Frick India Unlisted Share

₹3433

*Average Price as per 1 May, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

456.2

NO OF SHARES

5999750

EPS

70.54

SALES

481.29

INDUSTRY PE

0

DIVIDEND

0.4

DIVIDEND YIELD

0.01

PE

45.35

PB

7.01

PS

3.99

MARKET CAP

1919.32

EQUITY

6

PAT

42.32

MESSAGE

2023-24 (AFTER CONSIDERING BONUS ISSUE IMPACT)

OVERVIEW

Frick India Ltd. is the largest equipment manufacturer and turnkey solution provider of industrial refrigeration and air conditioning systems in India. They provide comprehensive turnkey solutions, handling all aspects from design and manufacturing to packaging, installation, and servicing.

Frick India Ltd. was established in 1962 through a collaboration with Frick Company USA, one of the world's oldest and largest manufacturers of industrial refrigeration & air-conditioning equipment. Frick India is now independent and has diversified its operations.

Key Highlights

- Frick India boasts over 50 years of experience in delivering energy-efficient and reliable refrigeration and air-conditioning solutions in India and 50+ countries.

- The manufacturing facilities are located in Faridabad, Haryana, and are spread over a 22-acre multi-block complex.

- The Company collaborates with technology partners from the UK, Japan, the USA, and Europe to deliver cutting-edge solutions.

- It provides energy management systems for industrial refrigeration applications through Frick Energy Management System (FEMS).

- Frick India is listed on the Metropolitan Stock Exchange of India Ltd (MSEI).

- CRISIL Ratings has reaffirmed its ratings on the bank facilities of Frick India Limited - CRISIL A-/Stable (Long term borrowings) and CRISIL A1 (Short term).

Product Portfolio

The product portfolio of Frick India Limited comprises:

- Compressors

- Condensers

- Frigid Coils

- Liquid Recirculation Ammonia Pumps

- Heat Exchanger & Pressure Vessels

- Packaged Chillers

- Packaged A/C

- Plate and Blast Freezers

- Air handling and circulation units

- Ice Making Equipment

- PUF Panels: Insulated panels for temperature control.

Notable Clients

Frick India caters to a broad spectrum of industries through its products and manufacturing capabilities, including:

- Dairy and Ice Cream Industry

- Food and Agriculture Industry

- Beverages and Brewery Industry

- Chemical & Pharmaceutical Industry

- Meat, Poultry & Seafood Industry

- Air-Conditioning and Coolers Industry

- Low-Temperature Applications

INSIGHT

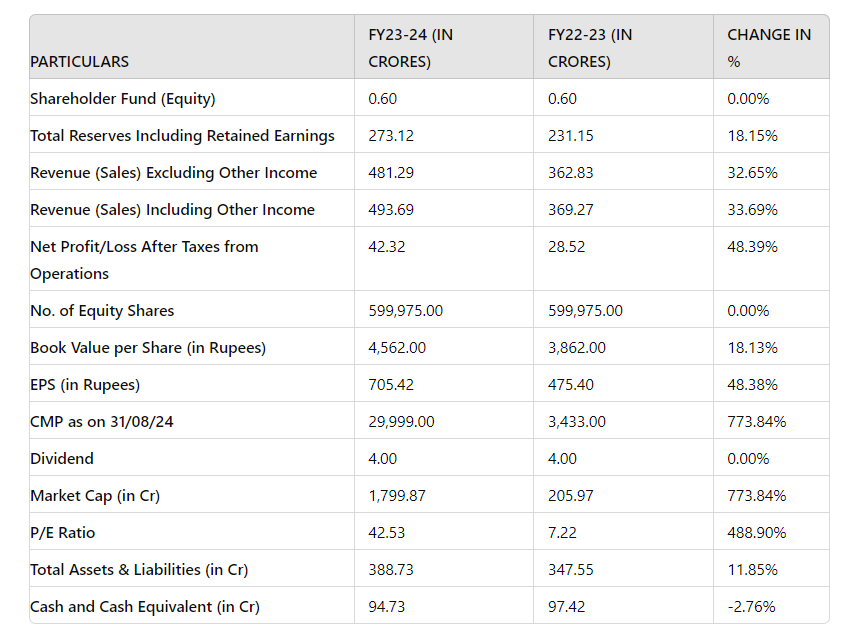

Financial Snapshot

- Revenue: The company achieved a strong revenue growth of 33.69%, increasing from ₹369.27 in FY22-23 to ₹493.69 in FY23-24.

- EPS: The earnings per share surged by 48.38%, rising from ₹475.40 to ₹705.42.

- Net Profit: The net profit saw a robust growth of 48.39%, jumping from ₹28.52 Cr to ₹42.32 Cr.

- Market Cap: The market capitalization skyrocketed by 73.84%, moving from ₹205.97 Cr to ₹1,799,87 Cr.

Industry Overview

- India's refrigerator compressor market was valued at US$ 1,700 million in 2022 and is projected to reach US$ 3,341 million by 2031 at a CAGR of 7.8% during 2023–2031.

- The Heating, Ventilation, and Air Conditioning (HVAC) market in India, along with intelligent building solutions, is estimated to reach Rs 1,78,000 crore (or $21.5 billion) by 2028.

- The Indian cold chain market was valued at nearly INR 1,678 billion in 2022 and is projected to grow at a CAGR of 14.3% from 2023-2028, reaching INR 3,740 billion by 2028.

The main customer base of Frick India is the dairy and food processing industry:

- India ranks 1st globally in milk production, with a total output of 230 MT in 2022-23, growing at an annual rate of 3.8%. The India Dairy Market size is estimated at 26 billion USD in 2024 and is expected to reach 35 billion USD by 2029, with a CAGR of 6.61%.

- India's food processing sector output is expected to reach $535 billion by 2025-26. The Union Cabinet has approved the Production-Linked Incentive (PLI) Scheme for enhancing India’s Manufacturing Capabilities under “Atmanirbhar Bharat”, projected to expand food processing capacity by nearly INR 30,000 Crs.

Strengths

- Strong Market Position: With over five decades in the industrial refrigeration industry and advanced equipment offerings, the company maintains an established market presence, serving customers in the dairy, food, and agriculture sectors.

- Healthy Financial Profile: The company exhibits a robust financial profile, highlighted by a large net worth of 231 Crs and comfortable debt protection metrics, such as the debt-equity ratio being 0.07.

Weaknesses

- Competition and Input Price Volatility: Facing competition from large players and unorganized entities, the company contends with volatile raw material prices, particularly steel, affecting operating margins.

- Large Working Capital Requirement: Significant gross current assets of 290 days, pose a challenge, exacerbated by delays in receivables realization and a large working capital requirement.

Investing Rationale

India's position as the top milk producer and THE second-largest producer of fruits and vegetables highlights the importance of a strong cold chain infrastructure. The growth of packaged food retail accentuates the need for the same. Moreover, the healthcare sector relies on precise temperature storage, for vaccines and biopharmaceuticals. Cold storage facilities also play a crucial role in the horticulture sector by minimizing post-harvest losses and enabling export expansion. Thus, Frick India plays a vital role in addressing India's essential requirement for efficient cold chain infrastructure, particularly crucial for its healthcare, and agricultural sectors.

Frick India Unlisted Share Price Journey

Frick India Limited's shares were listed on April 18, 2021, at an initial price of INR 4000 per share. The share price dropped to its lowest point on May 24, 2023, reaching INR 3540 per share. The notable surge in share price from 3433 to 16000 (approx. 350%) between March 31st 2023, and March 23rd 2024, was driven by robust revenue growth and excellent financial performance.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Jasmohan Singh | 36.37 % |

| Other | 63.63 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe