OYO Unlisted Share Prices

₹67

*Average Price as per 16 May, 2025

Fundamentals

FACE VALUE

1

BOOK VALUE

1.29

NO OF SHARES

7355000000

EPS

0.3

SALES

5388.79

INDUSTRY PE

0

DIVIDEND

0

DIVIDEND YIELD

0

PE

155

PB

36.05

PS

6.34

MARKET CAP

34200.75

EQUITY

735.5

PAT

219.5

MESSAGE

2023-24

OVERVIEW

OYO Hotels & Homes is a renowned hospitality company that has revolutionized the hotel industry with its innovative approach to affordable and comfortable accommodations. Founded in 2013 by Ritesh Agarwal, OYO has rapidly expanded its presence across the globe, operating in over 80 countries and managing more than 1.2 million rooms. The business offers consumers the option to choose rooms and living areas that best fit their needs at an affordable price.

Timeline

2013: Opens first oyo in Gurugram

2014: Received Series-A funding

2015: Launch of oyo app Expanded to 100 cities and crossed 10000 rooms

2016: First overseas expansionin Malaysia Hit 1 million checkin for the first time

2017: Launch of oyo townhouse

2018: Expansion outside of Asia-UK Expanded to China and Indonesia

2019: Launched in US, Europe and Middle East

2020: Acquired @Leisure to enter vacation home business across 40 countries

2021: Launched OYO360, a self onboarding platform for patrons.

Business Model

Earlier Model: OYO’s initial business model was to pre-book hotel rooms at a discounted price then sell these rooms on their platform, usually at a higher price. Their revenue was the difference between their price and the price they sold the room for.

Current Model: Slowly OYO has shifted their focus from being an aggregator to managing the entire hotel property.

Oyo presently sells the complete inventory of hotels under its very own branding. This is beneficial for hotels, listed on the OYO platform gives them more traction and helps them acquire more business. And as commission Oyo charges 22% from its hotel partners.

Global Presence

- OYO has expanded its footprint exponentialy in the US, it operates over 320 hotels across 35 states

- In August, 2024 OYO has accquired U.S. Hotel chain Motel 6 from Blackstone at a consideration of $525 Million

Funding Details

2015: $25 million from investors namely Lightspeed India, Sequoia, and others.

2015: OYO received $100 million in a Series C funding investor SoftBank.

2018: OYO got $800 million from SoftBank.

2019: OYO raised a total of $807 million from Ritesh Agarwal-led RA Hospitality Holdings and SoftBank in series F funding

2021: OYO’s latest funding has come from Microsoft in July. The firm invested $5 Million.

2024:Series G (August 2024) :- Raised Rs 1,457 Cr at a valuation of $2.4 billion which was done through CCPS, each priced at Rs 29

In December 2024,Ritesh Agarwal invested Rs.550 crore in OYO through RA Hospitality Holdings, raising its valuation to Rs.32,000 crore

Oyo withdraws IPO and goes for private placement? Let’s get a quick overview on this!

Oyo filed a confidential DRHP with SEBI by downsizing the IPO size by 40-60% in April 2023, however OYO has withdrawn its IPO in May 2024 and is going for a private placement. Read more about how OYO sought private funding due to the long IPO wait time.

Key things to note :

·Oyo plans to raise money privately at a valuation as low as $2.3 billion, which is at a cut of almost 74% from its peak valuation of $9 billion OYO achieved back in 2021 from Microsoft.

·InCred Wealth and Investment Services Private Limited is the key institutional buyer in this round.

· 14,37,41,379 Series G fully and compulsorily convertible cumulative preference shares (Series G CCPS) to be issued at a price of INR 29 per share.

·Total fund raised : 417 crores and the conversion ratio is set to be 1:1 meaning every CCCPS to be converted into 1 equity share

·Object of the issue - For general corporate purposes and other business-related activities, including supporting the continued growth of the Company, supporting the Company’s global expansion (including acquisitions), and enhancing the business plan.

INSIGHT

Financial Insights

| Particulars | FY24 | FY23 | FY22 | FY21 |

| Net Revenue | 5389 | 5464 | 4781 | 3962 |

| EBITDA | 707.17 | -373.9 | -1160 | -2023 |

| PBIT | 659.62 | -516.4 | -1335 | -2219 |

| PAT | 229.58 | -1286 | -194.2 | -336 |

- FY 23-24 - The company turned PAT positive for the entire fiscal year, its first since inception, clocking a profit of INR 2,292.6 million. The company’s consolidated adjusted EBITDA improved by ~216% to INR 8,735.09 million for the FY24 as against INR 2,777.42 million in the FY23.

- The company’s Adjusted Gross Profit margin remained strong at 23.6% in FY24 (23.2% in FY23) despite a substantial addition of new inventory.

- The Company has not transferred any amount to any Reserves account for the Financial Year 2023-24

- .As on April 1, 2023, the authorized share capital of the Company was INR 9,01,13,59,300/- and there is no change in the authorised share capital of the Company.for the year ended 2023-2024.

Private Placements:

Investment By Incred:

| Description | Value |

| Number of Shares Issued to INCRED WEALTH AND INVESTMENT, Around 5th July 2024 | 14,37,41,3799 |

| Issue Price per Share | Rs 29 |

| Total Amount Raised | Rs 416,85 crore |

| Valuation of the Company | Rs 199,00 crore |

| Number of Equity Shares Outstanding Post-Valuation (19900+416)/29 | Approximately 700 crore |

| Current Market Price per Share | Rs 41.5 |

| Current Market Capitalization | Rs 29,050 crore (Approx) |

Recent Funding

On 5th Jan, 2025, Indian hospitality leader OYO has raised INR 550 crore (approximately $65 million) from Redsprig Innovation Partners, a venture capital firm owned by founder Ritesh Agarwal. This move aligns with Agarwal's strategy to increase his stake in the company, resulting in a 1.728% dilution of OYO's total equity.

Regulatory filings reveal that OYO issued 12,91,07,982 equity shares at an issue price of INR 42.6 each to secure the funds. The capital will be allocated towards global expansion, growth initiatives, and business strategy enhancements.

Challenges and Concerns

1. Revenue Recognition Concerns:

- Questions about recognizing booking value as revenue in its hotel business in India.

- Oyos claims a 33% take rate, higher than industry peers (e.g., Treebo, MakeMyTrip).

2. Legal Issues:

- Lawsuits filed by hoteliers over unpaid dues.

- Disputes often related to previously promised fixed payouts.

- Resolving these legal challenges is crucial for Oyo’s publics offering plans.

IPO Plans

The Gurugram-based start-up has withdrawn its IPO draft papers twice due to unfavorable conditions. The firm reportedly said that it would refile the papers after concluding a large funding round, which is about to close after the latest fundraises. However, some reports suggest that OYO IPO's listing date will be around the second week of March 2025.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| RITESH AGARWAL | 38.42 % |

| Other | 61.58 % |

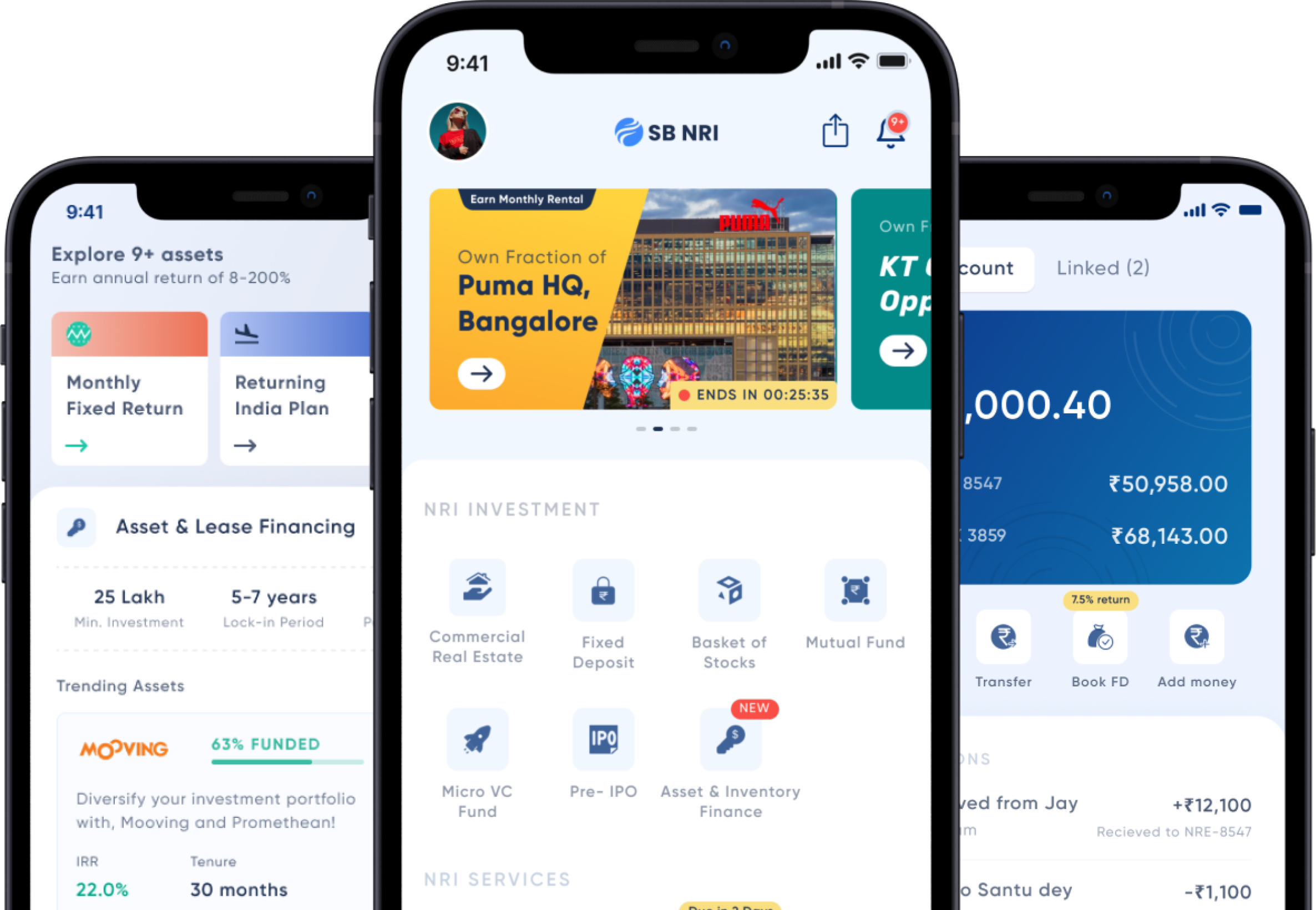

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe