Metropolitan Stock Exchange Unlisted Share

₹1

*Average Price as per 16 May, 2025

Fundamentals

FACE VALUE

1

BOOK VALUE

0.72

NO OF SHARES

6000217033

EPS

-0.08

SALES

21.05

INDUSTRY PE

28.02

DIVIDEND

0

DIVIDEND YIELD

0

PE

-87.5

PB

9.72

PS

175

MARKET CAP

4200.15

EQUITY

600

PAT

-48.74

MESSAGE

2023-24

OVERVIEW

Metropolitan Stock Exchange of India (MSEI) is a national-level stock exchange, recognized and licensed by SEBI. It offers an electronic, transparent, and high-tech platform for trading across multiple segments:

- Capital Market

- Futures & Options

- Currency Derivatives

- Debt Market

MSEI is committed to technological excellence and market expansion while ensuring compliance with global best practices and regulatory standards.

Key Milestones

October 7, 2008 – Commenced operations in the Currency Derivatives (CD) Segment under SEBI & RBI regulations.

February 9, 2013 – Launched the Capital Market Segment, Futures & Options Segment, and the flagship index ‘SX40’.

February 11, 2013 – Trading began in the Capital Market and Derivatives Segments.

May 15, 2013 – Introduced ‘SX40’ Index Derivatives, a free-float based index of 40 large-cap, liquid stocks across diverse sectors.

June 7, 2013 – Launched the Debt Market Segment; trading commenced on June 10, 2013.

January 20, 2014 – Started live trading in Interest Rate Futures (IRF), cash-settled on Government of India securities, providing a hedge against interest rate volatility.

June 3, 2019 – Implemented interoperability in clearing & settlement, allowing trades to be cleared through:

- Metropolitan Clearing Corporation of India Ltd. (MCCIL)

- Indian Clearing Corporation Ltd. (ICCL)

- National Securities Clearing Corporation Ltd. (NSCCL)

MSEI: Products & Services

1. Currency Derivatives

- Currency Futures

- Currency Options

- Cross Currency Futures

- Cross Currency Options

- Interest Rate Futures

2. Equity Capital Market

- Equity Shares

- Sovereign Gold Bonds

- Exchange Traded Funds (ETFs)

- Offer for Sale

3. Equity Derivatives

- Stock Futures

- Stock Options

- Index Futures

- Index Options

4. Index Offerings

- SX40: A large-cap diversified index

- SXBANK: Banking sector-focused index

Upcoming Products & Services

- SME Platform

- Book Building System

- Offer to Buy

- Mutual Fund System

Subsidiary: MSE Fintech Limited

- % Shareholding: 100% (Wholly Owned Subsidiary)

- Share Capital: ₹5.00 Cr

- Reserves & Surplus: ₹(3.62) Cr

- Profit After Tax (PAT): ₹0.13 Cr

Management Team

INSIGHT

Financial Highlights:

Notes:

Metropolitan Stock Exchange of India (MSEI) has a wholly-owned subsidiary named MSE Fintech Limited, with a face value of ₹10 per share. MSEI holds 50,000 equity shares in this subsidiary.

Employee count as of March 31, 2024, was 119, compared to 125 as of March 31, 2023.

Foreign currency earnings in FY 2023-24 were ₹22,50,000, unchanged from FY 2022-23.

Foreign currency expenditure in FY 2023-24 was ₹21,25,505, compared to ₹20,03,544 in FY 2022-23

100% of the Company’s shares are in dematerialized form as listed below as at March 31, 2024:

Private Placement:

The Board of Directors (BOD) has approved a private placement of equity shares, which will now require approval from the members at the Extraordinary General Meeting (EGM) scheduled for 18th January 2025. This private placement will lead to a notable shift in the ownership structure, the stake held by corporate bodies is set to rise from 15.49% to 27.29%, marking an increase of 11.80%, while public ownership will decrease from 58.96% to 47.27%, reflecting a reduction of 11.69%.

Source of Revenue:

- Transaction charges

- Revenue from clearing and settlement services

- Revenue from data feed charges

- Income from annual listing fees

- Membership admission fees

- Processing and other fees

Industry Overview

Indian IPO Activity

India has emerged as a global hub for IPOs, with record-breaking activity in FY 2023-24:

- Total IPO Proceeds: $7.89 billion

- Number of IPOs: 234, a 56% increase compared to 2022

- Highest IPO activity since 2017, showcasing strong investor confidence

India’s Equity Market

- Market Capitalization: Surpassed $5 trillion, making India the fourth-largest equity market globally.

- Foreign Capital Inflows: Increasing as investors diversify away from China, supporting India's long-term market growth.

Global Economic Outlook

- Projected Global Growth: 3.1% by 2029, driven by emerging markets and technological advancements.

- India’s economic resilience and growing digital infrastructure position it as a key player in global financial markets.

Peer Comparison

| Particulars | MSEI | NSE |

|---|---|---|

| Revenue (₹ Crore) | 7.36 | 14,780 |

| PAT (₹ Crore) | -48.74 | 8,305 |

| Market Capitalization (₹ Crore) | 5,393 | 4,76,437 |

| Share Price (As of Jan 2025, ₹) | 11.2 | 1,925 |

| Price-to-Earnings (P/E) Ratio | -112 | 57 |

| Price-to-Book (P/B) Ratio | 28 | 20 |

| Price-to-Sales (P/S) Ratio | 280 | 29 |

ANNUAL REPORT

Metropolitan Stock Exchange (MSEI) Annual Report 2023-24

Metropolitan Stock Exchange (MSEI) Annual Report 2022-23

Metropolitan Stock Exchange (MSEI) Annual Report 2021-22

Metropolitan Stock Exchange (MSEI) Annual Report 2020-21

Metropolitan Stock Exchange (MSEI) Annual Report 2019-20

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| MULTI COMMODITY EXCHANGE | 6.9 % |

| SIDDHARTH BALACHANDRAN | 4.96 % |

| RADHAKISHAN S DAMANI | 2.48 % |

| TRUST INVESTMENT ADVISORS PRIVATE LIMITED | 2.48 % |

| IL AND FS FINANCIAL SERVICES LIMITED | 2.48 % |

| OTHER | 80.7 % |

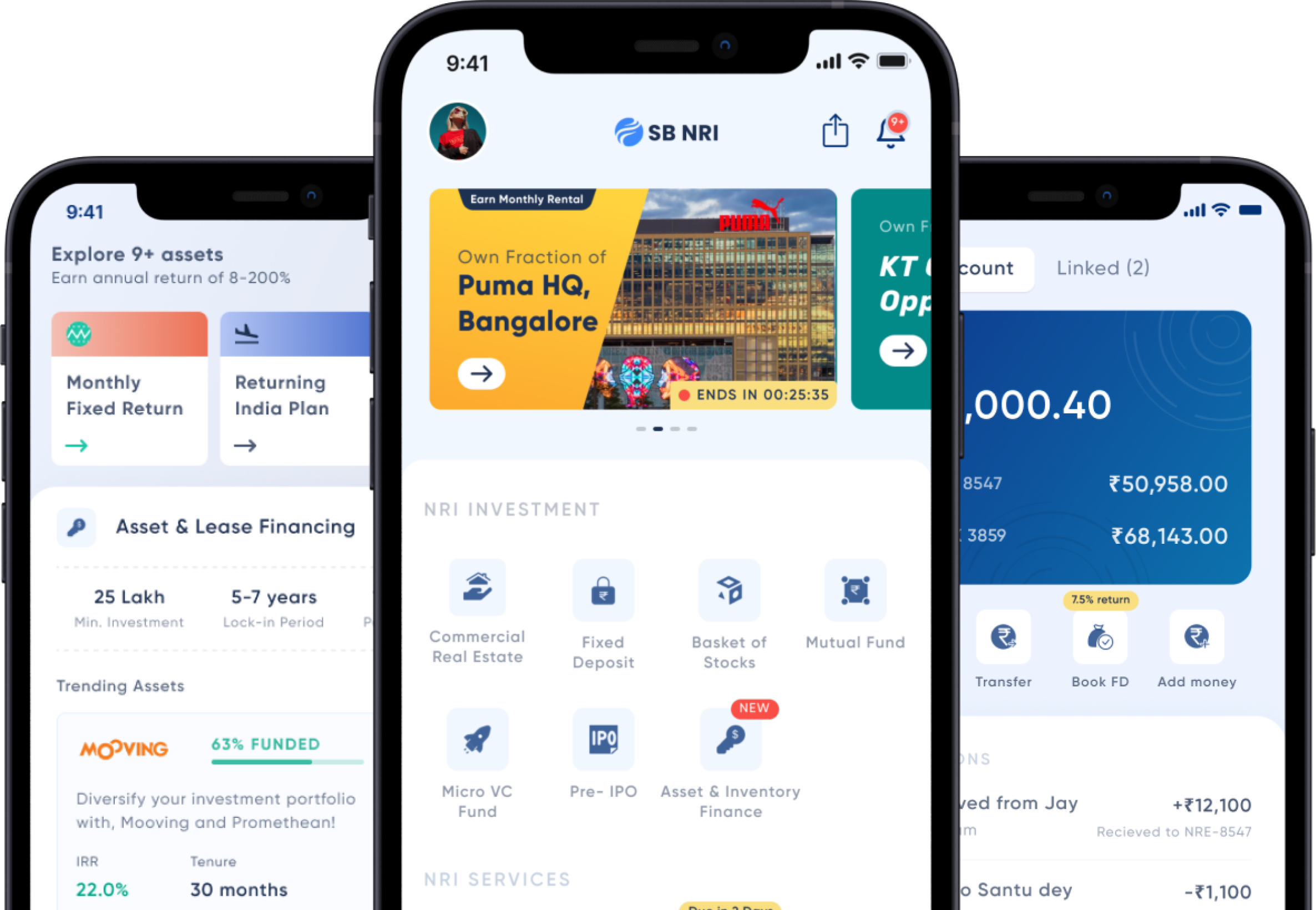

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe