Completing your KYC is the first and most important step to start investing confidently.

We’ve designed this process to be simple, secure and fully digital all you need is:

- Your PAN

- Your Aadhaar Offline e-KYC (XML). (with active mobile number linked)

- Your Active Indian Mobile Number for OTP linked to Aadhar

Follow the steps below to complete your KYC smoothly.

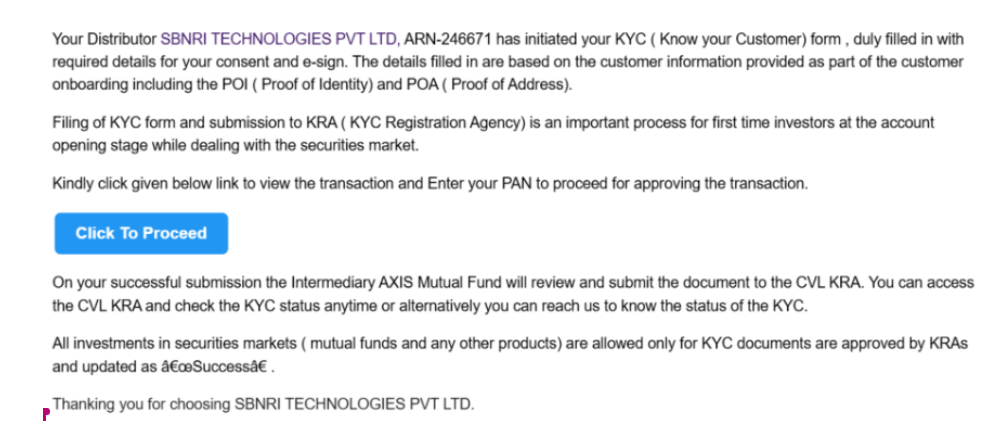

Step 1: Open the Email & Click “Click to Proceed”

You will receive an email from [email protected]. Open the email and click on the button/link that says: “Click to Proceed”

This will securely redirect you to the KYC portal.

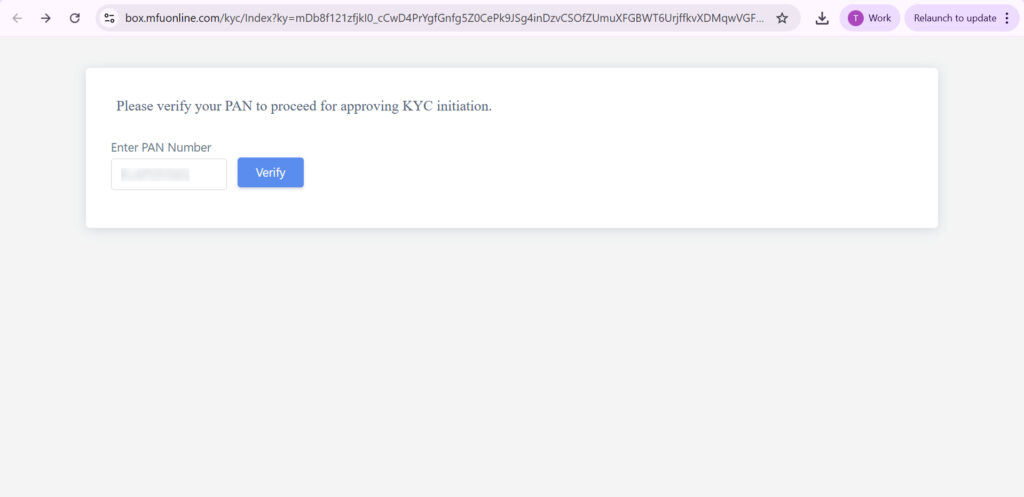

Step 2: Enter Your PAN & Verify It

On the first screen, simply enter your PAN Number and click on Verify. This helps the system fetch your basic identity details instantly and ensures that your KYC is linked to the correct PAN.

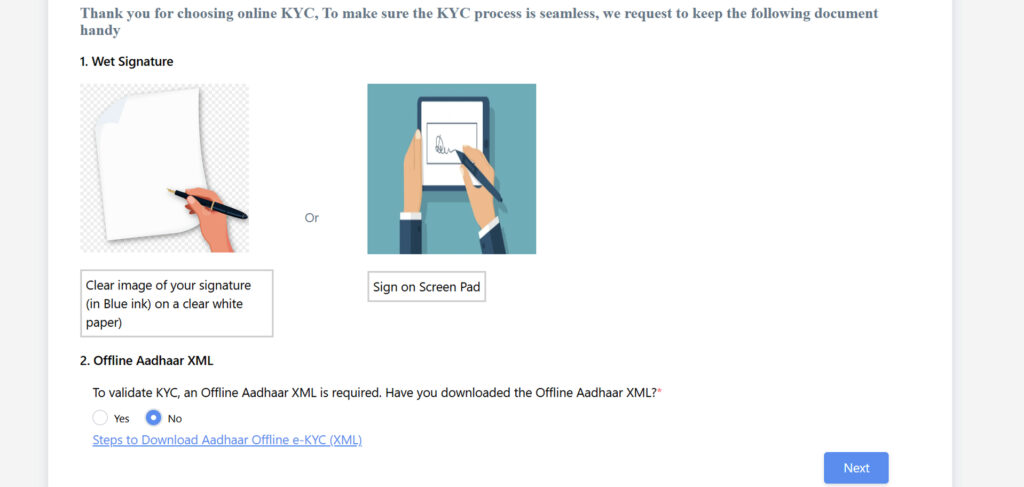

Step 3: Choose Whether You Already Have Your Aadhaar Offline XML File

You’ll now be asked whether you have downloaded your Aadhaar Offline e-KYC XML file.

- If you already have it, select Yes.

- If you don’t have it, select No and follow the on-screen link titled: “Steps to Download Aadhaar Offline e-KYC (XML)”

This link will take you to the UIDAI portal to download the XML using Aadhaar number & OTP sent to your Indian mobile number linked with Aadhaar

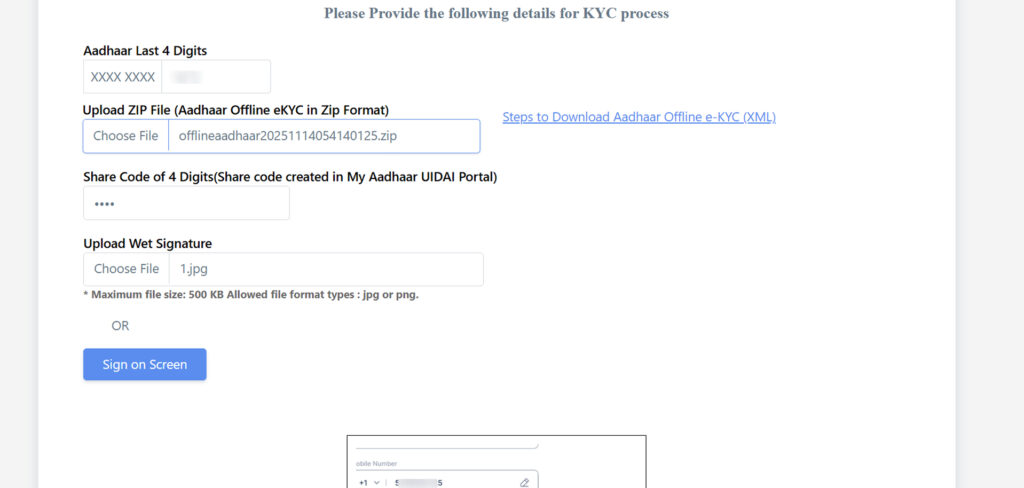

Step 4: Upload Your Aadhaar XML ZIP File

Now you will be asked to provide the details:

- Enter the last 4 digits of your Aadhaar number

- Upload the ZIP file (the same file downloaded from UIDAI)

- Enter the 4-digit Share Code you created during the download

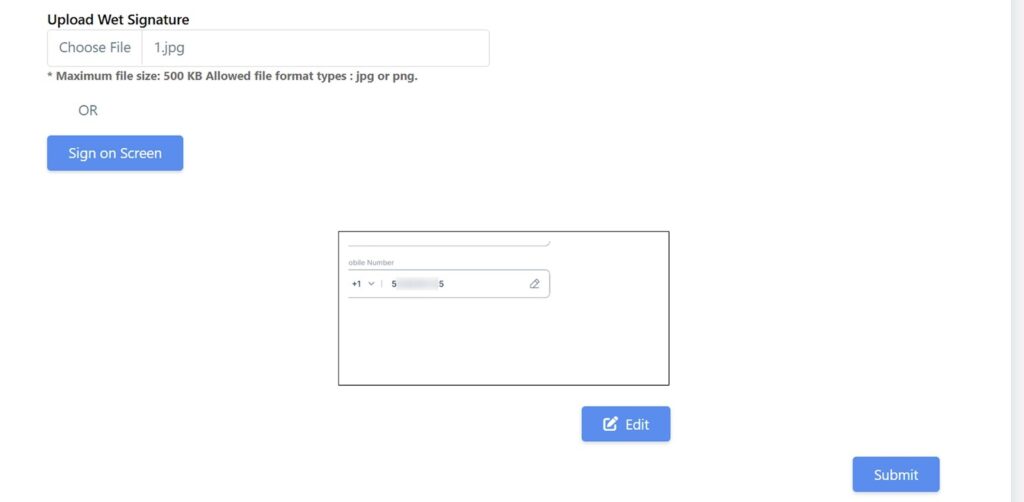

Step 5: Upload or Draw Your Signature

For the signature, you have two convenient options:

Option A: Upload Wet Signature – Take a clear photo and upload it.

Option B: Sign on Screen Pad – You can simply sign digitally using your mouse, trackpad, or touchscreen.

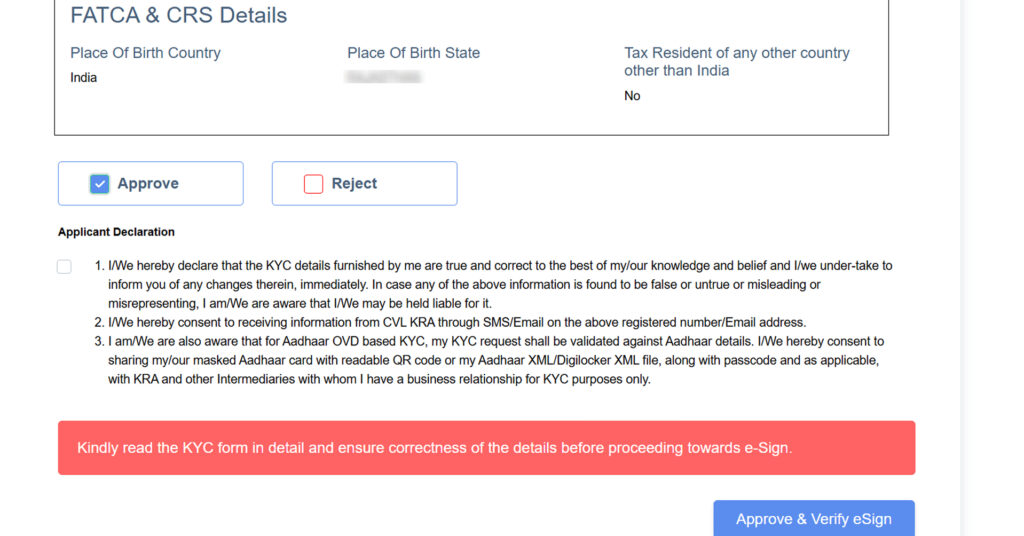

Step 5: Preview Your Auto-Filled KYC Form

Once your documents are uploaded, your complete KYC form will open. All of the fields will already be auto-filled

Scroll through the form to verify your: If everything looks correct:

✔ Click Approve

✔ Tick the declaration box

✔ Click Approve & Verify eSign

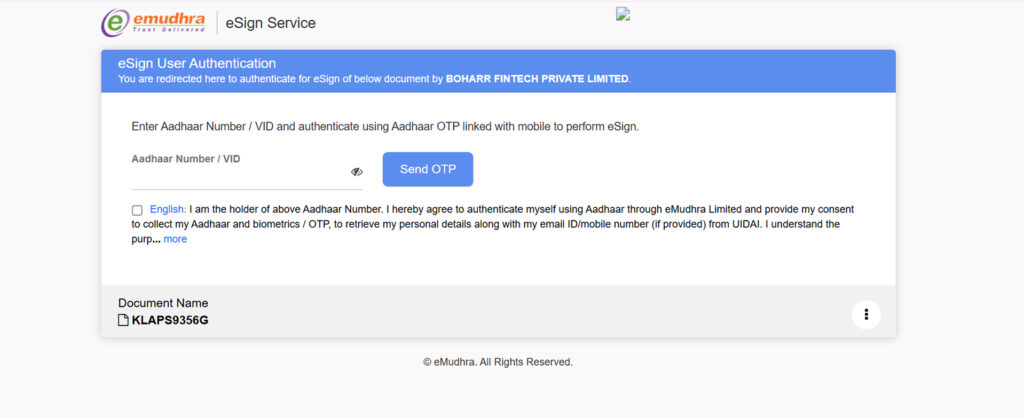

Step 6: Aadhaar eSign Authentication

You will now be redirected to the eMudhra eSign page.

Here:

- Enter your Aadhaar Number or VID

- Tick the consent box

- Click Send OTP

- Enter the OTP received on your Indian mobile number linked to Aadhaar

This OTP verifies your identity securely and completes your eSign.

That’s it! Your KYC Is CompleteOnce eSign is successful, your KYC request is submitted to the KRA for verification. You’ll receive updates on your registered email and mobile number as soon as it is approved.