Chennai Super Kings (CSK) Unlisted Shares

₹167

*Average Price as per 27 February, 2026

Fundamentals

FACE VALUE

0.1

BOOK VALUE

18.83

NO OF SHARES

379425004

EPS

4.08

SALES

673.8

INDUSTRY PE

0

DIVIDEND

1

DIVIDEND YIELD

0.39

PE

62.5

PB

13.54

PS

14.36

MARKET CAP

9675.34

EQUITY

3.79

PAT

148.32

MESSAGE

2024-25

OVERVIEW

In September 2014, the Chennai Super Kings’ parent business, India Cements, made the decision to demerge the IPL franchise to a wholly-owned subsidiary, CSKCL. Chennai Super Kings remained owned by India Cements after being converted from a division to a 100% subsidiary. In 2008, India Cements made a $91 million proposal for the Chennai franchise and the sum that needed to be paid in ten years. The company set a record date of October 9, 2015, with the intention of distributing CSKCL shares in the ratio of 1:1 to India Cements Ltd. Shareholders.

An Overview

- The Indian premier league’s (IPL) brand value is at $3.2 billion in 2023, from $1.8 billion in 2022, an increase of 80 percent.

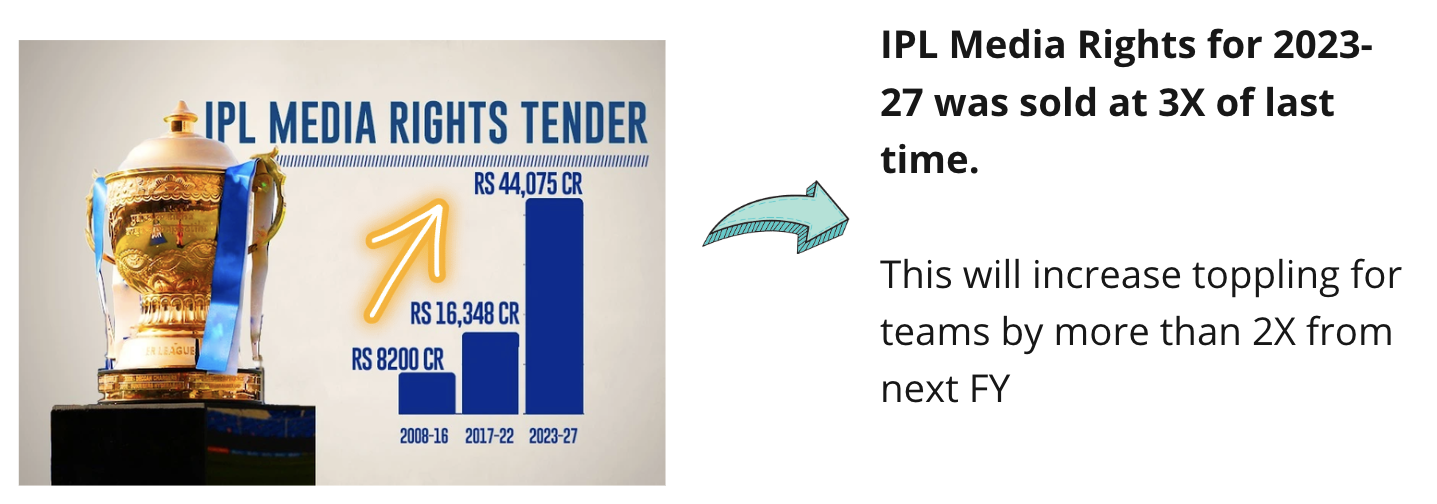

- The league’s business value also saw an increase of 80 percent and is worth $15.4 billion in 2023. One of the main reasons for this increase is the media rights deal with JioCinema and Disney Star, which is 3x the price of the five-year deal between Disney Star and the Board of Control for Cricket in India (BCCI) in 2017.

- As per the report, the media rights are expected to further increase during the next cycle. So far, the media rights have grown at a CAGR of 18 percent, between 2008 and 2023.

- The IPL is expected to go global by the next cycle in 2027 on similar lines to EPL, which would further enhance the growth in its revenue from broadcasting rights.

- Chennai Super Kings (CSK) was the number one IPL franchisee in terms of brand valuation, with $212 million in 2023, witnessing a growth of 45.2 percent from $146 million last year.

- Reason? Without a doubt the team’s captain MS Dhoni’s cult fan following and five title wins. This has helped in creating a strong brand identity.

From Seasonal to Evergreen: CSK's Formula for Sustainable Business Growth

• Chennai Super Kings (CSK) is more than just an IPL team - it's a global cricket powerhouse

• Not content with dominating the Indian cricket scene, CSK has recently ventured into the South Africa T20 (SA20) league with its Johannesburg-based franchise named Joburg Super Kings

• The CEO of CSK, Mr. Kasi Viswanathan, has stated that the team plans to be the world's leading T20 franchise by 2030

• To reach this ambitious target, CSK is planning to invest a whopping Rs. 150-200 crores in building a High-Performance Centre at Navalur - a move that's sure to boost the team's training and development capabilities to new heights

IPL Media Rights Auction

·On June 15, 2022, the Indian Premier League (IPL) achieved a significant milestone when the BCCI sold the media rights for the 2023–2027 season for Rs 48,075 Cr. TV rights brought in Rs 22,575 Cr, while internet rights brought in Rs 21,500 Cr for 410 matches. Read more about how IPL 2023 Ad Revenue Crossed. Rs 10,000 Cr!

·TV Rights for the Indian subcontinent have been sold to The Walt Disney Company India owned Star, while the digital rights have been bagged by Viacom18. The league signed a major title deal with TATA for Rs, 670 Cr.

·The Five Year revenue just from IPL Media Rights stands at upwards of Rs 2400 Cr for Chennai Super Kings (CSK) from FY 2023 onwards.

·IPL Media Rights for the period 2018-22: Star Sports had picked up the composite rights for Rs 16,347 Cr. By virtue of these rights, the revenue share of franchises over the next 5-year period was 50% of the above amount after deducting the production expenses incurred during the season.

·The league also signed a major title deal with VIVO for Rs, 2199 crore for the same period. ( 2018-2022). A combination of sponsorship and media rights ensures, the franchise will receive over Rs 1000 crore in the form of central revenue over the next five years from the BCCI-IPL. However, the Franchisees have to share 20% of the income with BCCI.

CSK Sponsors

CSK recently entered into an agreement with Gulf carrier Etihad Airways to become its official sponsor in 2024. CSK has a lot of brands under its belt like – The Muthoot Group, India Cements, Jio, Dream 11 etc.

CSK Revenue Streams

Central Media Rights – Major income from IPL broadcasting deals.

Sponsorships – Brand deals with companies like TVS Eurogrip and Gulf Oil.

Ticket Sales – Revenue from packed home matches at Chepauk Stadium.

Merchandise Sales – Jerseys, caps, and other fan gear.

Prize Money – Earnings from IPL performance (e.g., ₹20 crore for 2023 win).

Digital Platforms – Ad revenue from YouTube and social media content.

International Ventures – Ownership of teams in SA20 (Joburg Super Kings) and MLC (Texas Super Kings).

Cricket Academies – Income from training academies under Superking Ventures.

INSIGHT

Chennai Super Kings

Investment Analysis Based on FY25 Annual Report

Unlisted Share Price: ₹204

Investment Verdict at ₹204

At the current unlisted price of ₹204, the company trades at a P/E multiple of ~50× based on FY25 consolidated EPS of ₹4.08. This valuation reflects a scarcity and brand premium, with investors pricing in long-term global expansion (SA20 and MLC leagues), stability of IPL media rights, and franchise strength rather than near-term earnings growth. While fundamentals remain strong, the valuation leaves limited margin for error in the short term.

Key Positives (Top 10 Reasons to Invest)

Global Expansion and Asset Creation

The franchise has expanded internationally with ownership of Joburg Super Kings (SA20) and a 55.5% stake in Texas Super Kings (Major League Cricket, USA). This reduces dependence on the IPL and creates long-term global franchise value.High Revenue Visibility from Central Media Rights

Revenue from Grant of Central Rights (BCCI Media Rights) stood at ₹493 Cr in FY25, providing predictable, high-margin cash flows for the next 4–5 years irrespective of on-field performance.Resumption of Dividend Payout

The Board has recommended a ₹1 per share dividend for FY25, signalling confidence in cash flows after a period of dividend suspension.Strong Balance Sheet with Net Cash Position

Consolidated cash and cash equivalents stood at ₹336 Cr as of March 31, 2025, with negligible leverage (Net Debt/Equity ~0.01), offering strong downside protection.New Revenue Stream via Asset Monetisation

The company plans to commercially lease high-performance centres, grounds, and stadia, transitioning toward a sports-infrastructure monetisation model that can smooth seasonal revenue volatility.Scalable Academy Business

