Hero Fincorp Unlisted Shares

₹815

*Average Price as per 26 February, 2026

Fundamentals

FACE VALUE

10

BOOK VALUE

452.13

NO OF SHARES

127412759

EPS

8.62

SALES

9832.73

INDUSTRY PE

55

DIVIDEND

1.1

DIVIDEND YIELD

0.1

PE

128.89

PB

2.46

PS

1.44

MARKET CAP

14155.56

EQUITY

127.41

PAT

82.96

MESSAGE

2024-25

OVERVIEW

Hero Fincorp Ltd. is the financial services arm of Hero MotoCorp Ltd., offering solutions like two-wheeler financing, SME lending, and personal loans. Established in 1992 as Hero Honda FinLease Limited, it was renamed after Hero MotoCorp acquired full ownership post Honda's exit from their joint venture.

The company has a vast presence with nearly 2000 retail outlets, 2000 corporate clients, and 1000 dealerships across 1900 cities, towns, and villages. It holds a “AA+ (Stable)” rating from CRISIL, ICRA, and CARE.

Timeline

- 1991-2012: Incorporated as Hero Honda Finlease Ltd. | Renamed as Hero Fincorp Ltd.

- 2013-19: Received equity infusion of INR 106 Cr. | Launched Two-Wheeler Financing business, Used Car Business | 3000 touchpoints in 1700+ locations

- 2020: Achieved the status of India's No.1 Two-Wheeler Financier. | Among the Top 3 NBFCs in Pre-Owned Car Loans. | Secured a fund-raising agreement of INR 1,075 Cr. from PE Investors & Promoters.

- 2021: Launched a Customer Service App. | Introduced 'SimplyCash', a digital Loan Product.

- 2022: Launched Partnership Loans and achieved Disbursal of INR 1,900 Cr.+ in the first year.

- 2023: Achieved the highest-ever Disbursals in FY23 | Launched EV Financing | Crossed 10 Mn. Customers | Recognized as 'Great Place to Work' for the 6th year in a row.

- 2024: Achieved ₹53,642 Cr AUM & ₹34,463 Cr disbursals; new brand identity; 11 Mn lives touched.

Product Portfolio

The Company provides a wide portfolio of financial products including:

Retail Loans | Corporate Loans |

Two-Wheeler Loans | SME and Commercial Loans |

Used-Car Loans | Supply Chain Financing |

Personal Loans | Working-Capital Loans |

Subsidiary: Hero Housing Finance Ltd.

- Hero Housing Finance Limited (HHFL) is a wholly owned subsidiary of HFCL subsidiary of Hero Fincorp Ltd.

- HHFL commenced its lending operations from April, 2018.

- Products: Housing loans, loan against property and construction loans.

INSIGHT

Financial Highlights

₹ in crores

| PARTICULARS | FY 25 | FY 24 | FY 23 |

| REVENUE | 9833 | 8291 | 6402 |

| EBITDA | 4109 | 4055 | 2901 |

| PAT | 83 | 637 | 480 |

| EPS | 8.6 | 50 | 38 |

Segment Wise - Performance

Retail Business:

- Two-wheeler loans: Disbursements - 1 Million in FY24 | Total active customer base - over 2.5 Million.

- Loan asset book: Rs. 46,488 Cr. | 900 dealerships as of FY24.

- 4,200+ touch points across 2,000 cities, towns & villages.

- Disbursing speed: 1 loan every 10 seconds.

SME & Corporate Business:

- 74 Locations.

- Processing Capacity: 3,000 applications per month.

- In FY24, Rs. 10,779 Crs. worth of loans were disbursed.

Product Segmentation

| Personal loans | 30.70% |

| 2-wheeler finance | 16.90% |

| Secured small and medium-sized enterprise (MSME) loans | 12.90% |

| Unsecured MSME loans | 11.20% |

| Corporate loans | 9.70% |

| Pre-owned car finance | 7.30% |

| Home loans | 6.70% |

| Loan against property (LAP) and others | 4.70% |

Funding Information

Hero FinCorp, ahead of its proposed ₹3,668 crore IPO, raised ₹310 crore through a pre-IPO private placement. The round involved the issue of ~22.14 lakh equity shares at ₹1,400 per share, valuing the NBFC at ₹18,482 crore (post-money).

| Date | Company | Investment Amount |

|---|---|---|

| May 2025 | Shahi Exports, Vattikuti Ventures | ₹310 crore ($36 million) |

| Feb 2022 | Apollo Global Management | ₹937 crore ($125 million) |

| Feb 2022 | Hero MotoCorp | ₹700 crore ($94 million) |

Investors Holding

- Hero MotoCorp Ltd. owns around 40% stake in Hero Fincorp.

- Pawan Munjal, chairman of Hero Fincorp, and his extended family hold nearly 10% in the NBFC in individual capacity. The family's investment firm Bahadur Chand Investments holds over 20%.

- Apollo Global Management is estimated to have secured a 9-10% stake in the funding round held in Feb 2022.

- Mauritius-based Otter Limited has a significant stake of 10% in Hero Fincorp.

- ChrysCapital, Credit Suisse and Apis Partners are the other investors in the NBFC.

Future Outlook/Strategies

- Embracing Digital Initiatives: Prioritizing digital initiatives to enhance customer service and promote digital EMI payments.

- Implement Data Analytics: Utilizing data analytics to streamline loan disbursement processes and enhance loan recovery strategies to improve operational efficiency.

- Strengthen Loan Portfolio: Implementing robust risk management practices and ensuring prudent lending practices to mitigate credit risks.

Peer Comparison

Data as of 31st March 2025

Particulars | Hero Fincorp | Bajaj FinServ | Shriram Finance |

REVENUE | 9833Crs. | 133821Crs. | 41834Crs. |

PAT | 83Crs. | 17558 Crs. | 9576Crs. |

Net Profit Margins | 1.1% | 13% | 22.8% |

CMP (05/06/25) | ₹ 1700 | ₹ 1932 | ₹ 651 |

Market Cap | 21,660Crs. | 3,09,120Crs. | 1,22,388Crs. |

P/E Ratio | 260 | 34.8 | 14.8 |

P/B Ratio | 3.8 | 4.5 | 2 |

- Hero FinCorp appears overvalued at its current trading price of ₹1,700 as on (5 june 2025), with a Price-to-Book (P/B) ratio of 3.8, slightly above the industry average of 3.7, implying a book value per share of approximately ₹447.37.

- The calculated target price of ₹1,450–₹1,500, corresponding to a P/B of 3.2–3.4, is reasonable given the company’s weak profitability, with a Profit After Tax (PAT) margin of 1.1% and Return on Assets (ROA) of 0.18%, both significantly below.

- Recent reports of rising non-performing assets (NPAs) and an 80% increase in loan write-offs further justify applying a discounted P/B multiple, supporting the conclusion that the stock is overvalued at ₹1,700 and aligning with the target price range.

Industry Overview

Relevance of NBFCs in the Indian landscape:

- NBFCs have emerged as a significant force in promoting financial inclusion in India by successfully catering to the underserved segments of society.

- The growing market share of NBFCs can be attributed to the lighter and more flexible regulations imposed by the RBI, as well as their focus on specific sectors and niche markets.

Vehicle Finance Industry Trends – India

The two-wheeler loan market across India is estimated to be valued at over 12 Billion U.S.D by 2025. Vehicle loans have surged by 137% in the past 3 years, becoming the second-largest loan segment after home loans. Vehicle Finance Industry In India: CAGR of 11% | 2022-2027.

The rapid growth is driven by:

- Low interest rates

- Increasing ownership of two-wheelers due to their Cost-effectiveness

- Increasing number of Production Plants being set up by Automakers

- Increasing disposable income | Evolving consumer preferences

Key Trends:

- Rising demand for electric vehicles: Due to Government initiatives boosting EV adoption

- Expansion of car loans to Tier 2 and Tier 3 cities

- Digitalization

(Source: BCG Report – Dec 23, ET-BFSI, ICRA, Statista, Mint)

IPO Plans

- Hero FinCorp, the financial services arm of Hero MotoCorp, filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on August 1, 2024, proposing an initial public offering (IPO) totaling ₹3,668 crore.

- The IPO comprises a fresh issue of equity shares worth ₹2,100 crore and an Offer For Sale (OFS) of ₹1,568 crore by existing investors. The proceeds from the fresh issue are intended to bolster the company's lending activities. While the exact IPO date has not been officially announced, such offerings typically occur within a few months following the DRHP filing.

- In short, the pre-IPO funding is a big deal for Hero FinCorp but the road to IPO is bumpy. For now, the company has bought time—and capital—to stabilise before facing public market scrutiny.

Recent Developments

- Hero Fincorp witnessed a rise in AUM to Rs. 53,642 crore | 26% increase in Disbursals to Rs. 24,979 Crs. in the FY24.

- Ahead of its IPO, the company wrote off bad loans amounting to nearly Rs 1,200 crore, representing approximately 3.4% of its loan book.

- Hero Fincorp is targeting a PAT of Rs 1,000 Crs. in FY25, as per J-MD and CEO Abhimanyu Munjal.

- They have set-up an in-house tech and analytics centre in Bengaluru.

- With the IPO timeline uncertain, Hero FinCorp has also gone to the offshore debt markets to strengthen its balance sheet. The NBFC is raising a USD 200 million (~INR 1,694 crore) syndicated loan with DBS Bank as the lead. A roadshow was held in Taipei recently to drum up interest. This is similar to what other Indian NBFCs like Piramal Finance did, which raised USD 150 million at 7.078% in 2024.

SWOT Analysis

Future Outlook/Strategies

- Embracing Digital Initiatives: Prioritizing digital initiatives to enhance customer service and promote digital EMI payments.

- Implement Data Analytics: Utilizing data analytics to streamline loan disbursement processes and enhance loan recovery strategies to improve operational efficiency.

- Strengthen Loan Portfolio: Implementing robust risk management practices and ensuring prudent lending practices to mitigate credit risks.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Hero Motorcorp Ltd | 41.18 % |

| Bahadur Chand Investments Ltd | 20.33 % |

| Otter Ltd | 10.12 % |

| Other | 28.37 % |

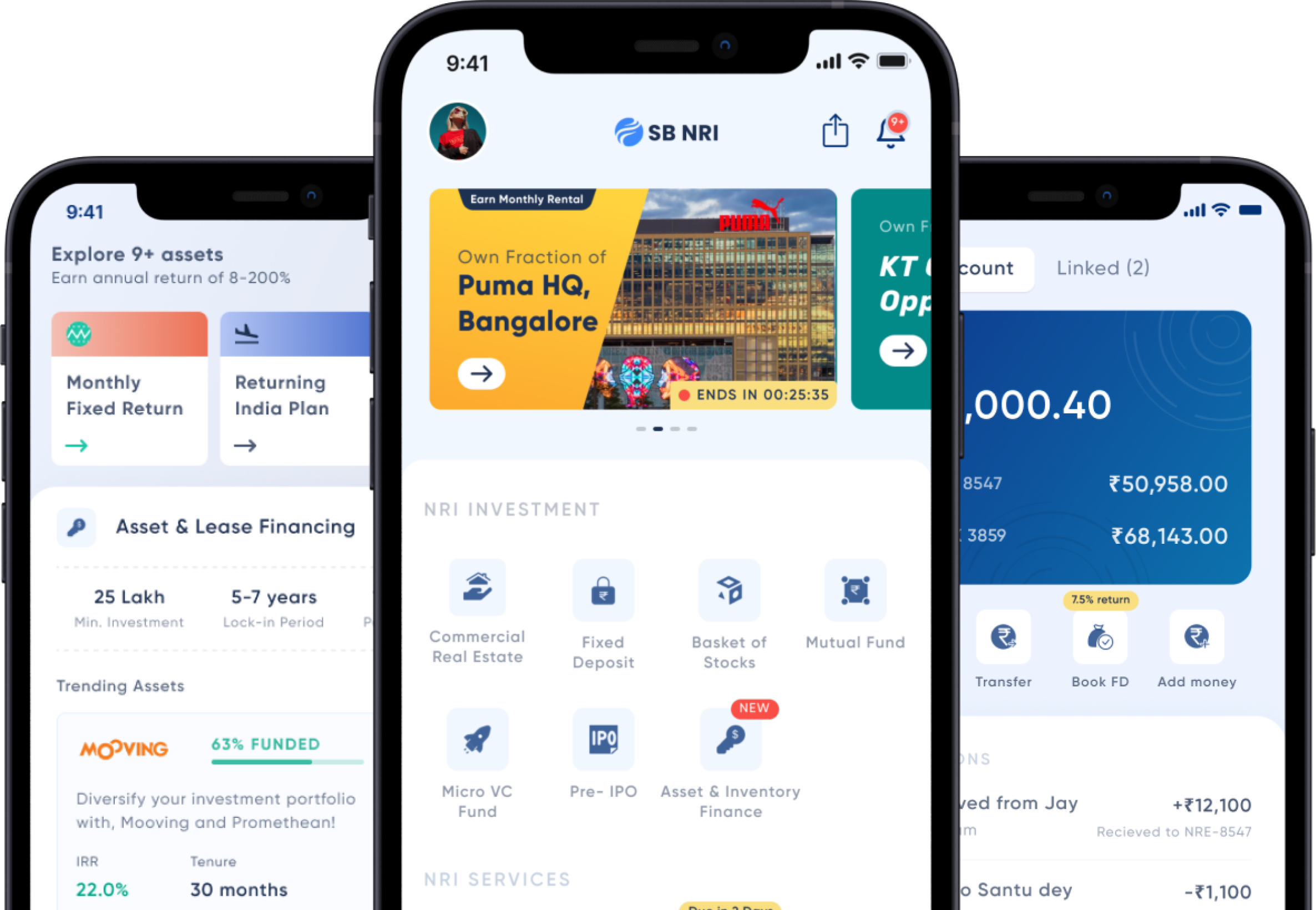

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe