Under the Liberalised Remittance Scheme (LRS), all resident individuals are allowed to freely remit up to USD 2,50,000 or its equivalent per financial year to another country for investment and expenditure. They can also open and maintain foreign currency accounts abroad for executing transactions. As a part of Foreign Exchange Management Act (FEMA) 1999, LRS was introduced on 4th February, 2004 with an outward remittance limit of USD 25,000 during a financial year.

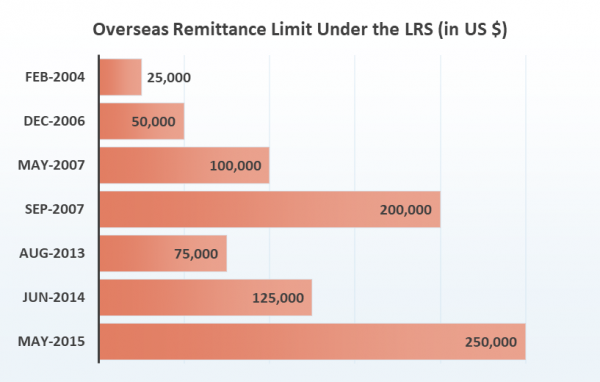

The LRS limit has been changed in stages based on the prevailing economic conditions. In case the remittance is being carried out by a minor, the natural guardian of the minor must countersign the LRS declaration form.

What is Liberalised Remittance Scheme

The Liberalised Remittance Scheme was introduced to enable millions of Indians who need to send money to their loved ones living abroad, for example their child studying abroad, or for other purposes. The LRS provides proper structure and guidelines, and highlights legal channels through which you can remit funds.

Anyone, including minors, can avail this scheme. However, corporates, partnership firms, HUF or charitable trusts can’t avail this scheme. Authorised dealers such as banks are enlisted to facilitate foreign exchange between resident Indians and their beneficiaries abroad. Your PAN number is required for each transaction under the Liberalised Remittance Scheme.

Key features of Liberalised Remittance Scheme

- The LRS prescribes guidelines for outward remittance from India.

- The scheme is a part of Foreign Exchange Management Act 1999 by the Reserve Bank of India (RBI).

- The scheme is applicable to all resident Indians.

- The current upper limit on outward remittance is USD 2,50,000 per financial year.

- You can freely remit money for any permissible current or capital account transactions, or a combination of both, such as child’s education or fund personal expenses.

- Remittance facility under LRS is not available for purchase of lottery tickets, sweepstakes, banned magazines, etc.

Purposes for Remittance under LRS

Indian residents can freely send money abroad for a wide range of purposes under the LRS. Following is the list of purposes for current account transactions and capital account transactions.

Current Account Transactions

- To travel abroad (except Nepal and Bhutan)

- Gift or donations to legitimate beneficiaries

- Travelling abroad for employment purposes

- Emigration

- To cover the living or medical expenses of close relative living abroad

- Business trips

- Education fee payment abroad

- Various current account transactions which are not covered under the FEMA

Capital Account Transactions

- Purchase of property abroad

- For opening, holding, maintaining a foreign currency account with a bank abroad

- For making investment abroad i.e. acquisition and holding of shares of listed and unlisted companies abroad, mutual funds, debt instruments, VC funds, etc.

- Providing loans to NRIs who are relatives as defined in the Companies’ Act.

- For establishing a wholly owned subsidiary (WOS) or a Joint Venture (JV) overseas for any bonafide business purpose subject to regulations framed under Overseas Direct Investment (ODI).

LRS Limit

Under LRS, you can remit up to $2,50,000 during a financial year without any prior approval from the Reserve Bank of India (RBI). There is no limit on the number of transactions made. Resident Indians who wish to remit must maintain a capital account for at least one year prior to the remittance.

Benefits of LRS Scheme

- LRS empowers resident Indians to invest in foreign assets and build a diversified portfolio for themselves and their loved ones.

- For parents whose children are studying abroad, LRS provides a safe and efficient way of funds transfer to fulfil their living expenses.

- It’s a boon for many Indians travelling abroad for medical treatment as it allows them to pay for it without any hassle of protocols and paperwork.

What types of Remittances are Prohibited under this Scheme

As per the latest RBI guidelines, the following items are not available under the LRS:

- Remittance for any purposes that are restricted under Schedule-I like purchase of lottery, sweep stakes, banned magazines, etc.

- Remittance for any items prohibited under Schedule II of Foreign Exchange Management (Current Account Transactions), Rules, 2000.

- Outward remittances from India for margins or margin calls to foreign exchanges/ foreign counterparty.

- Sending money for purchase of FCCB (Foreign Currency Convertible Bond) issued by an Indian company in the overseas secondary market.

- Remittance for trading in foreign exchange overseas.

- Direct or indirect capital account remittance to countries recognised by the Financial Action Task Force (FATF) as ‘non-cooperative countries and territories’. List of countries change from time to time.

- Fund transfers directly or indirectly to individuals or entities identified as posing considerable risk of indulging in terrorist activities as advised by the RBI to banks.

LRS Scheme for NRIs: Is LRS Applicable for NRIs?

The LRS applies to only resident Indians. The remittance rules for NRIs who hold a bank account in India differ. Following are the NRI bank accounts held by Non-Resident Indians:

- NRE (Non-resident external) Account

- NRO (Non- Resident Ordinary) Account

- FCNR (B) (Foreign Currency Non-Resident Bank Account)

As per the RBI guidelines, an NRI account holder can remit up to $10,00,000 per instance from India through his/ her NRO account. There is no upper limit for outward remittance through an NRE or FCNR (B) account. However, there are restrictions on inward remittance allowed through the NRE and FCNR accounts.

You can get preferential rates on currency conversion and a host of benefits when remitting from India to abroad for your loved ones by contacting SBNRI experts. At SBNRI, we keep an eye on the exchange rate on a regular basis to help NRIs with their remittances and investment. You can download SBNRI App to connect with our experts. They will help you evaluate the optimal time for remitting money to India from Australia.

You can also click on the button below to ask any questions. Visit our blog and YouTube Channel for more details.

FAQs

Under LRS, one can remit up to $2,50,000 during a financial year without any prior approval from the Reserve Bank of India (RBI).

The RBI offers the Liberalised Remittance Scheme (LRS), which grants resident Indians the opportunity to transfer a specific sum of money to a foreign country within a given financial year. This allocated amount can be utilized for both investment purposes and general expenses.

Individuals who are considered resident Indians as per FEMA regulations are eligible to take advantage of the LRS. However, the LRS is not accessible to entities such as corporations, partnership firms, HUFs (Hindu Undivided Families), trusts, and similar organizations.

To initiate a remittance under the LRS, the individual must possess a PAN (Permanent Account Number) and complete the KYC (Know Your Customer) process. Additionally, the individual should have held an account with the bank facilitating the remittance for a minimum of one year. The bank is responsible for conducting the required due diligence for account establishment, maintenance, and operation.

No, one can make their remittance in any freely convertible foreign currency.