Philips India Unlisted Share

₹999

*Average Price as per 9 May, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

214

NO OF SHARES

57517242

EPS

45.21

SALES

5734

INDUSTRY PE

50.98

DIVIDEND

222

DIVIDEND YIELD

23.49

PE

20.9

PB

4.42

PS

0.95

MARKET CAP

5435.38

EQUITY

57.5

PAT

260

MESSAGE

2022-23

OVERVIEW

Philips India Limited is a leading manufacturer of consumer electronics in India, offering products such as lamps, TVs, CD players, digital radios, personal care items, household appliances, lighting solutions, loudspeakers, audio systems, car lights, and accessories. PIL also plays a vital role in global innovation for its parent company, Philips, through its technology development center.

Additionally, PIL is active in the personal care and medical equipment sectors.

Strategic demergers of its domestic appliances and lighting businesses in 2022 and 2016, respectively, have aligned with Philips' global strategy, enabling PIL to concentrate on its core strengths and support the broader goals of Philips. Want to learn more about Philips? Read our in-depth blog about Philips India.

| Company Name | PHILIPS INDIA LIMITED |

| Company Type | Unlisted Public Company |

| Industry | Manufacturing (Personal Care & Medical Equipment) |

| Incorporation Year | 1930 |

| Registered Address | Kolkata, West Bengal, India |

Product Portfolio

Health Systems

- Medical Electronics Equipment: This includes advanced medical imaging systems such as MRI machines, CT scanners, X-ray machines, ultrasound machines, patient monitoring systems, and medical informatics solutions.

- Customer Services: Comprehensive support services including maintenance, repair, training, and consulting to ensure the optimal performance and uptime of medical equipment.

- Innovation Services: This involves the creation of software solutions embedded within various electronic devices and systems. Examples include software for healthcare devices, consumer electronics, automotive systems, industrial machinery, and more.

Personal Care

- Health and Wellness Products: This includes a wide range of consumer health monitoring devices such as blood pressure monitors, thermometers, activity trackers, and smart scales. It may also encompass products like air purifiers and humidifiers designed to enhance indoor air quality and overall well-being.

- Personal Care Products: This encompasses grooming and personal hygiene products such as electric shavers, hair trimmers, hair dryers, hair straighteners, epilators, and oral care products like electric toothbrushes and water flossers.

This diverse product portfolio enables the company to cater to the needs of both healthcare professionals and consumers, offering innovative solutions for medical diagnostics and treatment as well as enhancing personal health and everyday living experiences.

Key Strenghts

- Healthcare Market Leadership: PIL dominates premium medical equipment market in India with advanced technology.

- Innovation Services Growth: PIL's innovation services revenue surged 25% in 2023, catering to global needs.

- Personal Care Expansion: Excluding demerged segments, PIL's personal care division grew 12% in 2023, with more growth expected.

- Maintained Market Position: PIL poised to retain market position through new launches and healthcare focus post-demerger.

- Healthy Financial Profile: Strong cash accruals, net worth over Rs 1,200 crore, and robust debt protection metrics.

- Parent Company Support: PIL benefits from strategic and technical support from KPNV, aligning with global plans.

Key Weaknesses

- Modest Healthcare Profitability: Operating margins expected around 4-5%, despite significant revenue.

- Competitive Landscape: PIL faces competition from GE and Siemens but maintains edge through brand and distribution.

Board Members

INSIGHT

Financial Highlights

₹ in crore

| Particulars | FY 2023 | FY 2022 | FY 2021 |

| Net Revenue | 5734 | 5481 | 4843 |

| EBITDA | 404 | 334 | 372 |

| Profit After Tax (PAT) | 260 | 266 | 176 |

| Earning Per Share (EPS) | 45.21 | 46.23 | 30.6 |

2 Years Revenue CAGR: 8.8% | 2 Years PAT CAGR: 21%

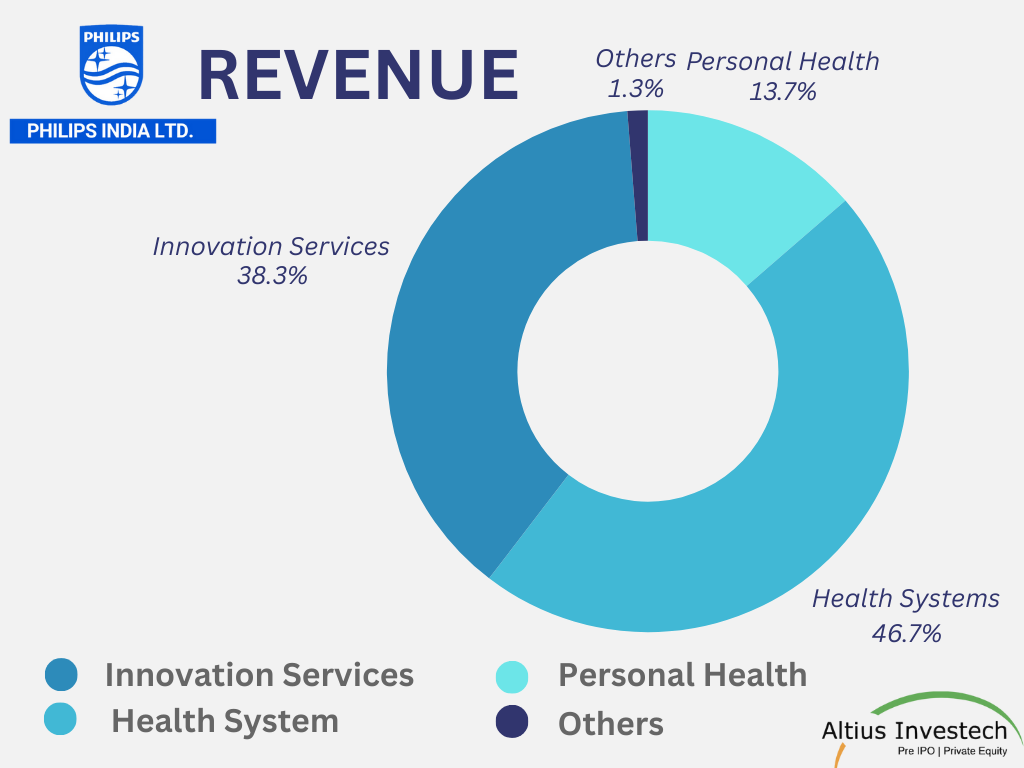

Revenue Breakup

| SEGMENT | SALES 2022-23 |

|---|---|

| Health Systems | 26,493 |

| Innovation Services | 21,729 |

| Personal Health | 7,746 |

| Others | 714 |

| Total | 56,682 |

Dividend

During the year ended 31 March 2023, Philips India Limited has declared an interim dividend of Rs. 222 per share on the fully paid equity shares.

Delisting and Investment Opportunities

Following a takeover by Philips Electronics NV in 2004, the equity shares of Philips India Limited were delisted from the stock exchanges in India. Despite this delisting, certain retail shareholders still retain equity shares in the company. However, post-delisting, these shares are not traded on any stock exchange in India.

Re-Listing/ IPO Plans

As of now, there are no plans from the company’s side for relisting its equity shares on the stock exchanges in India.

Overview of Indian Medical Electronics Industry

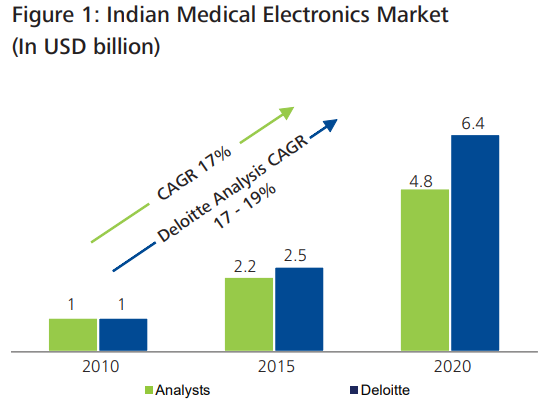

The Indian Medical Electronics industry, valued at around USD 1 billion and growing steadily at an average rate of 17% in recent years, is poised for substantial expansion, with forecasts predicting a surge to nearly USD 6.5 billion by 2020. This growth trajectory is propelled by various factors, including demographic shifts, rising disposable income, and favorable regulatory environments. Medical Electronics encompass a wide range of healthcare products requiring external energy sources, such as personal medical devices, monitoring systems, and implants. While challenges such as infrastructure development and regulatory advancements persist, market drivers like growing population, increased awareness, and government initiatives are expected to fuel continued growth. Projections indicate a market size of approximately USD 5 billion by 2020, with potential for even greater expansion beyond current estimates.

Recent Developments

Philips Unveils New Innovation Campus in Bengaluru, India, to Accommodate 5,000 Engineers

(November 2023) CEO Roy Jakobs inaugurated a new innovation campus in Bengaluru, India, capable of accommodating 5,000 engineers. He emphasized the potential of Generative AI in addressing customer needs, particularly in healthcare, where the focus lies on serving more patients efficiently. With over 9,000 employees in India, 5,000 of whom will be based in Bengaluru working on innovative health technologies, Philips aims to accelerate access to care and develop solutions locally for global markets. The company’s investment in Pune’s healthcare innovation center and plans for further expansions underscore its commitment to innovation in India. Philips views India as a significant hub for innovation, reflecting its longstanding presence in the country dating back 92 years.

Powering Wellness with Star Ambassadors

Philips shines with a star-studded cast of brand ambassadors, including Alia Bhatt, Varun Dhawan, Virat Kohli and Arjun Kapoor. Each embodies the brand’s values of excellence, innovation, and holistic well-being. With their influence and resonance, they amplify Philips’ mission to empower individuals to lead healthier, happier lives through cutting-edge technology and lifestyle solutions.

Peer Comparison

₹ in crores (FY 23)

| Particulars | Philips India Limited | Poly Medicure Limited | Schneider Electric Infrastructure |

| Net Revenue | 5734 | 1153 | 1804 |

| EBITDA | 404 | 267 | 168 |

| Profit After Tax | 260 | 179 | 124 |

| Market Capital | 5320 | 16142 | 19343 |

| Share Price (as on 15.05.2024) | 930 | 1682 | 809 |

| P/E | 20.46 | 89.99 | 156.47 |

| P/S | 0.93 | 14 | 10.72 |

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Koninklijke Philips N V | 96.13 % |

| Other | 3.87 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe