Calcutta Stock Exchange Unlisted Share

₹760

*Average Price as per 20 May, 2025

Fundamentals

FACE VALUE

1

BOOK VALUE

3311.9

NO OF SHARES

611250

EPS

13.61

SALES

12.81

INDUSTRY PE

0

DIVIDEND

0

DIVIDEND YIELD

0

PE

62.09

PB

0.26

PS

4.03

MARKET CAP

51.65

EQUITY

0.06

PAT

0.83

MESSAGE

2023-24

OVERVIEW

The year 1997 had been a momentous one in the history of this illustrious institution as on 26th February, 1997 the Calcutta Stock Exchange ushered in a new era by replacing the old manual trading system with completely computerized on-line trading & reporting system known as C-STAR (CSE Screen Based Trading And Reporting). The on-line electronic screen based trading system was inaugurated by Shri Jyoti Basu, Hon’ble Chief Minister of West Bengal on 26th February, 1997. The computerized trading started initially with 101 "B" Group scrips. Subsequently with effect from 7.3.1997 remaining "B" Group and all "Permitted Group" scrips (approx. 3,500) were transferred on to the C-STAR systems. The Exchange finally shifted the entire "A" Group scrips on the computerized system with effect from April 4, 1997.

At the time of incorporation in 1908, the Stock Exchange had 150 members. Today the total membership has risen to more than 900, which contains several corporate and institutional members. The number of companies listed on the Exchange is more than 3,500. The Annual turnover of the Exchange in 1997-98 was to the tune of Rs, 1,78,779 crores. The Calcutta Stock Exchange has been granted permanent recognition by the Central Government with effect from April 14, 1980 under the relevant provisions of the Securities Contracts (Regulation) Act, 1956, with a view to render useful service to investors.At the time of incorporation in 1908, the Stock Exchange had 150 members. Today the total membership has risen to more than 900, which contains several corporate and institutional members. The number of companies listed on the Exchange is more than 3,500. The Annual turnover of the Exchange in 1997-98 was to the tune of Rs, 1,78,779 crores. The Calcutta Stock Exchange has been granted permanent recognition by the Central Government with effect from April 14, 1980 under the relevant provisions of the Securities Contracts (Regulation) Act, 1956, with a view to render useful service to investors.

On June 7, 1923 the Association was registered as a limited liability concern, with an authorized capital of Rs. 3 lakhs divided into 300 shares of Rs. 1,000/- each. The shares were subdivided into 4 shares of Rs. 250/- each in 1959. The Golden Jubilee of the Association was celebrated in 1938. The Diamond Jubilee in 1968 and The Platinum Jubilee in 1983.

INSIGHT

Ketan Parekh defaults Calcutta Stock Exchange.

The Calcutta Stock Exchange, which had been grinded to a halt following a Rs. 120-crore scandal involving the notorious stock broker Ketan Parekh, is throbbing again with life. Ketan Parekh used the Kolkata stock exchange to trade as this was the stock exchange where no strict and pivotal rules and regulations were not formed. He misused such exchange and also tied up with many other brokers to trade on his behalf and gave the commission.

Stocks had given over 100-200% return during Ketan Parekh's tenure in the market, but it was not his own capital at all times. Ketan Parekh too had multiple sources of funds. After the 1992 Securities Scam, the Bombay Stock Exchange (BSE) started being on its toes and improved security and fraud detection, so Ketan chose the Calcutta Stock Exchange (CSE) as his stock exchange of choice. Ketan sold off all his shares in a hurry overnight and this entire chaos led to not only the crashing of the Calcutta Stock Exchange but also the shutdown of the entire exchange.

Calcutta Stock Exchange owns 5 acre land on Kolkata's Eastern Metropolitan Bypass for valuation around Rs 300 crores. Intrinsic worth of company just on the basis of this plot is approx Rs.5000/- per share.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|

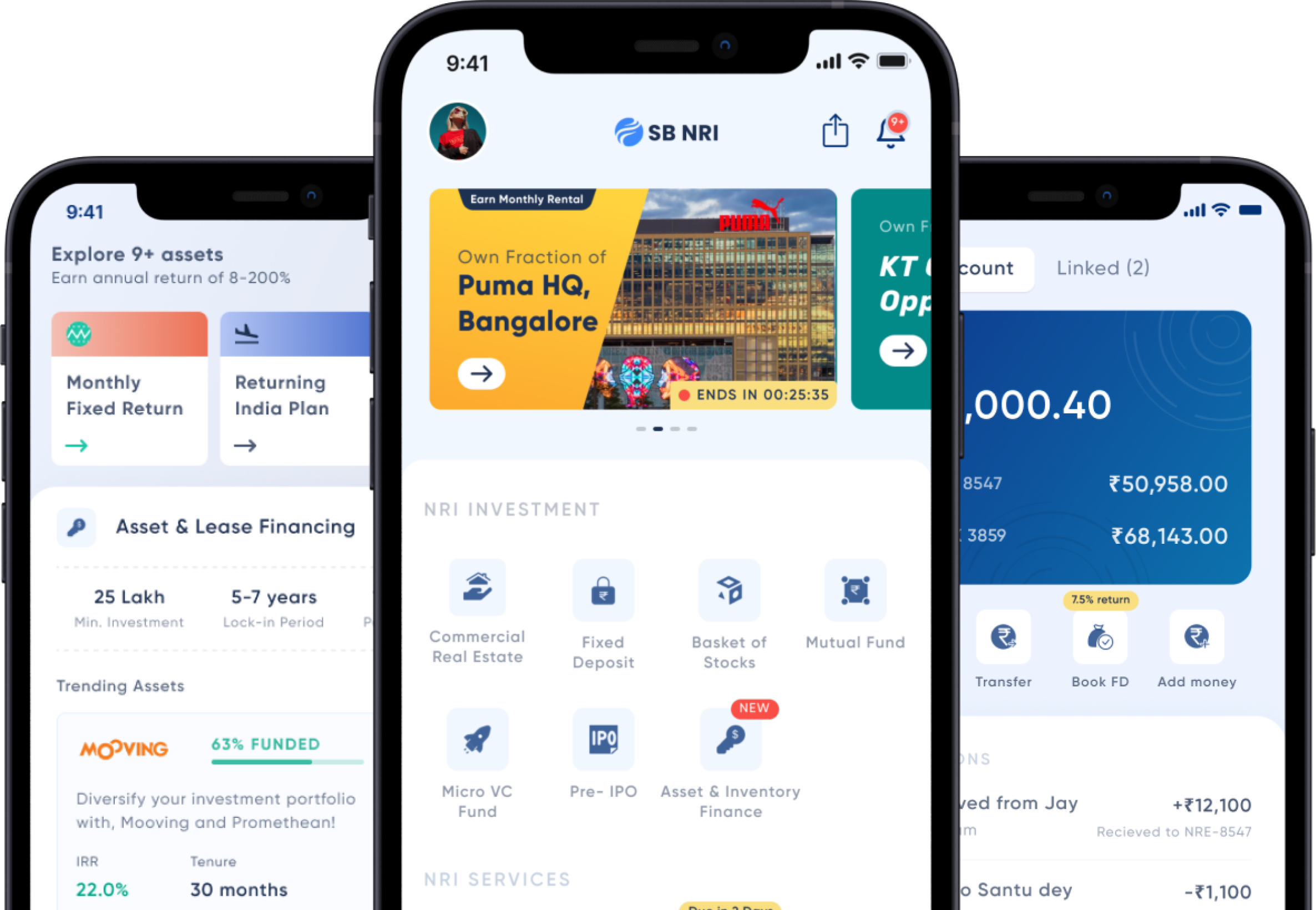

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe