Pharmeasy Unlisted Share Prices

₹22

*Average Price as per 9 May, 2025

Fundamentals

FACE VALUE

1

BOOK VALUE

1.89

NO OF SHARES

11547619047

EPS

-2.2

SALES

5664.29

INDUSTRY PE

0

DIVIDEND

0

DIVIDEND YIELD

0

PE

-3.18

PB

3.7

PS

1.42

MARKET CAP

8071.79

EQUITY

1154

PAT

-2533.51

MESSAGE

2023-24

OVERVIEW

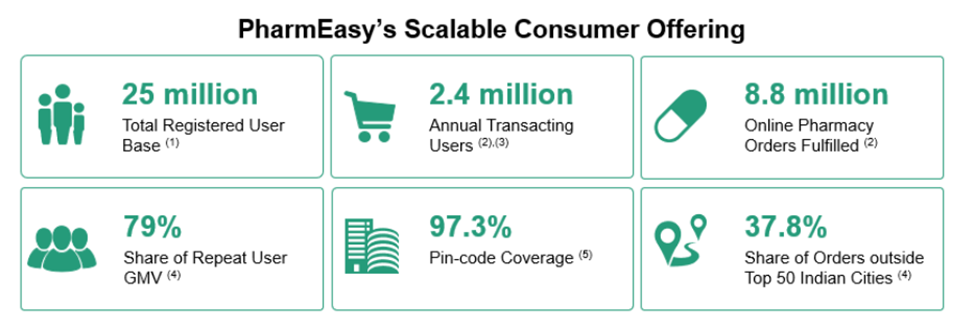

PharmEasy is a consumer healthcare “super app” that provides consumers with on-demand, home delivered access to a wide range of prescription, OTC pharmaceutical, other consumer healthcare products, comprehensive diagnostic test services, and teleconsultations thereby serving their healthcare needs.

API Holdings Ltd aka Pharmeasy is India’s largest digital healthcare platform (based on GMV of products and services sold for the year ended March 31, 2021), according to RedSeer Report.

Pharmeasy operate an integrated, end-to-end business that aims to provide solutions for the healthcare needs of consumers across the following critical stages -

A. providing digital tools and information on illness and wellness,

B. offering teleconsultation,

C. offering diagnostics and radiology tests, and

D. delivering treatment protocols including products and devices

Product Offerings

- Healthcare

- Personal Care

- Healthcare devices

- Health Food & Drinks

- Accessories & Wearables

- Home Care

Timeline

2015: PharmEasy was founded by Dharmil Sheth and Dhaval Shah in Mumbai, India

2016: Raised $5 million in Series A funding led by Bessemer Venture Partners

2017: Secured $18 million in two rounds of Series B funding from Bessemer Venture Partners

2018: Raised $77.23 million across two Series C funding rounds from Eight Roads Ventures India, F-Prime Capital

2019: Raised $220 million in Series D funding from Temasek Holdings

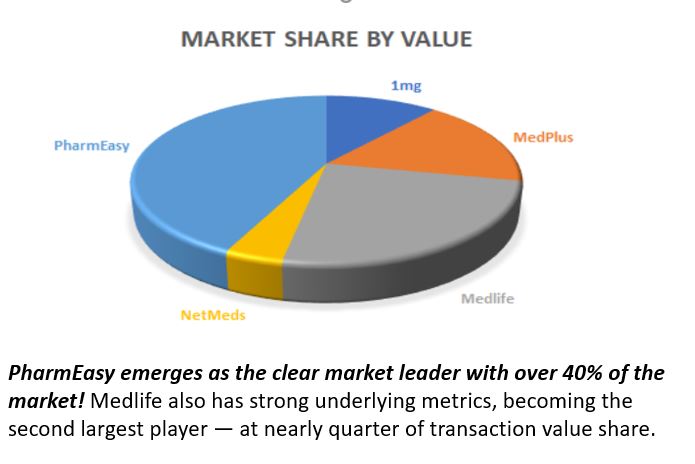

2020: Merger of Medlife with PharmEasy

2021:

- PharmEasy acquired a 66.1% stake in Thyrocare for ₹4,546 crore ($620 million)

- Acquired a majority stake in healthcare supply chain company Aknamed

- Raised $500 million in Series F funding

- Completed a Pre-IPO round of $354 million

- Received additional private equity funding from VestinWolf Capital Management

- Filed for an initial public offering (IPO) of ₹6,250 crore ($843.46 million)

2022: PharmEasy withdrew its IPO plans and went with rights issue

Management

Siddharth Shah: Co-Founder, Managing Director and Chief Executive Officer

- He holds a bachelor’s degree in computer engineering from the Dwarakadas J. Sanghavi College, Mumbai

- Post graduate diploma in management from the Indian Institute of Management, Ahmedabad

- He was associated with Ascent Health and Wellness Solutions Private Limited as its managing director

Dharmil Sheth: Co-Founder and Whole-time Director

- Bachelor’s degree in electronics engineering from the K.J. Somaiya College of Engineering, University of Mumbai

- Post graduate diploma degree in management (marketing) from the Institute of Management Technology, Ghaziabad.

- He was associated with MakeMyTrip (India) Private Limited as a part of the online products team

- 91Streets Media Technologies Private Limited as director and co-founder.

Dr. Dhaval Shah: Co-Founder

- Post graduate diploma in management from XLRI, Xavier School of Management, Jamshedpur, Jharkhand

- MBBS degree certificate from the Maharashtra University of Health Sciences, Nashik

- McKinsey and Company Inc. as a consultant

- Associated with 91Streets Media Technologies Private Limited as an executive director

Harsh Parekh: Co-Founder and Whole-time Director

- Master’s degree in business administration from the School of Business Management, Narsee Monjee Institute of Management Studies, Mumbai

- Chief Operations Officer of Ascent Health and Wellness Solutions Private Limited

Hardik Dedhia: Co-Founder

- He joined Ascent Health and Wellness Solutions Private Limited

- Bachelor’s degree in electronics and telecommunication engineering from the University of Mumbai, Maharashtra

- Master’s degree in electrical and computer engineering from the Carnegie Mellon University, Pennsylvania

INSIGHT

Financial Insights

| Particulars (In Crs) | 31st March, 2024 | 31st March, 2023 |

| Revenue | 5664 | 6700 |

| EBITDA | -646 | -1570 |

| PBT | -1495 | -2282 |

| PAT | -2533 | -2276 |

Market Share

Marquee Investors

- Naspers Ventures BV

- Macritchie Investments Pte Ltd

- TP G Growth V SF Markets Pvt Ltd

IPO Updates

PharmEasy plans to re-enter the IPO market following a major business overhaul. The company aims to discuss its IPO strategy, including a potential merger with Thyrocare, at its February 2025 board meeting.

Industry Outlook

The Indian e-pharma industry is experiencing explosive growth, with a projected CAGR ranging from 44% to 63%.

Here's a breakdown of the promising outlook with specific figures:

Market size: The e-pharmacy market in India was valued around $512 million in 2018 and is expected to reach anywhere from $3.6 billion by 2022 to $4.5 billion by 2025.

Revenue growth: E-pharmacies are expected to see their revenue grow at a significant rate, with estimates suggesting a 54% CAGR over the next 4 years.

This translates to capturing around 5% of the total pharmaceutical sector revenue. These figures paint a bright picture for e-pharma companies like PharmEasy. The industry is attracting significant investment, with funding of $700 million secured in 2020 alone.

Recent Funding

PharmEasy's parent company, API Holdings, secured its most recent funding in April 2024.

Amount raised: $216 million (Rs 1,804 crore)

Investors: The round was led by Manipal Education and Medical Group (MEMG) along with participation from existing investors like Prosus, Temasek, and 360 One.Impact:

This funding came with a significant valuation drop of around 90% compared to PharmEasy's peak valuation of $5.6 billion in 2021. The current valuation is estimated to be around $710 million.

Listed Subsidaries

API Holdings is a holding company that owns 71.18% of Thyrocare Technologies Ltd, making Thyrocare Technologies Ltd a subsidiary of API Holdings.

API Holdings owns 3,76,56,092( AS PER BALANCE SHEET FY 22-23) equity shares of Thyrocare Technologies Ltd, and the current market price (CMP) of the share is 751,(AS ON 24/07/2024) equivalent to 2827.9 Crores

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Naspers Ventures BV | 13.24 % |

| Macritchie Investments Pte. Ltd | 11.93 % |

| Surbhi Singh jointly with Universal Trustees Private Limited | 6.1 % |

| TP G Growth V SF Markets Pvt Ltd | 7.32 % |

| Evermed Holdings Pte. Ltd | 6.45 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe