Reliance Retail Unlisted Share

₹2335

*Average Price as per 7 May, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

74.59

NO OF SHARES

4990422513

EPS

14

SALES

223886.23

INDUSTRY PE

20

DIVIDEND

0

DIVIDEND YIELD

0

PE

98.21

PB

18.43

PS

3.06

MARKET CAP

686183.1

EQUITY

4990.42

PAT

7008.82

MESSAGE

2022-23

OVERVIEW

Is Reliance Retail Share Price Justified?

Company Summary

Retail market in India is estimated to be at US$822 billion in FY20 and is expected to grow by a CAGR of 10% over the next five years to reach almost US$1,315 billion by FY25. The penetration of the organised retail market is estimated at 11% (FY20). And it is expected to grow to 17% by FY25E. The organised retail market is estimated to be at US$89 billion in FY19 and is expected to grow at a CAGR of 21.0% over the next five years to reach US$230 billion by FY25E.

Reliance Retail demonstrated yet another year of highest-ever revenue, EBITDA and margin expansion despite a slowing consumer demand, challenging market environment, and COVID-19 disruption towards the end of the year. Consistent strategy, sharp operational execution and a customer-centric approach is what backs this robust business performance.s

The Company is India’s largest and most successful retailer. In just 14 years of launch, the Company has accomplished a feat no other retailer has achieved. The Company touches every aspect of its consumers’ life from morning to evening, items of necessities to luxuries of life, cities to towns, food to fashion, online to offline and much more, enabling the ease of living for every Indian.

The Company has established its business across five key consumption baskets:

a) Consumer Electronics

b) Fashion & Lifestyle

c) Grocery

d) Connectivity

e) Petro Retail.

The Company is now embarking on a journey to transform traditional retail through its JioMart Digital Commerce Platform. The roadmap to this journey requires Reliance Retail to establish a complex yet robust physical and digital pan-India infrastructure and neatly weave this network into a smooth, sound and responsive operating system, enabling the Company to serve consumers in partnership with traditional retailers.

The Company has commenced taking strides towards this with the launch of the pilot phase of JioMart in select cities. It provides an omnichannel experience to consumers who can place orders through alternative ways, including Whatsapp, which merchant partners will serve. It aims to change the entire customer journey so that even consumers who are not comfortable with digital channels become satisfied with JioMart. JioMart is a centralised procurement and delivery platform between manufacturers and merchant partners. JioMart enables the digitisation of merchants through Jio PoS at the backend and the JioMart app at the front. As for the pilot, the Company has commenced onboarding merchant partners in a limited geography.

The Company will continue to invest in expanding the existing store network and enhancing core capabilities, including omnichannel solutions, innovative store concepts, and the store environment to provide an immersive customer experience. And leveraging customer insights through sophisticated technology and much more to consolidate its market leadership across all consumption baskets and store concepts.

INSIGHT

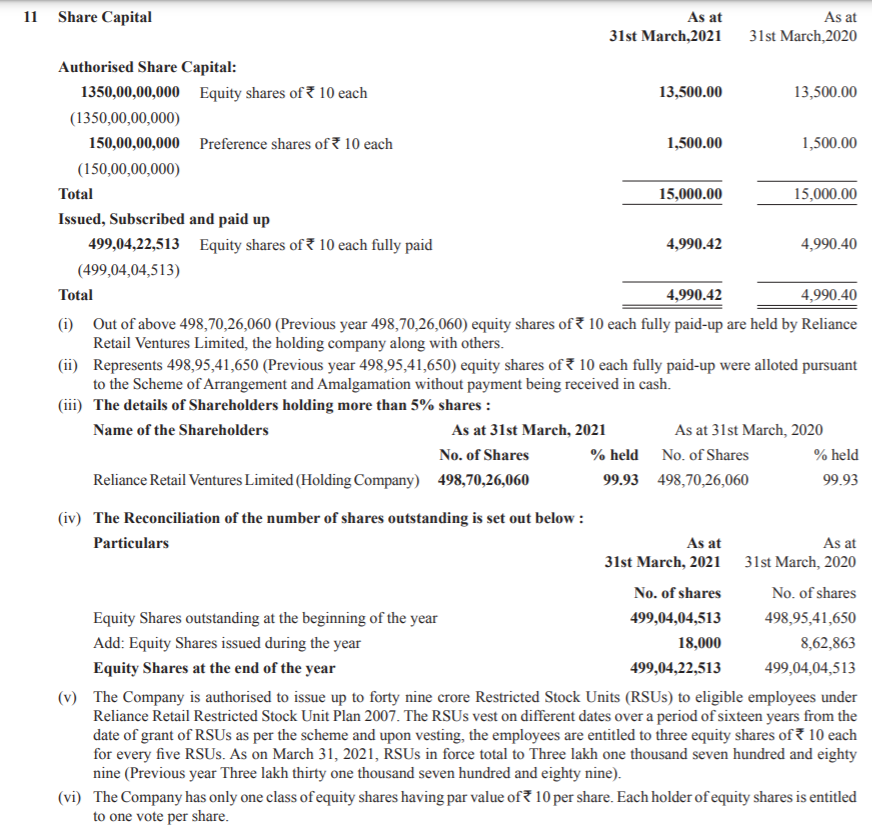

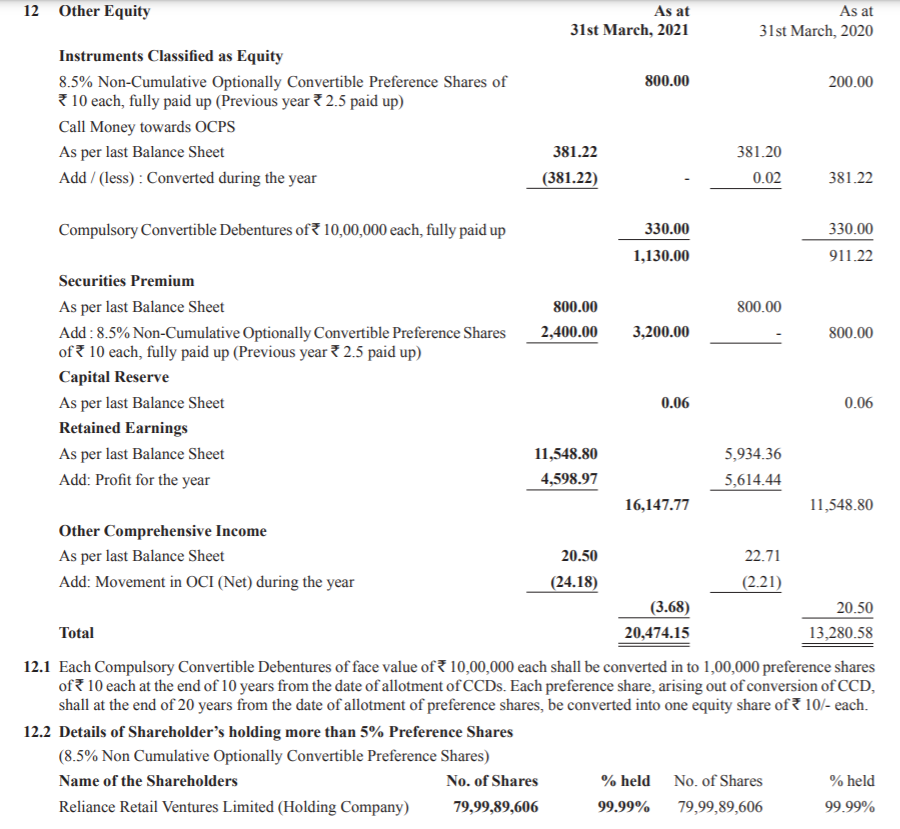

Reliance Retail Capital Structure

Capital structure by incorporating the adjustments of conversions:

Equity Share Capital - Rs 4990.42 Cr

8.5% Non-Cumulative Optionally Convertible Preference Shares - Rs 4000 Cr

Compulsory Convertible Debentures - Rs 330 Cr

Total diluted equity stands at Rs 9320.42 Cr

Terms of Conversion of the Preference shares & Debentures

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

DISABLETRADING

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Reliance Retail Ventures | 99.95 % |

| Other | 0.05 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe