The Union Budget is one of the most anticipated events in India’s financial calendar. It sets the tone for economic policies, tax reforms, and growth strategies for the coming year. While it is an important document for everyone, for Non-Resident Indians (NRIs), Union Budget carries significant implications. It can heavily influence their investment opportunities, taxation rules, and financial planning. Just like the Budget 2024 LIVE coverage, we will also cover Union Budget 2025 live for you. So, stay with us on 1st Feb, 2025 here!

Till then, let’s do some pre-budget analysis & understand the basics.

Understanding the Union Budget

The Union Budget is an annual financial statement presented by the Finance Minister of India. It has the details regarding the government’s revenue and expenditure for the upcoming fiscal year. Also, it outlines economic priorities, tax proposals, policy changes, and sector-specific allocations. Hence, it is a crucial event for individuals, businesses, and investors alike.

What NRIs Should watch for in Union Budget 2025

Every budget has a direct impact on NRIs, especially in terms of taxation and investment avenues. Key areas to monitor include in this year’s budget:

NRI Taxation: The government may introduce changes in TDS rates on foreign remittances, revise tax exemptions for various NRI income sources, and modify capital gains tax policies. These adjustments could significantly impact financial planning, making it crucial for NRIs to stay informed about potential tax reliefs or new compliance requirements.

Investment Reforms: To attract more foreign investments, the budget might include new investment schemes, enhanced incentives for overseas investors, and simplified regulatory requirements. These reforms could make it easier for NRIs to invest in Indian stocks, bonds, and businesses, fostering greater participation in the country’s financial markets.

Banking & Remittances: Changes in FEMA regulations, lower transaction costs for international remittances, and streamlined fund repatriation processes could improve banking efficiency for NRIs. If implemented, these reforms would make transferring and managing funds in India more convenient and cost-effective.

Retirement & Savings Plans: The introduction of new pension schemes or increased tax benefits for NRIs investing in Indian financial instruments could provide better long-term financial security. These measures would encourage NRIs to plan their retirement more effectively while taking advantage of favorable savings options.

What to do after Budget 2025

We know you may have a lot of questions on your mind even after the budget is presented.

- How will Union Budget 2025 impact NRI investments?

- What market trends should NRIs watch out for?

- What changes will affect your investment strategies?

That’s exactly why we’re bringing you an exclusive webinar to break it all down, simplify the details, and answer your most pressing questions—LIVE!

Seats are filling fast—secure yours now and get actionable financial planning tips!

Register For LIVE Budget 2025 Webinar

How is the Budget made in India?

The budget-making process follows a structured approach:

Pre-Budget Consultations: The government consults with economists, industry leaders, and financial experts to gather valuable insights and recommendations.

Preparation & Drafting: Based on these inputs, the Finance Ministry drafts the budget, considering economic data, revenue forecasts, and key policy objectives.

Presentation in Parliament: On February 1, the Finance Minister presents the budget in Parliament, outlining the government’s main financial proposals and plans.

Discussion & Approval: Following the presentation, Parliament members debate the proposals. They then pass the Finance Bill, often with some revisions.

Implementation: Once approved, the budget comes into effect on April 1. It impacts taxes, government spending, and policy changes for the upcoming fiscal year.

Expectations from Union Budget 2025

Tax Relief: The government may revise income tax slabs to offer higher exemptions and deductions, putting more money in the hands of individuals, including NRIs. These changes could increase disposable income, encouraging better long-term financial planning. Additionally, the government may introduce tax benefits for digital transactions, further supporting the push for a cashless economy.

Incentives for Investments: To attract more overseas capital, the government is likely to ease investment norms for NRIs, making it easier to bring money into India and repatriate funds. By simplifying compliance processes and removing bureaucratic hurdles, India aims to become a more attractive investment destination. NRIs can also expect enhanced tax incentives for investments in Indian stock markets, startups, and government bonds, unlocking lucrative opportunities for wealth growth.

Ease of Business: In a bid to attract higher foreign direct investments, the government plans to streamline regulations and eliminate red tape. Faster approval processes, reduced compliance burdens, and sector-specific incentives will make India a more business-friendly environment. These reforms will benefit NRIs looking to start businesses or expand their investments in India.

SOPs for Real Estate: Investing in Indian real estate could become even more rewarding for NRIs. The government may introduce tax incentives, such as relaxed capital gains tax rules and reduced stamp duties, to encourage property investments. By simplifying transaction procedures, India aims to make real estate deals smoother and more appealing to NRIs and global investors.

What sectors can boom after Budget presentation?

Infrastructure: By 2030, nearly half of India’s population will live in urban areas, creating a huge demand for infrastructure. To meet this need, the government plans to increase capital spending on roads, railways, and airports, building on the momentum from the previous budget. Infrastructure spending is expected to grow from ₹11.1 trillion to ₹18 trillion—a 30% rise. This expansion will offer exciting opportunities for NRIs interested in investing in India’s rapidly growing tech and infrastructure sectors.

Defence: The Union Budget 2025 is likely to prioritize strengthening India’s defence sector. The government will invest heavily in research and development, drone technology, and anti-drone systems. By 2030, India aims to produce ₹3 lakh crore worth of defence equipment, including ₹50,000 crore in exports. This growth will provide NRIs with new investment avenues in India’s expanding defence manufacturing industry.

Energy: The government is ramping up efforts to expand renewable energy, aiming for 500 GW of green energy capacity by 2030. To achieve this, the country needs ₹42 lakh crore in investments for solar, wind, and hydro projects, along with upgrades to power transmission networks. These initiatives will create promising opportunities for NRIs looking to invest in India’s clean energy future.

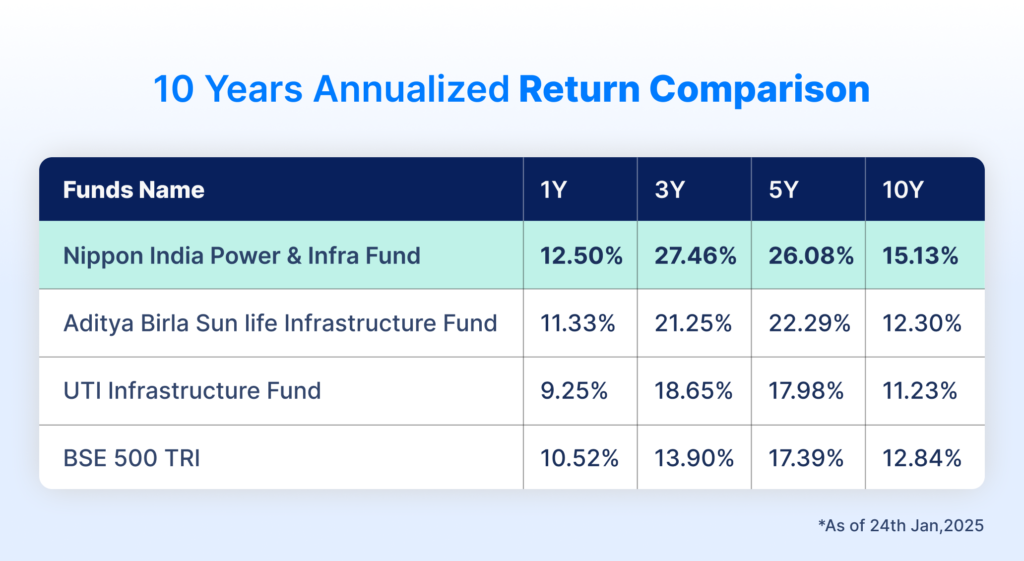

Based on the expectations and our team’s research, the following mutual funds have a healthy allocation in all these sectors and hence must be looked out for. These show a high potential to grow post Union Budget 2025.

Here are the TOP 4 funds to look out for after Budget 2025, along with the data.

Want to be the first to invest in tomorrow’s big wins? Try SBNRI

SBNRI is an authorized Mutual Fund Distributor platform & registered with the Association of Mutual Funds in India (AMFI). ARN No. 246671. NRIs willing to invest in mutual funds in India can download the SBNRI App to choose from 2,000+ mutual fund schemes or can connect with the SBNRI wealth team to better understand Mutual Fund investments.

Download SBNRI

Live coverage of Union Budget 2025 by SBNRI

SBNRI will provide real-time updates and expert insights on the budget’s impact on NRIs. Stay tuned to our live coverage on 1st Feb, 2025 for:

- Key announcements as they happen

- Breakdown of NRI-specific provisions

- Expert analysis on tax and investment implications

NRIs can now download the SBNRI App and choose to invest in different investment options in India with ease. Experts at SBNRI can give you detailed investments advice. Also, visit our blog and YouTube channel for more details.

FAQs

How does the Union Budget impact NRIs?

The budget affects NRIs by influencing taxation, investment policies, repatriation rules, and financial planning opportunities in India. Also, changes in tax slabs, capital gains policies, and investment incentives can directly impact NRI finances.

Will there be any changes in NRI taxation in Budget 2025?

While the specifics will be announced in the budget, NRIs should watch for potential revisions in TDS on foreign remittances, capital gains tax rules, and exemptions on income earned in India.

What investment opportunities could emerge for NRIs post-budget?

The government may introduce new incentives for NRIs investing in real estate, stock markets, government bonds, or startups. Also, the relaxed regulatory norms and tax benefits could make Indian investments more attractive.

How can NRIs stay updated on Budget 2025 announcements?

SBNRI will provide live coverage, expert analysis, and real-time updates on all budget-related changes impacting NRIs, so that you can easily understand the financial implications. Click here to register for our LIVE webinar.

Will Budget 2025 introduce any changes in remittance or repatriation rules for NRIs?

Speculations are positive, hence the potential reforms in FEMA regulations or reduced transaction costs for international remittances may be introduced. It can impact how NRIs transfer and manage funds in India.

Will Budget 2025 impact NRI property investments in India?

The budget could introduce incentives such as reduced capital gains tax, simplified repatriation rules, or lower stamp duties, making real estate investments more attractive for NRIs.

Are there expected changes in banking and remittances for NRIs?

Possible reforms in FEMA regulations, transaction fees, and NRI deposit interest rates could impact how NRIs manage their funds and send money to India.