Manjushree Technopack Unlisted Shares

₹1090

*Average Price as per 19 February, 2026

Fundamentals

FACE VALUE

2

BOOK VALUE

164.38

NO OF SHARES

94370875

EPS

34.35

SALES

2569.82

INDUSTRY PE

24.55

DIVIDEND

53.5

DIVIDEND YIELD

5.52

PE

28.24

PB

5.9

PS

3.56

MARKET CAP

9153.97

EQUITY

17.33

PAT

247.63

MESSAGE

2024-25

OVERVIEW

Manjushree Technopack Limited manufactures polyethylene terephthalate (PET) jars and bottles, multilayer containers, PET hot-fillable bottles, and pre-forms for use in the food, beverage, pharmaceutical, cosmetic, agricultural chemicals, and allied sectors. In February 2013, it started operations at its state-of-the-art PET preform manufacturing facility at Bidadi, Bengaluru. This facility has a ‘platinum green’ certification under the Leadership in Energy & Environmental Design programme and is the largest of its kind in South Asia.

- Establishment: Founded in 1983 by Vimal Kedia and Surendra Kedia.

- Acquisition: Advent International acquired a 77% stake in 2018, catalyzing growth.

- Capacity: Converting capacity exceeds 1,75,000 MT annually.

- Clientele: Serves top global FMCG companies across various industries.

- Manufacturing Plant: The manufacturing plants are located in Amritsar, Baddi, Pantnagar, Guwahati, Manesar, Silvassa, and Karnataka.

- Sustainability: Commissioned a recycling plant in Bidadi, Karnataka, in June 2020.

- Expansion: Acquired Pearl Polymers Ltd.'s B2B business in September 2020.

- Market Presence: Enhanced presence in FMCG, pharmaceutical, and liquor segments.

- Integration: Four manufacturing units of Pearl Polymers to seamlessly integrate upon regulatory approval.

- Leadership: Reinforcing leadership in the packaging industry.

- Green Energy: Utilizing green energy,the company reduces its carbon footprint and remains committed to socially responsible initiatives.

| Company Name | Manjushree Technopack Limited |

| Company Type | Unlisted Public Company |

| Industry | Packaging |

| Founded | 1983 |

| Headquarters | Bangalore, India |

| Services | Design Innovation, Packaging Product, Post Molding Operations |

| Website | www.manjushreeindia.com |

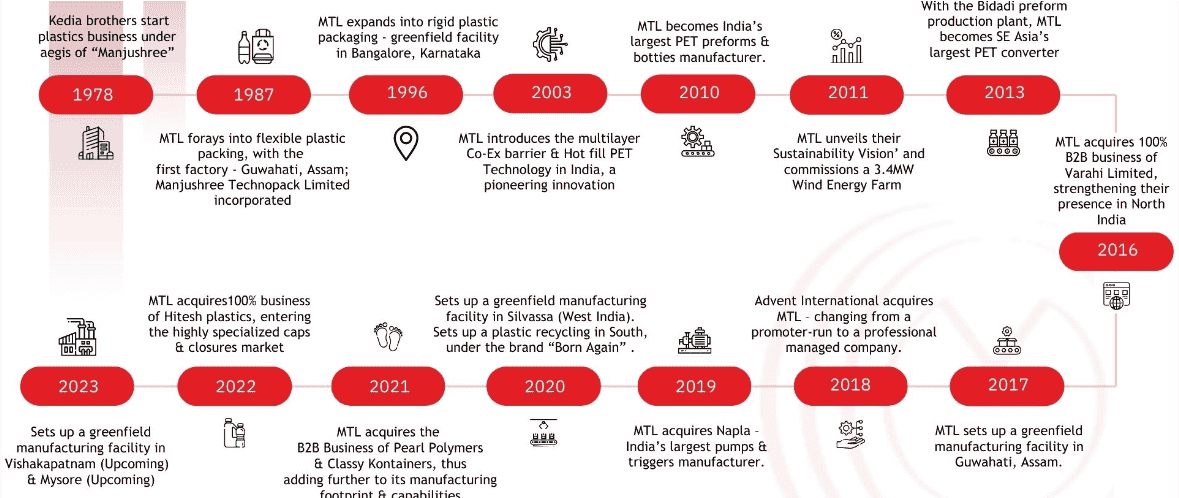

Manjushree's Journey

Services

Manjushree Technopack Limited provides end-to-end packaging solutions, beginning from the creation of sustainable packaging designs to ensuring rapid time-to-market delivery. Their offerings encompass a diverse array of catalog design options for bottles and containers. Additionally,Manjushree Technopack Limited boasts an extensive collection of promotional packaging designs, complemented by the flexibility of white labeling.

Product Portfolio

By Type:

· Containers· Preforms

· Caps and closures

· Sprays and pumps

· Shrink film

By Material:

· HDPE

· PP

· PET

Brand Association

Board of Directors

INSIGHT

Financial Highlights-

| Metric | FY25 (₹ Cr) | FY24 (₹ Cr) | YoY Growth |

|---|---|---|---|

| Revenue | 2,569.83 | 2,117.00 | +21.4% |

| EBITDA | 397.20 | 373.33 | +6.4% |

| PAT | 265.15 | 140.79 | +88.3 |

- Innovation Center: Established “MTL AVINYA” in Bidadi, Karnataka, to drive innovation in packaging solutions.

- Sustainability Initiatives:

- Materiality Assessment: Conducted biennially per GRI 2021 standards, adopting a double materiality approach to align ESG with business strategy.

- Renewable Energy: 46% of operational energy from renewables in FY 2024, with a 410% increase in in-house solar power and 141.2% in purchased solar power from FY 2020-2024.

- Carbon Footprint: Reduced Scope 1 CO2e emissions by 20.09%, Scope 2 by 79.7%, and combined emission intensity by 45.14% from FY 2021-2024.

- Extended Producer Responsibility (EPR): Purchased 4,099.19 MT of recycled materials for production.

- Net-Zero Commitment: Pledged to achieve net-zero emissions per SBTi targets, with plans for a CDP report in FY 2025.

- EcoVadis Rating: Applied for an ESG rating to benchmark performance.

- Employee Development: Invested ₹9,804 per employee (53% increase from FY 2023), with 100% of eligible employees receiving performance reviews.

- Governance: Achieved 33.3% female board representation and 50% independent directors. 100% employee training on Code of Conduct and alignment with UNGC principles.

- Domestic vs. Exports:

- Domestic Turnover: ₹2,05,024.43 Lakhs (96.8% of total, up 1% from ₹2,02,974.27 Lakhs).

- Export Turnover: ₹6,675.84 Lakhs (3.2%, flat from ₹6,659.60 Lakhs).

- Industry Focus: Primarily serves FMCG and pharma, with growth driven by premiumization in categories like shampoo, beauty, and fragrances.

- Product Portfolio: Rigid plastic packaging (containers, bottles, preforms, closures), with a focus on sustainable and innovative solutions.

- Issuance Details:

- Allotted 5,26,95,960 CCDs to AI Lenarco Midco Ltd (₹526.96 Cr) on 15-07-2024.

- Allotted 2,13,734 CCDs to other shareholders (₹2.14 Cr) on 24-07-2024.

- Total allotted: 5,29,09,694 CCDs (~₹529.10 Cr); ~12.81 Lakhs CCDs unallotted.

- Rights Issue Structure:

- Ratio: 4 CCDs per 1 equity share (pre-split: 1,35,47,700 shares).

- Record Date: 14-06-2024.

- Non-renounceable, limiting participation to existing shareholders.

- CCD Terms:

- Tenure: 8 years (~July 2032).

- Coupon Rate: 9% p.a., paid semi-annually (~₹47.62 Cr annual interest).

- Conversion: Into ~17,47,533 equity shares at ₹3,101/share (~2.58% dilution post-split 6,77,38,500 shares).

- Approval: Via postal ballot (17-05-2024 to 15-06-2024), alongside share split and IPO resolutions.

- Purpose:

- Fund acquisitions (e.g., Oricon’s ₹520 Cr deal, completed 24-07-2024).

- Support expansion (new plants in Vizag, Chamarajanagar).

- Prepare for IPO (DRHP filed with SEBI, BSE, NSE).

- Previous CCDs: Issued 5,87,21,747 CCDs at ₹100 each to AI Lenarco Midco Ltd (₹587.22 Cr) in prior years.

New Projects and Initiatives-

Segmental Revenue

IPO History, Stake Sale, and Delisting of Manjushree Technopack Ltd

Manjushree Technopack Ltd made its IPO debut on January 31, 2008, offering shares at ₹45 per share and raising ₹3.3 crore. The issue closed on February 6, 2008, and the stock was listed on February 28, 2008, opening at ₹48.00 and hitting a high of ₹66.00 before closing at ₹52.70. The holding period return on the offer and listing prices stood at 894.00% and 831.88%, respectively. However, on March 24, 2015, the company voluntarily delisted from the stock exchanges under SEBI (Delisting of Equity Shares) Regulations, 2009. Later, on August 20, 2024, the company filed its Draft Red Herring Prospectus (DRHP) with SEBI and received the NOD on November 12, 2024, for a proposed ₹3,000 crore IPO. As part of the offer, a US-based private equity fund aimed to offload shares worth ₹2,250 crore. However, instead of proceeding with the public offering, the fund divested its stake to Hong Kong-based PAG at a valuation of ₹8,400 crore, marking a significant strategic shift in ownership.

Manjushree Techopack Limited(MTL) CCD details-

Manjushree Technopack Limited (MTL) issued 5,41,90,800 unsecured Compulsorily Convertible Debentures (CCDs) at ₹100 each, raising ~₹541.91 Crores to support strategic initiatives.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| AI Lenarco MIDCO Ltd | 97.24 % |

| Other | 2.76 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe