HDFC Securities Unlisted Share

₹11500

*Average Price as per 8 May, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

1282.55

NO OF SHARES

15828975

EPS

600.5

SALES

2660.12

INDUSTRY PE

55

DIVIDEND

510

DIVIDEND YIELD

5.28

PE

16.1

PB

7.54

PS

5.75

MARKET CAP

15300.29

EQUITY

15.97

PAT

950.89

MESSAGE

2023-24

OVERVIEW

Company Overview

HDFC Securities operates in India's stock broking domain as a subsidiary of HDFC Bank, leveraging technology to serve retail and institutional investors. It provides access to various asset classes, including equities and debt instruments, offering seamless trading through online portals, mobile apps, telephone services, and physical branches. The company introduces solutions like online IPO and NCD ordering, backed by a responsive Customer Care team, to enhance the investment process. It delivers real-time, research-backed insights to help investors make informed financial decisions and manage their portfolios efficiently.

Extensive Network

With over 250 branches, the company prioritizes transparency and aims to revolutionize the investment experience in an evolving industry.

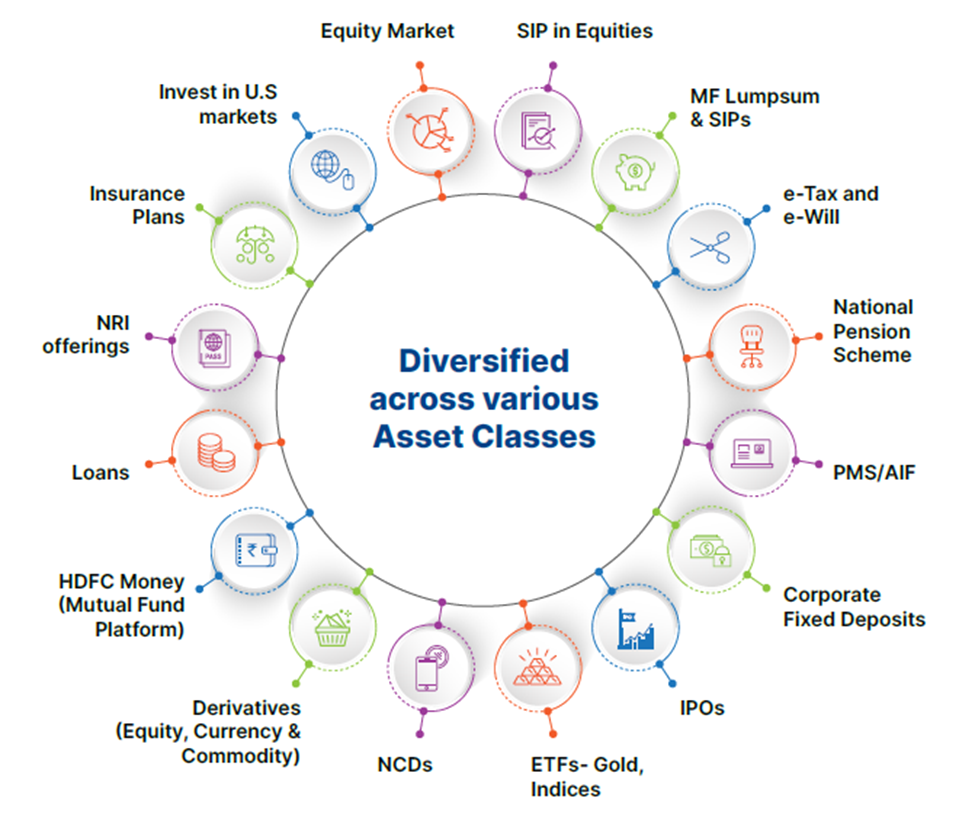

Product Offerings of HDFC Securities

HDFC Securities offers 3-in-1 online investment accounts, a combination of an account with HDFC bank and demat and trading services of HDFC Securities. The company offers a host of services to its clients, which include:

HDFC Securities new platform - HDFC SKY

A discount broking platform that allows trading and investing at a single price point of Rs 20 similar to other online platforms such as Groww, 5Paisa, and Zerodha. HDFC Sky's USP is its margin trading facility which is available at a 12% interest rate whereas its competitors charge between 18 to 21%. Its target market is Gen-Z, millennials, and new-age investors. HDFC Sky is accessible to everyone, in contrast to HDFC Securities, which restricts demat account opening, trading, and investment to HDFC Bank customers only.

Management of the Company

INSIGHT

Financial Highlights

₹ in crores

| Particulars | 2023-24 | 2022-23 | 2021-22 | 2020-21 | 2019-20 | 2018-19 |

|---|---|---|---|---|---|---|

| Net Revenue | 2660 | 1892 | 1990 | 1399 | 862 | 770 |

| Earnings per Share | 595 | 490 | 623 | 447 | 246 | 212 |

| Dividend per Share | 144 | 440 | 547 | 318 | 135 | 110 |

| Profit after Tax | 951 | 777 | 984 | 703 | 384 | 348 |

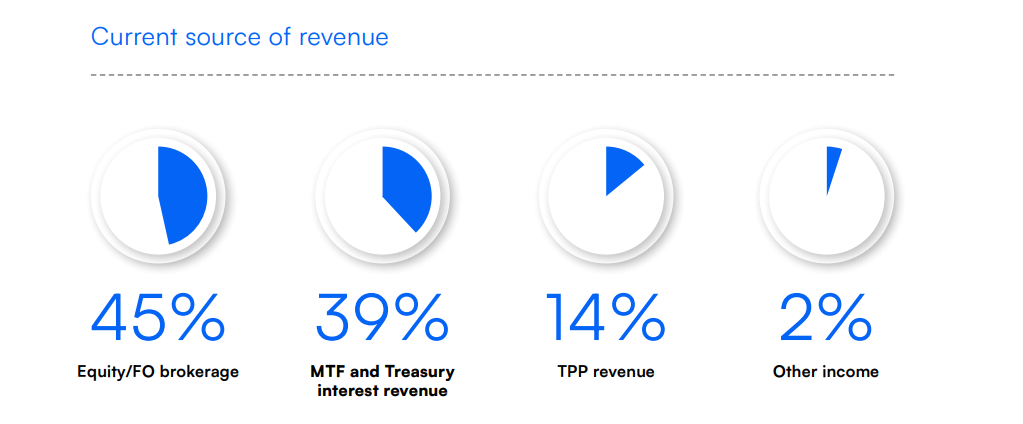

Segment Wise Revenue

₹ in crores

Takeaway: The company derives revenue primarily from the share broking business. Its other major revenue sources are interest income and services income.

FY 2024 Highlights

Active Clients: 1.21 million

Customer Base Growth: Total customer base reached 53,82,198, nearly 20% higher than FY23 (12,14,713 traded clients)

Top Broking Houses Rank:HDFC Securities is ranked in the top 10 of all broking houses in India

Digital Brokerage Contribution: 84% of brokerage from digital sources (previous year: 85%)

Average MTF Book Size (FY24): ₹4,855 Cr, a 50% increase from FY23

Total IPOs in FY24: 77 IPOs

Total IPO Applications: 319.48 lacs

IPO Volume: ₹1,19,790.84 Cr

Dividend per Share Growth: 15.90% increase (FY23: ₹440, FY24: ₹510)

CSR Spend: ₹22.06 Cr

Average Daily Turnover Growth: 113.42% increase

Active Transacting Clients (FY23-24): More than 1.09 million

Year-End Book Size: ₹6,033 Cr

Active Client Base

Peer Comparison

₹ in crores- Figures as of March 2024

HDFC Securities IPO Plans

HDFC Bank plans to consider the public listing of its brokerage and non-banking finance subsidiaries, HDFC Securities and HDB Financial Services, only after completing its merger with HDFC Ltd.

At the bank’s 28th AGM, CEO and Managing Director Sashidhar Jagdishan stated that the decision will be made only after the merger is finalized, regulatory directions are received, and the bank has fully absorbed the changes brought by the merger.

Jagdishan emphasized that the IPO plans will be evaluated at a later stage, once the bank has clarity on post-merger integration and regulatory requirements.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| HDFC bank | 96.34 % |

| HDB Employees Welfare Trust | 0.26 % |

| Chatapuram Venkatraman Ganesh | 0.15 % |

| Sanju Verma | 0.12 % |

| Kamala SundaraKamala Sundara | 0.08 % |

| Siddhartha M Khiraiya | 0.08 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe