SBI Fund Management Unlisted Share

₹960

*Average Price as per 4 May, 2025

Fundamentals

FACE VALUE

1

BOOK VALUE

133.3

NO OF SHARES

506810563

EPS

40.9

SALES

3265.4

INDUSTRY PE

0

DIVIDEND

4

DIVIDEND YIELD

0.16

PE

63.08

PB

19.35

PS

40.04

MARKET CAP

130757.13

EQUITY

50.6

PAT

2063

MESSAGE

2023-24

OVERVIEW

SBI Mutual Fund is an Indian asset management company created by the State Bank of India (SBI), an Indian multinational public sector bank and financial services entity. Incorporated in 1987, the company is headquartered in Mumbai, India. SBI Mutual Fund is a result of a partnership between SBI and the European asset management firm Amundi, forming SBI Fund Management Limited (SBIFML).

Background

The mutual fund market in India was initiated by the Unit Trust of India, along with the Government of India and the Reserve Bank of India, in 1963. SBI Mutual Fund was the first non-UTI mutual fund in India, launched on June 29, 1987.

Timeline

→ 1987 : Inception of SBI Mutual Fund

→ 1992 : SBI Mutual Fund crosses investor base of 1 million

→ 1999 : Introduction of India’s first contra fund and sector-specific funds

→ 2011 : Joint Venture with Societe General Asset Management

→ 2014 : Launch of SBI MF’s online platform for corporate investors

→ 2020 : First AMC in India to fully Comply with GIPS Becomes the Largest AMC in India

→ 2021 : First AMC in India to cross INR 5 trillion in average AUM for Domestic Mutual Funds

Service and Expertise

SBI Mutual Fund actively manages investors’ assets with expertise in various domains:

- Domestic mutual funds

- Offshore funds

- Alternative investment funds

- Institutional investor portfolio management advisory services

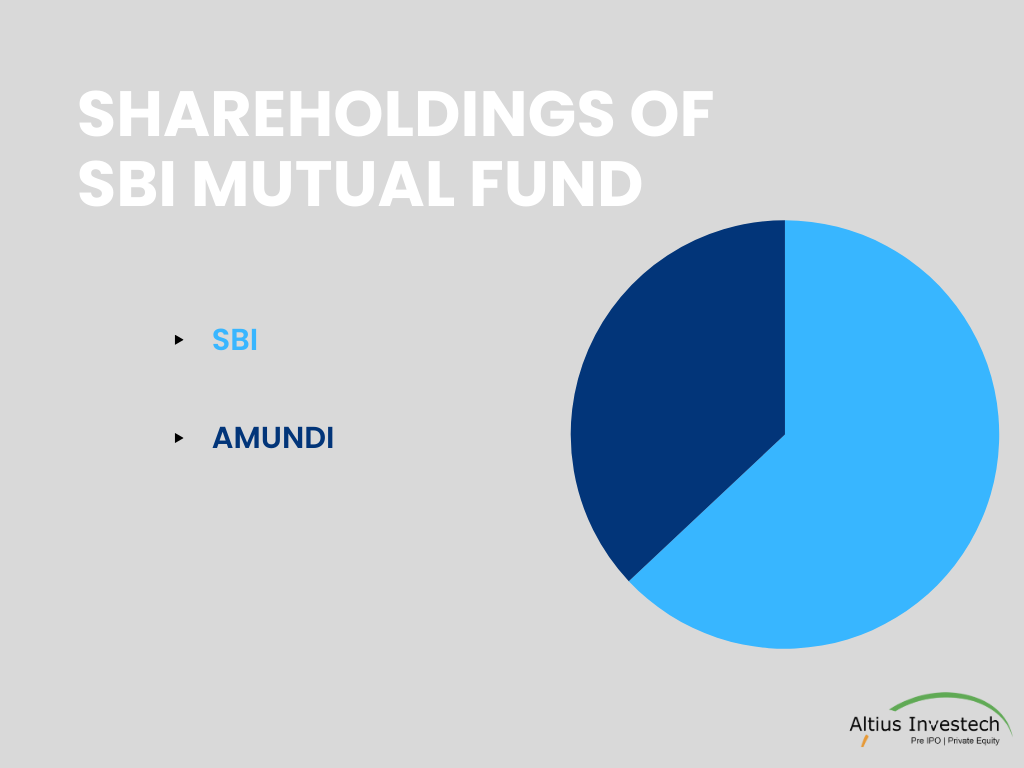

Ownership Structure

- SBI holds a 63% stake in SBIFML.

- AMUNDI Asset Management owns the remaining 37% stake through its wholly owned subsidiary, AMUNDI India Holding.

Categories of SBI Mutual Fund

Industry Overview

The Indian Mutual Fund Industry witnessed a decent annual growth of 33.51% in the Quarterly AAUM (average assets under management) during the year on the back of net inflows of funds.

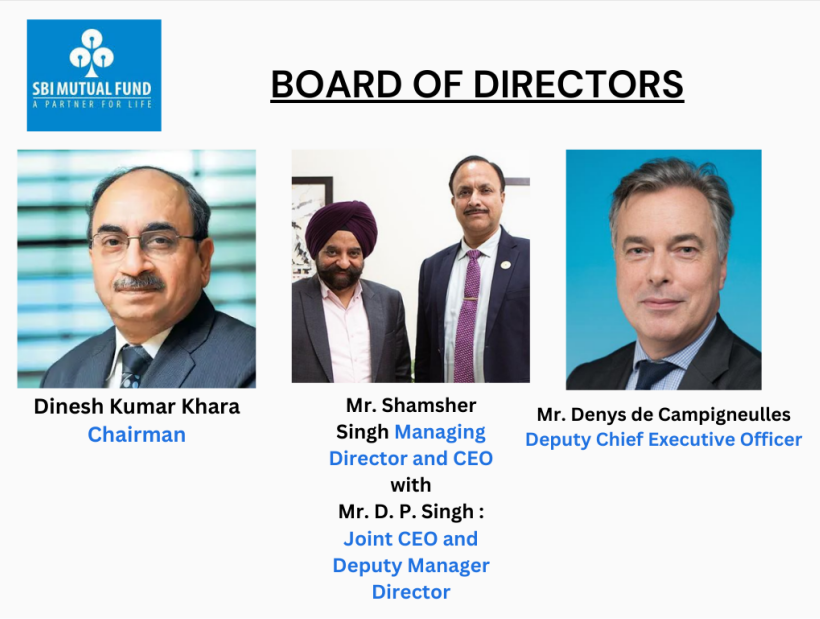

Board Members

INSIGHT

Financial Highlights

₹ in crores

Particulars (In Rs. Crore) | FY24 | FY23 | Growth (%) |

Revenue | 3265 | 2297 | 42 |

EBITDA | 2560 | 1697 | 51 |

PAT | 2062 | 1331 | 55 |

EPS | 40.90 | 26.30 | - |

Dividend History

- FY24: Rs.4/ Share.

- FY23: RS.3.5/Share

- FY22: Rs.3/Share

SBI AMC Fund Metrics

Particulars | FY24 | FY23 | Growth (%) |

Total Asset Mobilized (In Rs. Crore) | 24,11,449 | 25,83,924 | -7 |

Total Redemptions (In Rs. Crore) | 23,76,374 | 25,41,903 | -7 |

Net Inflows (In Rs. Crore) | 35,075 | 42,021 | -17 |

Q4 Average AUM (In Rs, Crore) | 914,365 | 717,161 | 28 |

Monthly SIP (In Rs. Crore) | 3007 | 2306 | 30 |

Live SIPs (In Lakhs) | 116.70 | 90.53 | 28 |

Fresh SIPs during the year (In Lakhs) | 55.46 | 37.02 | 18 |

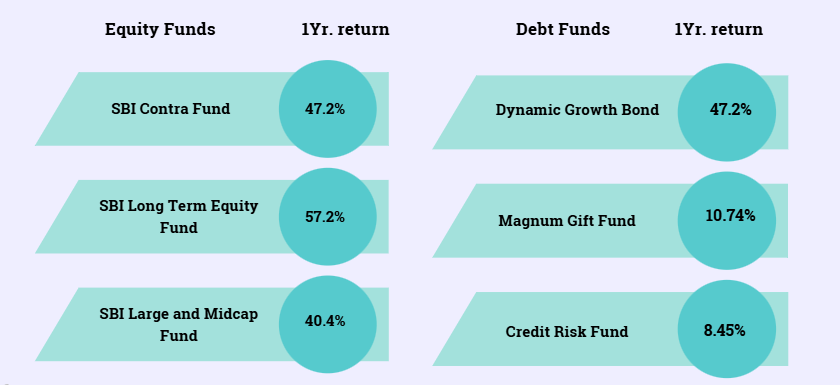

SBI Fund Returns

Peer Comparison

Asset Management Companies | AUM (31.03.24) (In Rs. Cr.) | M.CAP (In Rs. Cr.) | P/E | P/B | P/S |

SBI MF | 919,519 | 1,23,408 | 59.54 | 18.27 | 37.79 |

HDFC AMC | 6,00,000 | 94,430 | 45.6 | 13.3 | 33.9 |

UTI AMC | 2,91,000 | 15,921 | 20.3 | 3.62 | 8.85 |

Valuation

SBI AMC has shown a commendable growth in the 9 months of FY-24. As of 9M FY-24, with an EPS of 30, SBI fund Management is currently trading at a P/E of 48 with a market price of 1400 per share as of 1st Feb, 2024.

As of 9M FY-24, with an EPS of 66, HDFC AMC is currently trading at a P/E of 55 with a market price of 3600 per share as of 1st Feb, 2024.

SBI Fund Management :

· Estimated PAT for FY-24 - 1500 Crores which will be a 12% increase in the bottom line of the company.

· Estimated P/E (FY-24) - 36

· SBI fund Management has shown a better growth in numbers in comparison to its peer HDFC AMC and UTI AMC, hence the street is expecting the stock to perform well.

IPO Plans

The IPO plan for SBI’s Mutual Fund unit, set to raise $1 billion, is now abandoned, as announced by SBI Chairman Dinesh Khara in August 2023, despite its initial proposal in December 2021. In August 2023, SBI Chairman Dinesh Khara announced during a post-earnings media briefing on Friday that the bank’s planned initial public offering (IPO) for its mutual fund unit is now “out of focus.” On December 15, 2021, SBI initially announced that it planned to go public with the mutual fund subsidiary in an effort to raise $1 billion. SBI owns 62.6% of the SBI Mutual Fund, with Amundi Asset Management, a top French insurer, holding the remaining 36.8%.

FY 2024 Performance

SBI Mutual Fund has experienced significant growth in FY 24. Their Profit After Tax (PAT) has surged to INR 2063 Cr, marking a remarkable 55% increase from FY 23's INR 1331 Cr. SBI Mutual Fund thus stands as the biggest player in the market since Q4FY20.

SBI Fund Management Unlisted Share Price Journey

SBI Fund Management Unlisted Shares were introduced into the unlisted market in Feb-23 at a price of 999 per share and the stock made a low of 889 in May-23. Since then SBI Fund Management Unlisted Shares has rallied to a share price of 1600 per share in Feb-24.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| State Bank of India | 62.59 % |

| Amundi India Holding | 36.76 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe