Fincare Unlisted Shares

₹185

*Average Price as per 9 May, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

58.84

NO OF SHARES

220779720

EPS

4.69

SALES

1744.12

INDUSTRY PE

18.87

DIVIDEND

0

DIVIDEND YIELD

0

PE

41.15

PB

3.28

PS

2.44

MARKET CAP

4261.05

EQUITY

220.78

PAT

103.64

MESSAGE

2022-23

OVERVIEW

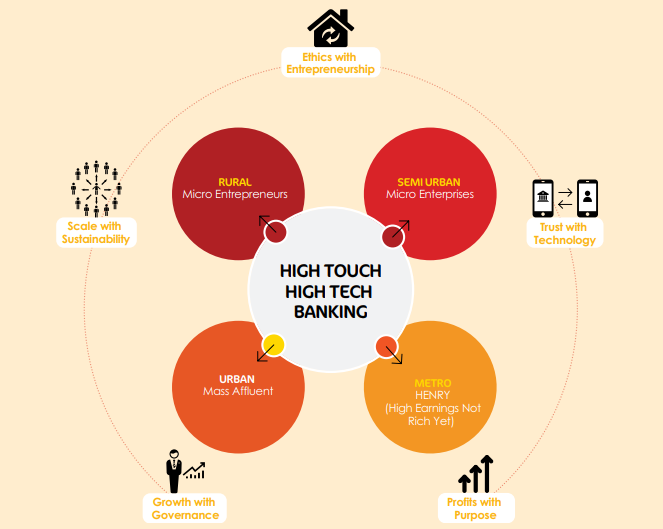

AU Small Finance Bank has acquired Fincare, a rapidly growing financial services company, effective from April 1, 2024. Established in 2017, Fincare has swiftly evolved into a significant player in the banking sector. Beginning as a small finance bank and later expanding into a full-fledged commercial bank, Fincare prioritizes financial inclusion, aiming to make banking services accessible to everyone. Guided by principles such as customer delight, ethical values, and technology-driven processes, Fincare focuses on delivering excellent service and building trust with customers across rural and urban areas.

History

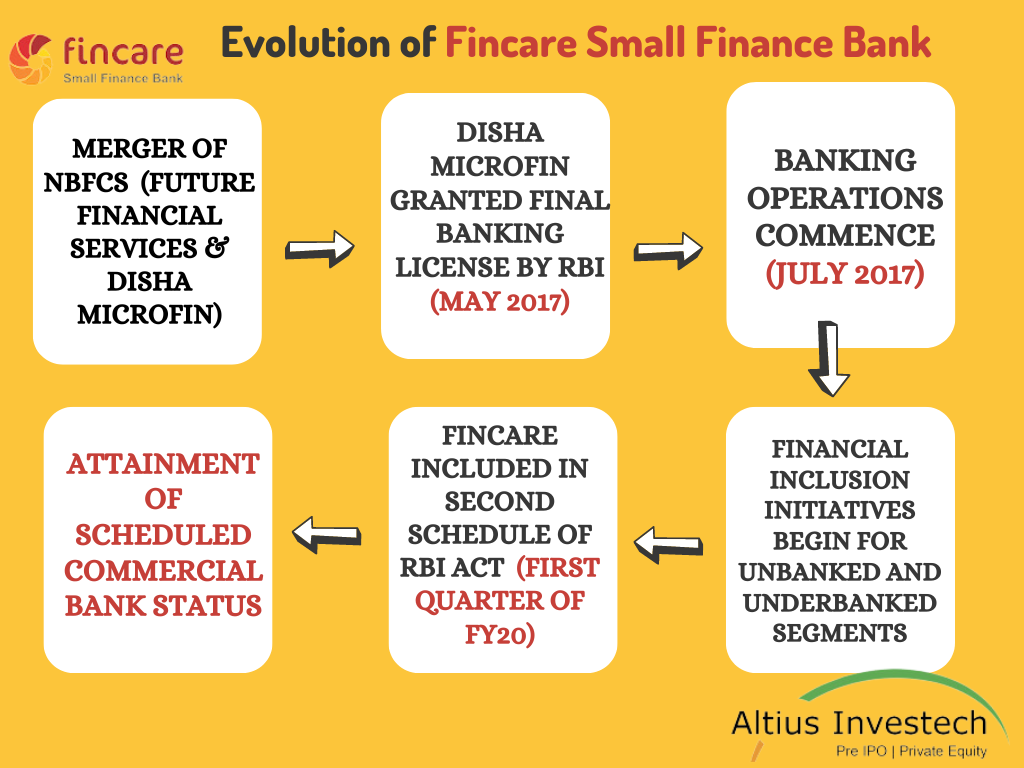

The genesis of Fincare Small Finance Bank was the merging of two NBFC Micro Finance Institutions, Future Financial Services and Disha Microfin. In May 2017, Disha Microfin was granted the final license by the RBI under section 22 of the Banking Regulation Act, 1949, to initiate banking operations. Banking operations commenced on 21st July 2017, with a vision to facilitate the financial inclusion of unbanked and underbanked customer segments, including microentrepreneurs and microenterprises, along with broader masses, with active involvement from the affluent. In the first quarter of FY20, Fincare Small Finance Bank was included in the Second Schedule of the Reserve Bank of India Act, 1934. Consequently, the bank attained the status of a Scheduled Commercial Bank, signifying the highest level of trust and governance.

Empowering Principles

Fincare Small Finance Bank’s Values. The name FINCARE represents a set of guiding principles that shape the bank’s ethos and operations: Fair, Innovative, Nimble, Collaborative, Accountable, Resolute, and Excellent.

Fincare SFB: Business Model

Product & Services

Deposit Products | Loan Products |

Savings Account | Micro Loan |

Fincare 101 Account | Loan Against Property |

Current Account | Loan Against Gold |

Recurring Deposit | Affordable Housing Loan |

Retail Term Deposit | Institutional Finance |

Fincare and AU Merger Details

MERGER DETAILS | INFORMATION |

Share Swap Transaction | Shareholders of Fincare SFB: 579 shares in AU SFB for every 2,000 shares held in Fincare SFB |

Post-Merger Shareholding | Existing shareholders of Fincare SFB to hold ~9.9% stake in AU SFB |

Regulatory Approvals | Approval received from RBI on March 4, 2024; CCI sanctioned the merger scheme on January 23, 2024 |

Capital Infusion | Promoters of Fincare SFB committed ₹700 Cr in capital infusion |

Regulatory Approval:

The merger received regulatory approval from the RBI on March 4, 2024, following endorsement from the boards and shareholders of both banks. Furthermore, the Competition Commission of India (CCI) sanctioned the merger scheme on January 23, 2024, underlining its compliance with regulatory requirements.

Impact and Statistics:

- · Expanded Customer Base: The merged entity is poised to serve a diverse customer base exceeding 1 Crore individuals. This substantial increase in clientele signifies the enhanced reach and accessibility of banking services across various segments of the population.

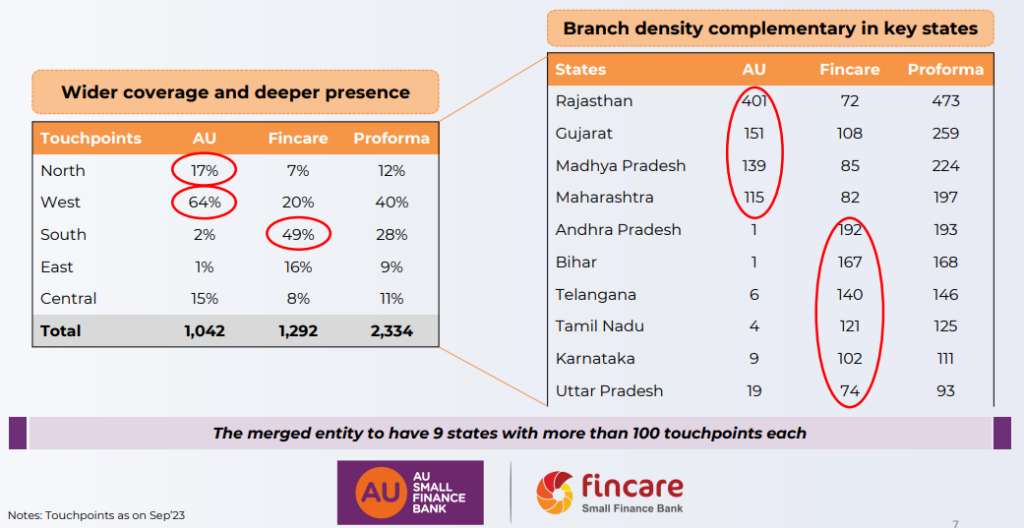

- · Widespread Presence: With a network spanning over 2,350 physical touchpoints across 25 states and union territories, the merged bank is primed to offer unparalleled convenience and accessibility to its customers nationwide.

- · Financial Strength: As of December 31, 2023, the combined bank will boast a deposit base of ₹ 89,854 Crore and a Balance Sheet Size of ₹1,16,695 Crore, reaffirming its position as a significant player in the Indian banking landscape.

Key Strategic Rationale:

Complementary Branch Footprint:

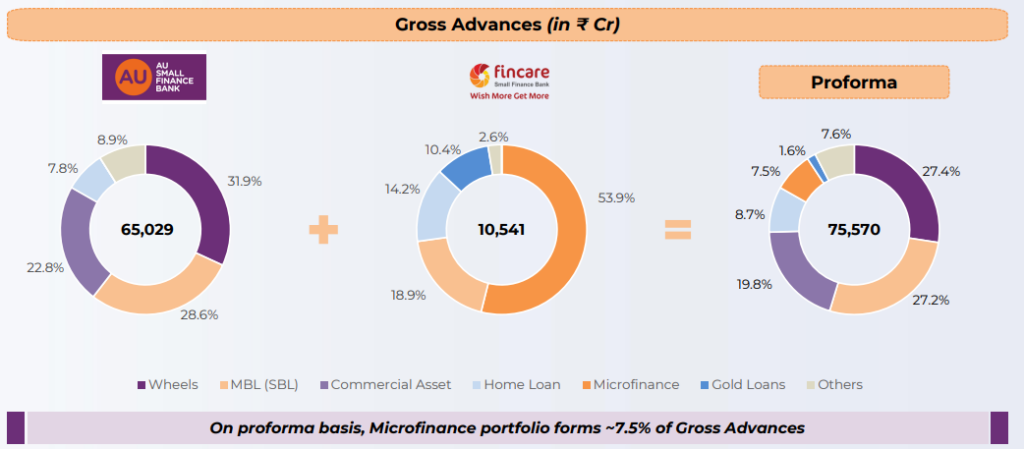

Diversification of Portfolio:

Board of Directors

INSIGHT

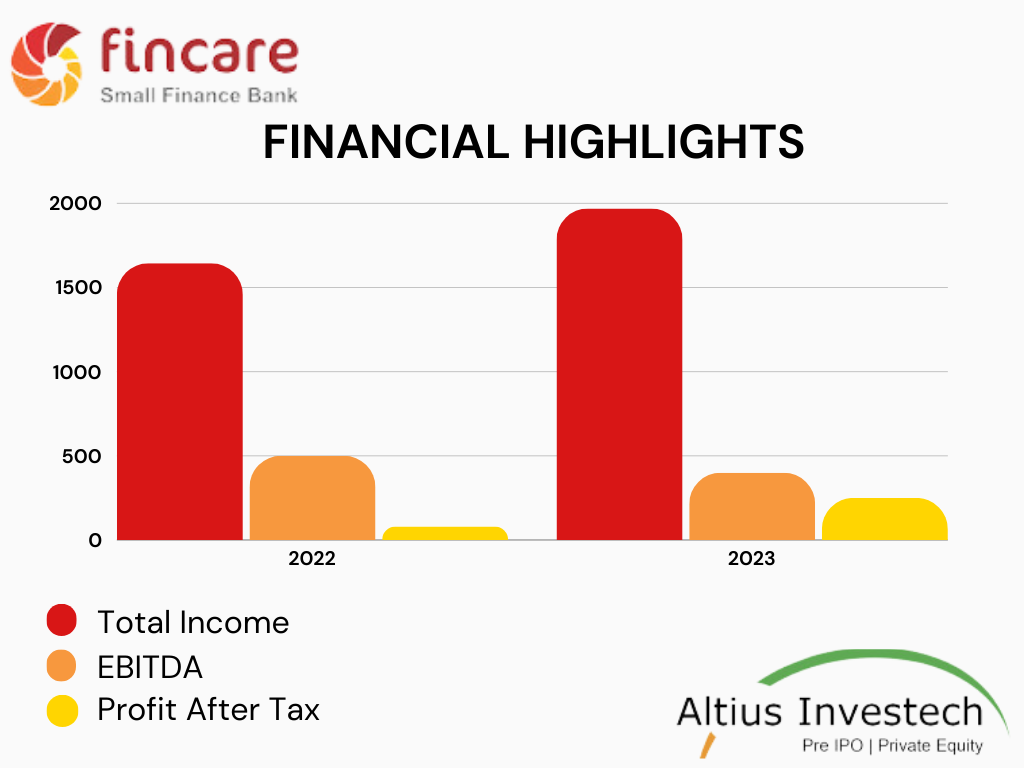

Financial Highlights

| Particulars | FY 2023 | FY 2022 | Y-o-y growth |

| Total Income | 1970 | 1644 | 19.95% |

| EBITDA | 216.39 | 229.29 | -5.62% |

| Profit After Tax | 103 | 8.8 | 1070.45% |

| EPS | 4.69 | 0.38 | – |

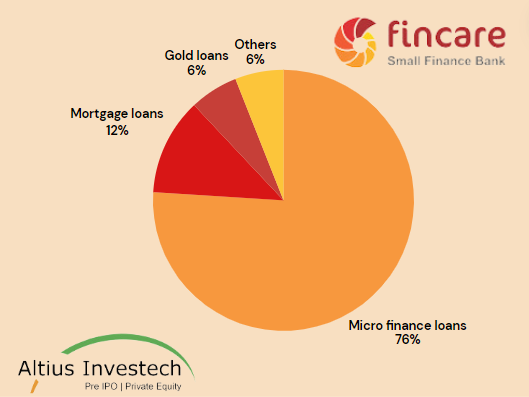

Product Mix

- 93.47% of the bank’s customers originate from rural or low-income areas.

- The Gross Loan Portfolio (GLP) expanded from ₹6,072 crores in FY21 to ₹9,911 crores in FY23, marking a CAGR of 27.76%.

- The number of borrowers increased from 0.22 crores in FY21 to 0.34 crores in FY23, demonstrating a CAGR of 21.87%, which primarily drove the GLP growth.

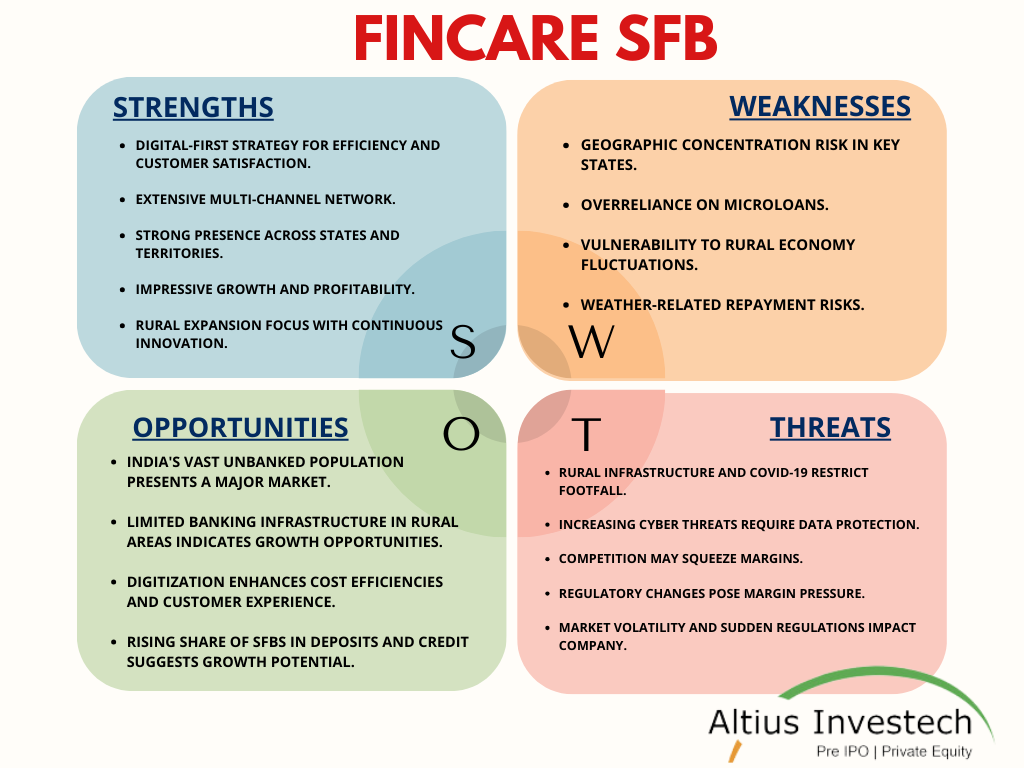

SWOT Analysis

Key Milestone

Peer Comparison

Peer Comparison

₹ (in crores)- as of 31st March, 2022

| Particulars | Fincare SFB | AU SFB | Equitas SFB | Ujjivan SFB |

| Total Income | 1404 | 6632 | 3437 | 3390 |

| Advances | 7000 | 56300 | 24900 | 21900 |

| Deposits | 6500 | 61100 | 23400 | 23200 |

Fincare SFB IPO

Fincare Small Finance Bank was initially planning an IPO to raise Rs 625 crore. But following the completion of its merger with AU Small Finance Bank, Fincare Small Finance Bank, has opted to consolidate its operations with the already listed entity.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

DISABLETRADING

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe