluctuations, making them an important part of a well-balanced portfolio.

As you evaluate your investment choices in 2024, consider including gilt funds to safeguard your wealth while taking advantage of the opportunities available in India. Remember, while gilt funds are low-risk, all kinds of investments, including investing in government securities, come with risk. Therefore, a well-thought-out investment strategy aligned with your financial goals is essential. If you are still wondering how to buy Indian government bonds, just download the SBNRI app and we will assist you to buy the right bonds so that you can earn consistent returns!

SBNRI is an authorized Mutual Fund Distributor platform & registered with the Association of Mutual Funds in India (AMFI). ARN No. 246671. NRIs willing to invest in mutual funds in India can download the SBNRI App to choose from 2,000+ mutual fund schemes or can connect with the SBNRI wealth team to better understand Mutual Fund investments.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions. SBNRI does not intend to predict future returns, please read all related documents before investing.

Frequently Asked Questions

Are gilt funds safe for NRIs?

Yes, gilt funds are considered safe as they invest in government-backed securities with almost no credit risk.

Do gilt funds offer better returns than fixed deposits?

Gilt funds often provide higher returns than fixed deposits over the long term, which is why it is important to stay invested.

How do gilt funds differ from corporate bond funds?

Gilt funds invest only in government securities, while corporate bond funds invest in bonds issued by companies, which are considered risky.