The Super Kings Academy has expanded to 16 centres with 1,000+ students. While currently small (₹18 Cr turnover), it offers a scalable, high-margin franchise and licensing opportunity.Strong Operating Cash Generation

Despite lower profits, net cash from operating activities was ₹206 Cr, highlighting the inherent cash-generative nature of the business.Scarcity Value of a Global Sports Franchise

As one of the most successful and recognisable cricket franchises globally, the brand commands a premium in the unlisted market that is not fully captured by traditional valuation metrics.Effective Tax Management

Recognition of Deferred Tax Assets (₹34.62 lakh) reflects prudent tax planning and potential support to future profitability.Strategic Headroom for Expansion

Proposal to raise loan and investment limits to ₹750 Cr indicates preparedness for future acquisitions or infrastructure investments that could unlock the next growth phase.

Key Risks and Concerns (Top 10 Cons)

Weak FY25 Financial Performance

Revenue declined to ₹673 Cr (from ₹695 Cr in FY24)

Net profit fell ~26% to ₹148 Cr

EPS declined to ₹4.08 from ₹6.14

The drop was largely driven by failure to qualify for playoffs, resulting in zero prize money vs ₹30 Cr in FY24.

Loss-Making International Subsidiaries

Joburg Super Kings: ₹32.8 Cr loss

Texas Super Kings: ₹2.17 Cr consolidated loss

These ventures are likely to suppress consolidated earnings over the next 2–3 years.

Premium Valuation Despite Earnings Decline

A 50× P/E multiple is demanding for a company that has reported a material decline in profits, increasing downside risk if growth expectations are delayed.Material Tax Litigations

GST disputes: ₹36.27 Cr

Service tax disputes: ₹6.78 Cr

Total contingent exposure of ₹43.05 Cr, equivalent to ~30% of FY25 profit.

Sharp Increase in Employee Costs

Employee benefit expenses rose ~2.5× to ₹16.6 Cr, compressing margins and reflecting rising player and support staff costs.Key-Man Risk

Brand value and commercial appeal remain closely linked to MS Dhoni, and his eventual retirement poses a significant intangible risk to sponsorships and fan engagement.Complex Related-Party Transactions

Significant loans and guarantees to subsidiaries and group entities (including India Cements) add complexity and may obscure standalone operational efficiency.Governance Observation by Auditors

Audit trail (edit-log) software was operational only from January 2, 2025. While no misstatement was reported, this is a governance weakness for compliance-focused investors.Performance Sensitivity of Business Model

The FY25 outcome demonstrates that match performance directly affects revenues (gate receipts, prize money), increasing earnings volatility.Illiquidity of Unlisted Shares

Exit flexibility is limited, with typical 5–10% bid–ask spreads and the risk of delayed liquidity during market downturns.

Consolidated Financial Snapshot

| Metric | FY25 | FY24 | Change |

|---|---|---|---|

| Revenue | ₹674 Cr | ₹695 Cr | ▼ 3% |

| Net Profit | ₹148 Cr | ₹201 Cr | ▼ 26% |

| EPS | ₹4.08 | ₹6.14 | ▼ 33% |

| Cash & Equivalents | ₹336 Cr | ₹167 Cr | ▲ 101% |

| Dividend | ₹1.00 | Nil | ▲ |

Final Recommendation

For long-term investors (5+ years) with a higher risk appetite, the current phase represents a structural accumulation opportunity, driven by inflation-protected IPL media rights and long-term optionality from global leagues.

However, for valuation-sensitive investors, the entry price of ₹204 (P/E ~50×) offers limited margin of safety amid declining earnings and loss-making subsidiaries. A more attractive risk–reward may emerge closer to ₹170–180, or once international franchises demonstrate a clear path to profitability

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| India Cements Shareholder Trust | 30.06 % |

| Shri Saradha Logistics Private Limited | 6.88 % |

| Life Insurance Corporation of India | 6.04 % |

| ELM Park Fund Ltd | 4.99 % |

| Radhakishan S Damani | 2.94 % |

| HIRTLE Callaghan Emerging Markets Portfolio | 2.87 % |

| Dreyfus International Funds INC | 1.77 % |

| The Boston Company INC Pooled Employee Funds Emerging Markets Value Equity Fund | 1.6800000000000002 % |

| Dimensional Emerging Markets Value Fund | 1.65 % |

| Government Pension Fund Global | 1.52 % |

| Other | 39.6 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe