Indian Potash Unlisted Share Prices

₹1499

*Average Price as per 27 April, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

3327.6

NO OF SHARES

28597200

EPS

439.84

SALES

20946

INDUSTRY PE

11.19

DIVIDEND

7.5

DIVIDEND YIELD

0.24

PE

7.05

PB

0.93

PS

0.42

MARKET CAP

8862.27

EQUITY

28.59

PAT

1296

MESSAGE

2023-24

OVERVIEW

Indian Potash Limited (IPL), founded in 1955 as the Indian Potash Supply Agency, remains a prominent player in India’s fertilizer industry under the leadership of Chairman Shri Pankaj Kumar Bansal. The business underwent a name change to Indian Potash Limited (IPL) in 1970. Ever since, it has emerged as a significant force in the fertilizer market, bringing in fertilizers such as sulfate of potash, monoammonium phosphate, Indian Potash Ltd. super phosphate, and muriate of potash. The cooperative sector holds more than 70% of Indian Potash Limited Share., with Indian Farmers Fertiliser Cooperative being the largest shareholder. The company is also involved in the production and marketing of cattle feed, dairy products, sugar, and trading of precious metals.

COMPANY NAME | INDIAN POTASH LIMITED |

NATURE OF BUSINESS | POTASH DISTRIBUTION ALL OVER INDIA |

ISIN NO. | INE363S01015 |

FACE VALUE | RS.10/- |

YEAR OF ESTABLISHMENT | 1955 |

COMPANY WEBSITE | WWW.INDIANPOTASH.ORG |

REGISTERED ADDRESS | FLOOR 1,SEETHAKATI BUSINESS CENTRE, 684-690,ANNA SALAI,CHENNAI-600 006 |

Their Product line includes:

| Fertilizer |

| Feeds |

| Dairy |

| Sugar |

| Precious Metal |

Plants

Indian Potash Ltd has expanded its operations to include the production and distribution of cattle feed from plants in Uttar Pradesh and Andhra Pradesh. Additionally, it has ventured into the dairy industry with plants in Haryana and Uttar Pradesh. Furthermore, Indian Potash Ltd has acquired sugar units in Uttar Pradesh and is working on joint ventures for a Green Field Port Facility in Gujarat and an Integrated Sugar Complex with Co-generation and Distillery in Bihar.

Name | Place | Incorporation Year | Paid up capital | % of shares held | Subsidiary/Associate |

Indian Potash Ltd. SUGARS AND BIOFUELS LIMITED | Delhi, India | 2011 | 1.00 cr | 100% | Subsidiary |

JORDAN PHOSPHATE MINES COMPANY | Amman, Jordan | 1949 | 1.50 cr | 27.38% | Associate |

INSIGHT

Key Strengths of Indian Potash Ltd

- Dominant position in the fertilizer industry, particularly Muriate of Potash (MOP) sales, with 65% market share in FY22.

- Enduring supplier relationships providing access to favorable prices and loan conditions.

- Robust distribution network covering over six lakh villages, facilitating quick inventory turnover.

- Improved financial performance in FY22 and 9MFY23, driven by increased revenue and government subsidy rates.

- Diversification into non-core assets like sugar, dairy, and cattle feed to expand business opportunities.

Key Weaknesses of Indian Potash Ltd

- Vulnerability to foreign exchange and commodity price fluctuations impacting profitability, despite adept risk management strategies.

- Challenges in executing capital-intensive processes due to significant working capital requirements, although recent improvements in subsidy disbursement have eased working capital intensity.

- Exposure to agroclimatic hazards and heavy regulation in the fertilizer industry, where government pricing and subsidy policies significantly affect profitability and liquidity, despite potential benefits from Direct Benefit Transfer (DBT) implementation.

Financials

₹(in crores)

Particulars | FY 2022-2023 | FY 2021-2022 | 2020-2021 | Growth Percentage |

Total Income | 34010.75 | 18715.48 | 16581.09 | 106% |

Profit Before Tax | 1022.97 | 821.85 | 759.94 | 35% |

Profit After Tax | 751.50 | 615.06 | 570.07 | 32% |

Earning Per Share | 262.79 | 215.08 | 199.35 | 32% |

Overall Gearing(times) | - | 2.17 | 1.01 | - |

Interest Coverage (times) | - | 6.97 | 5.69 | - |

Over the past three fiscal years, the company has experienced robust growth across key financial metrics. Total income has seen a remarkable Compound Annual Growth Rate (CAGR) of approximately 46%, reflecting a significant increase in revenue generation. Similarly, the profit before tax has demonstrated steady growth, with a CAGR of approximately 18%, indicating improving profitability over the observed period. Profit after tax has also shown notable expansion, with a CAGR of approximately 17%, highlighting the company's ability to maintain and enhance its bottom line.

Indian Potash Limited Unlisted Share Price Journey

The unlisted share price reached a 52-week low on February 6, 2024, at Rs. 1385 and a 52-week high is the current market price which stands at Rs. 3555 as of February 27, 2024.

Indian Potash Ltd.: IPO Plans

Indian Potash Limited (IPL) has not yet made any official announcements or public declarations regarding the start of an Initial Public Offering (IPO). In spite of Indian Potash Ltd.’s prominence in the Indian fertiliser distribution industry, no evidence is currently accessible indicating that the firm is actively contemplating or intends to carry out an IPO in the near future. A number of variables, including the company’s financial situation, market conditions, and internal strategy concerns, may have contributed to the decision to forego an IPO.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Indian Farmers Fertilisers Cooperative Limited | 33.99 % |

| Gujarat State Co-operative Marketing Federation Limited | 10.45 % |

| Gujarat State Fertilisers and Chemicals Limited | 7.87 % |

| Andhra Pradesh State Cooperative Marketing Federation Limited | 6.23 % |

| Madras Fertilisers Limited | 5.54 % |

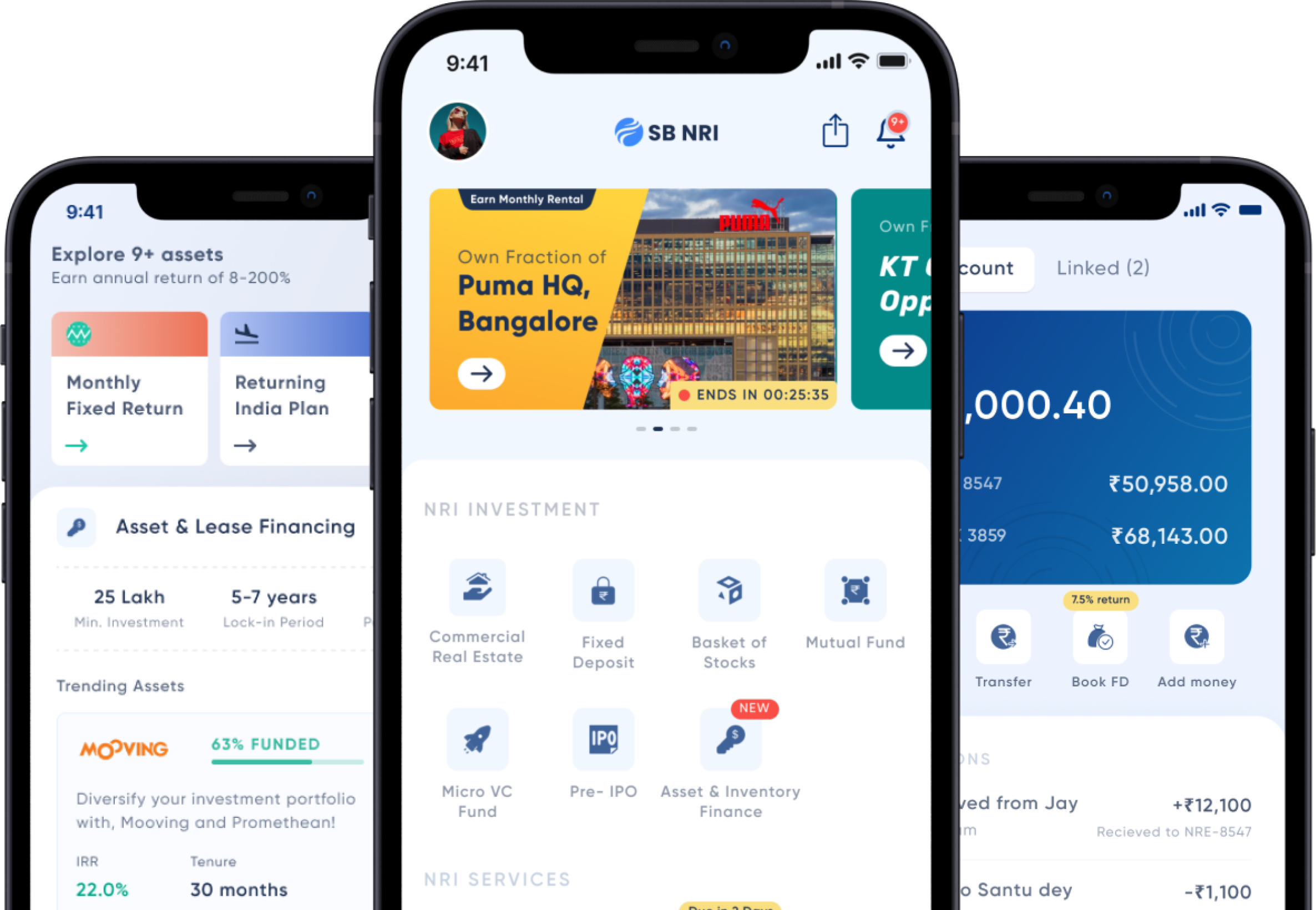

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe