Motilal Oswal Home Finance Unlisted Share

₹7.99

*Average Price as per 9 May, 2025

Fundamentals

FACE VALUE

1

BOOK VALUE

2.13

NO OF SHARES

6051582587

EPS

0.22

SALES

577.99

INDUSTRY PE

22

DIVIDEND

0

DIVIDEND YIELD

0

PE

65.91

PB

6.81

PS

15.1

MARKET CAP

8774.79

EQUITY

605.15

PAT

132.52

MESSAGE

2023-24

OVERVIEW

Underwriting:

In the business of lending, underwriting is the single most parameter which one should look in order to make an investment in the company. Underwriting is a process of distribution of loans. If the company has a robust process for underwriting, then chances of NPAs get reduced considerably. Now, let us see how MOFH does underwriting?

a. The loan approval process at MOHFL is in 4 layers of an approval process based on the ticket size of the loan.

b. Approvals of lending proposals are carried out by various authorities from Cluster Credit Head to National Credit Head. Approvals beyond certain limits are referred to as the Chief Operation Officer. An additional layer of in house legal

and technical makes the underwriting process more robust.

c. There is a Dedicated Risk Containment Unit (RCU) in the Company to minimize fraud related to income documents, profiles, and collateral.

Borrowing:

Lending is a business where we need money to give money. MOHF first arranges money and then distributes it to the people in the economy to buy a new house or reconstruct. Now, how MOHF arranges fund?

a. From banks by a way of term loan.

b. NCD by issuing commercial paper

MOHFL total borrowings as of March 31, 2020, of Rs 2,954 crores. And, the cost of borrowing in FY20 at 10.16%.

A journey of Motilal Oswal Home Finance

2014:

(i) Commencement of Business Operation on 22.05.2014.

(ii) The first disbursement booked in Akola Branch in June 2014.

(iii) The loan book crossed 50 Cr.

2015:

(i) Presence across 14 locations.

(ii) Total staff: 160 employees.

(iii) Loan book at 357 Cr with 3565 live accounts.

(iv) Year-end PAT at 18 Cr CRISIL upgrades rating for long term borrowings from “A/Stable” to “A+/Stable“ Loan book crosses 550 Cr with 5,500 Cr live loan accounts Present at 23 locations.

2016:

(i) Present in 51 Locations with employees count of 500.

(ii) PAT for the years at 40 Cr.

(iii) Received the first 50 Brand 2016 award by WCRC.

(iv) Presence extended to 62 locations.

2017:

(i) Awarded second prize for best performing Primary Lending Institution under CLSS for EWS/LIG by the Ministry of Housing and Urban Poverty Alleviation.

(ii) Expanded to 6 new states with a presence in 121 locations with a staff count of 1049.

(iii) loan Book of 4165 Cr with 46,142 live accounts.

2018:

(i) 4682 Cr of the loan book.

(ii) Capital Infusion by MOSFL of Rs. 150 Cr.

(iii) Strengthening of a core team.

(iv) Strengthening Credit & Risk

2019-20:

(i) CRISIL has upgraded MOHFL’s rating to AA- (stable outlook) from earlier A+ (stable) based on several positive changes undertaken.

(ii) Sold NPA pool to ARC resulted into significant reduction into NPAs.

(iii)Profitability is back in FY20 after taking one time provisioning hit in FY19

(iv) Awarded the Customer Excellence Award at the India CX & Digital Customer Excellence Awards, 2019

(v) Loan book of 4,357 crore with 52,000+ live accounts.

(vi)Capital Infusion of 200 crore in FY19, taking the total cumulative Capital Infusion to ` 850 crore.

FY20 witnessed a slight drop in profitability ratios for HFCs owing to lower disbursements and interest spreads. Further, March quarter got impacted due to lockdown in March month. FY21 outlook remain muted amid COVID-19 pandemic outburst and no visibility on how long it will continue. Considering lockdown is only solution for time being to control spread, it has created huge impact on global economy. We believe that HFC Industrywill also face challenges from asset side as well as liability side. Further, slowdown in real estate sector led by supply side as well as demand side constrains will aggravate problem. As per ICRA estimate loan book growth for HFC would be 6-8% for FY21. Profitability for the sector would also be impacted due to shrinking spreads and elevated credit cost.

INSIGHT

Standalone Financial Highlights:

- Net Revenue for FY 2024 is ₹589 Cr. compared to ₹532 Cr. in FY 2023, showing a 10.71% growth. This increase indicates improved sales performance, higher demand for the company’s products/services

- EBIT grew to ₹422 Cr. in FY 2024 from ₹394 Cr. in FY 2023, marking a 7.11% increase. This indicates sustained operational performance after accounting for depreciation and amortization costs.

- EBT declined slightly to ₹171 Cr. in FY 2024 from ₹175 Cr. in FY 2023, a decrease of 2.29%. The drop may be due to higher interest expenses or an increase in operational costs, which affected pre-tax profitability.

- Book Value per Share increased to ₹2.13 in FY 2024 from ₹1.90 in FY 2023, reflecting a 12.11% growth. This improvement indicates growth in the company’s net worth, driven by retained earnings and asset accumulation, strengthening the overall financial position.

Notes:

- Presence: MOHFL operates in 110 locations across 12 states.

- Credit Rating: MOHFL has received a robust AA rating with a Stable Outlook from CRISIL, ICRA, and India Ratings.

- Corporate Structure: MOHFL does not have any subsidiaries, joint ventures, or associate companies.

- The parent company, Motilal Oswal Financial Services, provided robust support with a total cumulative capital infusion of ₹850 crore, which led to a reduced net leverage (Debt/Equity ratio) of 2.00.

- MOHFL have in-house Loan Management System (LMS) and Loan Origination System (LOS) and separate mobile apps for sales, credit and collection.

Maharashtra leads in the loan portfolio, accounting for 60% of the total loan book.

Promoter Shareholding:

The promoters holding 97.49% of the company’s shares reflects their strong commitment and confidence in the company’s growth and future. Such a high level of promoter holding not only indicates a deep-rooted belief in the business model but also inspires trust and assurance among investors.

Segregation of Revenue from Operations:

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Like Minded Wealth Creation Trust | 0.15 % |

| Mr. Anil Krishanan | 0.1 % |

| Mr. Satish Kotian | 0.07 % |

| Mr. Kalpesh I. Ojha | 0.04 % |

| Mr. Sachin Bhausaheb Nikam | 0.02 % |

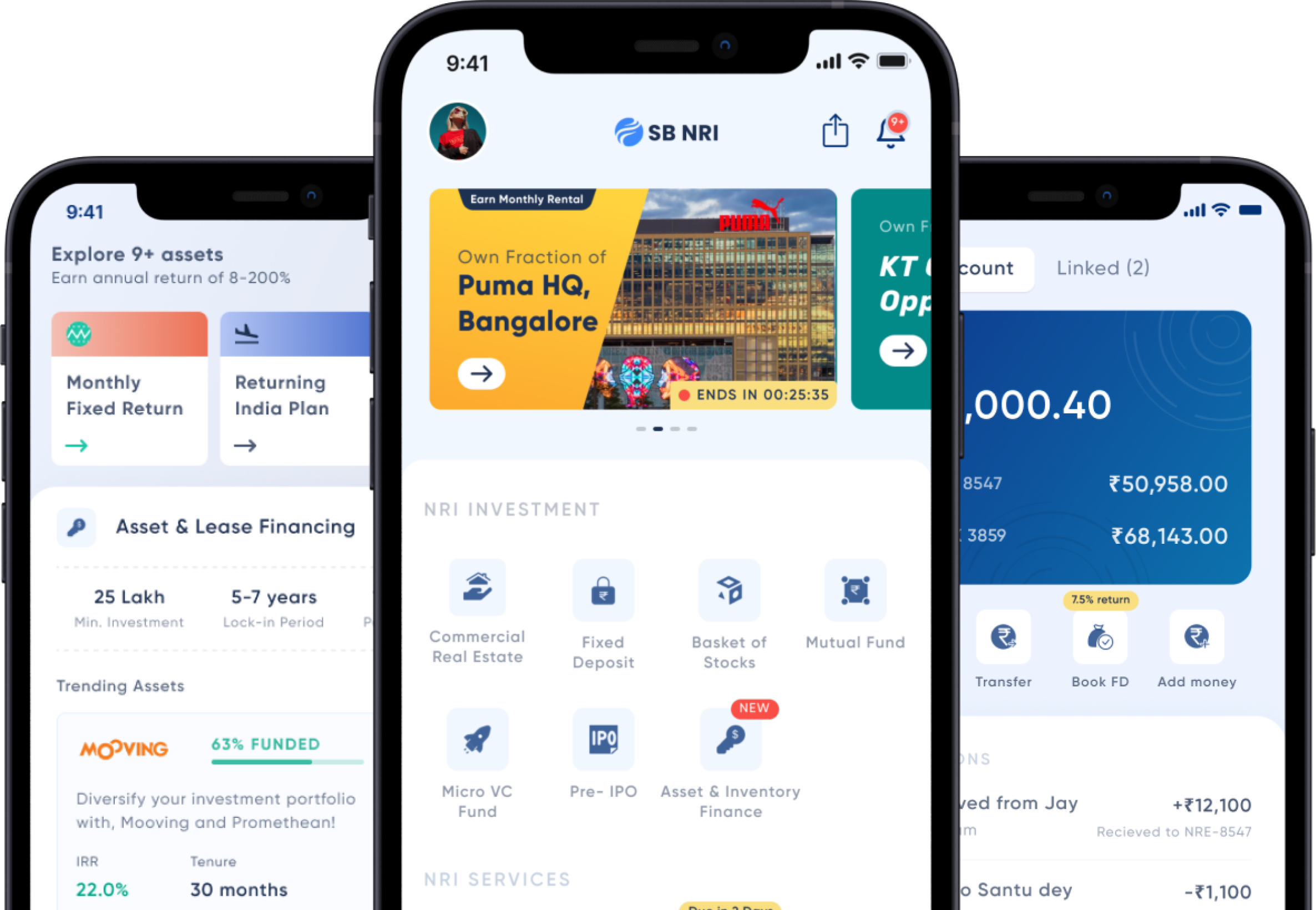

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe