Ecom Express Unlisted Share

₹10675

*Average Price as per 22 May, 2025

Fundamentals

FACE VALUE

1

BOOK VALUE

19.03

NO OF SHARES

134573150

EPS

-19.02

SALES

2652.89

INDUSTRY PE

64.45

DIVIDEND

0

DIVIDEND YIELD

0

PE

-35.02

PB

35

PS

3.38

MARKET CAP

8962.57

EQUITY

256.04

PAT

-255.58

MESSAGE

2023-24

OVERVIEW

Snapshot

Founded in 2012, Ecom Express Limited is an end-to-end technology enabled logistics solutions provider for the Indian retail and e-commerce industries. Headquartered in Gurugram, Haryana, Ecom Express serves a broad range of customers, including e-commerce marketplaces, D2C brands, and small and large online sellers.

Key Highlights:

- Extensive Reach: Covering 27,000+ pin codes across India, with delivery access to 97% of Indian households.

- Large-Scale Operations: Over 2 billion parcels delivered since inception.

- Infrastructure: 3,738 facilities including gateways and delivery centers, along with 3,420+ dedicated delivery centers.

- Workforce: A team of 15,616 employees and associates.

- Real Estate: 9.3 million sq. ft. of space for supply chain, storage, and fulfillment operations.

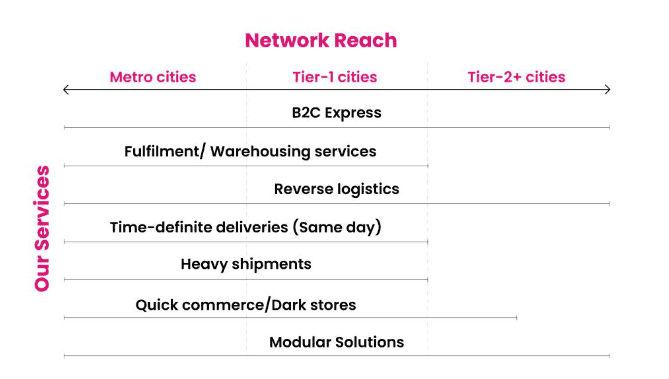

Services Offered

- Ecom Express Services (EXS): Comprehensive logistics offerings including first-mile pickup, network operation, last-mile delivery, reverse logistics, and returns management.

- Ecom Fulfillment Services (EFS): End-to-end supply chain, storage, and fulfillment solutions.

Operating Model:

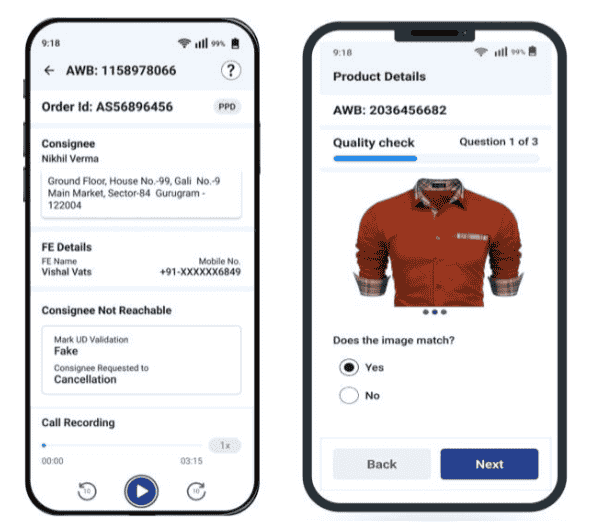

Reverse Pickup Application: Streamlined pick-ups and returns for 100,000+ sellers, enhanced network reliability, and implemented advanced routing and tracking to reduce costs, delays, and pilferage risks, ensuring a secure and transparent supply chain.

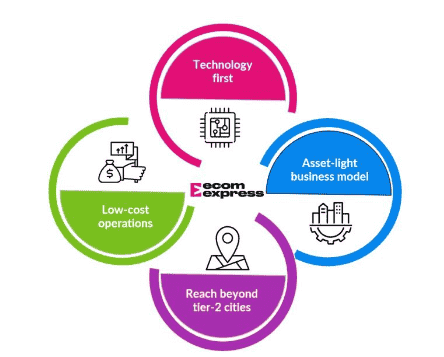

Digital Initiatives

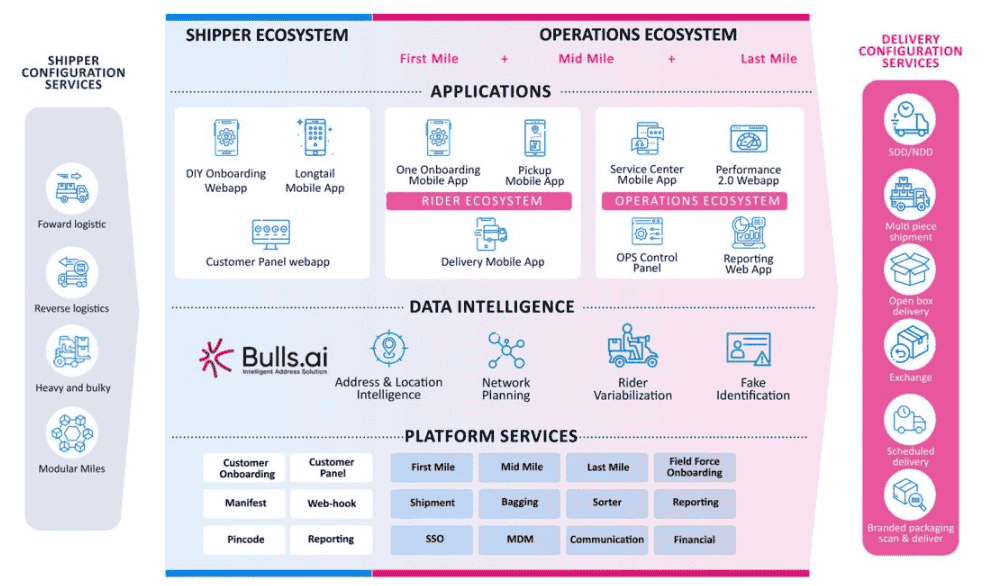

Ecom Express leverages cutting-edge technology and AI/ML driven proprietary tech-stack to ensure reliable customer experiences, creating a highly scalable and automated logistics infrastructure to meet the growing demands of India’s ecommerce ecosystem.

Below is a depiction of their usage of technology across the business:

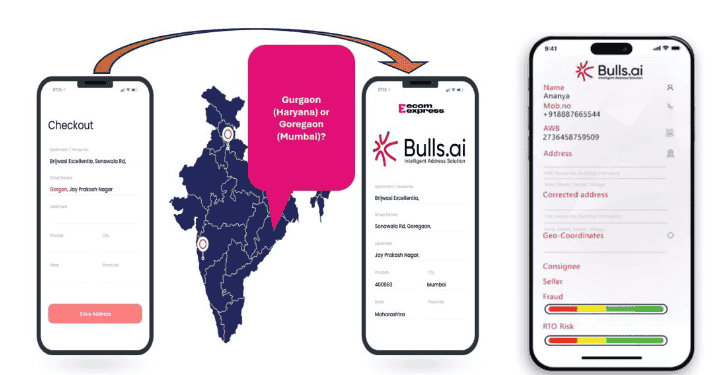

Bulls.ai leverages advanced AI technology to tackle address-related challenges in e-commerce logistics across India. It enhances delivery accuracy and speed, particularly in smaller towns and cities. By optimizing address verification and routing, Bulls.ai reduces return rates and improves overall customer satisfaction, ensuring a seamless delivery experience.

Awards | Recognitions

- Logistics Champion – Awarded by the Institute of Supply Chain Management in Logistics Ranking 2024.

- Great Place to Work Certification – Received for the period March 2024 to March 2025 by Great Place to Work Institute, India.

- Best Tech for SCM & Logistics – Awarded by Idea at the India Digital Enabler Awards 2023.

- Top 25 Companies in Tech Startups – Ranked in the ‘Best Places to Work in India’ by AmbitionBox in 2022.

Management

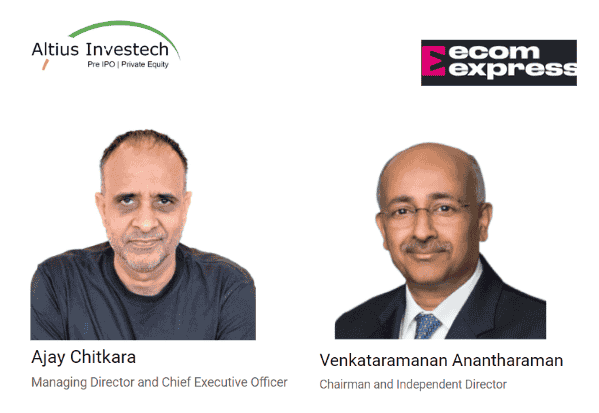

Ajay Chitkara | Managing Director and Chief Executive Officer

- Education: Post Graduate Diploma in Business Management from the Institute of Management Technology (IMT), Ghaziabad.

- Experience: Over 22 years of experience, last serving as Director and CEO of Airtel Business.

Venkataramanan Anantharaman | Chairman and Independent Director

- Education: Holds a bachelor's degree in metallurgical engineering from Jadavpur University and a postgraduate diploma in management from XLRI, Jamshedpur, along with a Pearson SRF BTEC Level 7 Advanced Professional Diploma from the Financial Times.

- Experience: With over 30 years of experience in financial services, he has held senior roles including Vice President at Bank of America, Director at Deutsche Bank, Global Head at Standard Chartered Bank, Managing Director at Credit Suisse, and Senior Advisor at CDC India Advisors.

INSIGHT

Financial Snapshot

All values are in INR Cr.

Particulars | FY 24 | FY 23 | Y-O-Y Growth |

Revenue | 2653 | 2548 | 4% |

EBITDA | 103.5 | 3.2 | 3134% |

PAT | -255.88 | -428.13 | 40% |

PAT Margin | -9.6% | -17% | 42% |

Key Takeaways:

- The revenue has increased marginally y-o-y by 4%.

- The largest expenditure category comprises cost of services at ₹1,389.9 crore in FY24, showing a slight increase of 0.23% from ₹1,386.7 crore in the previous fiscal year.

- Damaged/lost shipments cost: Notable rise of 9.21%, reaching ₹92.4 crore in FY24, compared to ₹84.6 crore in the prior year.

- EBITDA has shown massive improvements.

- The PAT margins have shown improvement as the losses have dropped down significantly indicating that the company might become profit-making in the next few years.

Valuation

As of August 19, 2024

- Nominal Value: ₹9,071

- Post 1:10 Stock Split Price: ₹907.10

- Post 1:2 Bonus Issue Price: ₹604.73

- Present Price (market adjusted): ₹550

- Approximately at a 21% discount to CMP.

Peer Comparison

All values are in INR Cr for FY24.

Particulars | Ecom Express | Blue Dart Express Limited |

Revenue | 2652.89 | 5318.6 |

PAT | -255.88 | 301.01 |

PAT Margin | -9.6% | 5.47% |

Current Market Price (10/09/24) | 550 | 8131 |

MCAP | 7402 | 19441 |

P/E | N/A | 64.5 |

P/S | 2.8 | 3.6 |

P/B | 28.9 | 14.1 |

Key Takeaways:

- Blue Dart has over 2x revenue and m-cap. It is profitable against its peer with a P/E ratio of 64.5.

- The P/S ratio indicates that Ecom Express might be undervalued but a significantly higher P/B ratio emphasizes on the lower profit margins than peers, as it is not converting sales into tangible value on its balance sheet effectively, despite strong revenue generation.

Industry Overview

India's Logistics Sector & B2C E-Commerce Market (FY 2024)

The Indian logistics sector is highly fragmented, dominated by small-scale fleet operators.

Core Transportation Modes:

- Road Transport: Key mode, split into B2B full-truck load (FTL), part-truck load (PTL), and B2C e-commerce logistics.

- B2C E-Commerce Logistics: A significant, more organized segment catering to growing online shopping demand, with focus on quick and slotted deliveries.

Key Challenges:

- Pre-GST Tax Regime: Limited smooth interstate movement, hindering growth.

- Poor Road Infrastructure: Restricts travel distances, leading to inefficiencies.

Market Size: Valued at ₹100-130 billion (US$ 1.2-1.6 billion) in FY 2024.

Growth Potential: Expected to grow at a CAGR of 24-26%, reaching ₹340-380 billion (US$ 4.2-4.6 billion) by FY 2029.

Revenue Sources: Majority from forward shipments; reverse shipments account for ~20% of value due to higher costs.

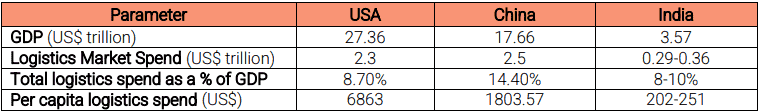

Below is a comparison of logistics market across USA, China and India:

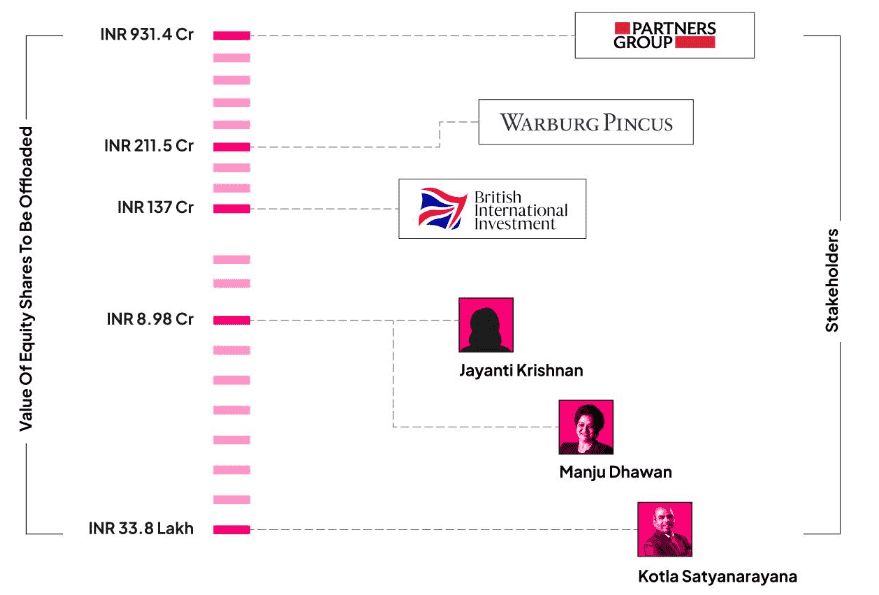

Funding History

The latest funding round, held on July 5, 2023, was executed via Compulsorily Convertible Preference Shares (CCPS), with each preference share priced at ₹9,071, reflecting the company’s strategic valuation approach in securing capital.

- July 5, 2023: The company raised $14.7M in a Series C round from Warburg Pincus and British International Investment.

- October 3, 2022: A funding of $39M was secured in a Series C round, led by Warburg Pincus, British International Investment, and another investor.

- February 23, 2021: The company raised $20.2M in its Series C round, with British International Investment as the investor.

- December 16, 2020: The company raised an undisclosed amount in a Series C round, with Partners Group participating.

- October 25, 2019: A funding round of $36M was raised in a Series C round, led by British International Investment.

Subsidiaries

In FY23, the startup made a strategic decision to exit Paperfly, a partly-owned subsidiary in Bangladesh. This move reflects the company's proactive approach to optimizing its portfolio and maintaining financial discipline.

Despite the exit, the company reported losses of INR 248.5 Cr from its continuing operations in FY24. However, this decisive step highlights the company's focus on:

- Streamlining Operations: The exit from Paperfly is a clear effort to concentrate on core business areas and reduce financial strain.

- Enhancing Financial Discipline: By divesting non-core assets, the company is taking measures to improve overall financial health and focus on sustainable growth.

IPO Plans

The company filed its DRHP on August 19, 2024.

- Planned to raise Rs 2,600 crore via IPO.

- IPO consists of a fresh issuance of Rs 1,284.5 crore and an OFS of Rs 1,315.5 crore by promoters and investors.

- Promoters & Investors in OFS: Kotla Satyanarayana, Manju Dhawan, Kotla Sridevi, Kotla Rathnanjali, Eaglebay Investment (Warburg Pincus), PG Esmeralda Pte (Partners Group), and British International Investment.

- Pre-IPO Placement: Potential fund raise of up to Rs 256.9 crore before IPO.

Use of IPO Proceeds:

- New Processing and Fulfillment Centres: Rs 387.44 crore.

- IT and Tech Infrastructure: Rs 312.9 crore for computers, technology, and data science.

- Debt Repayment: Rs 87.92 crore for repaying debt (outstanding borrowings of Rs 165.65 crore as of June 2024).

- General Corporate Purposes and Inorganic Acquisitions.

ANNUAL REPORT

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| KOTLA SRIDEVI | 8.88 % |

| LEPAKSHI SACHDEVA | 5.08 % |

| MANJU DHAWAN | 5.08 % |

| RABEYA SAXENA | 8.96 % |

| BRITISH INTERNATIONAL INVESTMENT PLC | 6.48 % |

| EAGLEBAY INVESTMENT LTD | 33.75 % |

| PG ESMERALDA PTE LTD | 17.57 % |

| Other | 14.2 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe