Bharat Hotels Unlisted Share

₹164

*Average Price as per 3 May, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

125.37

NO OF SHARES

75991199

EPS

11.16

SALES

862.34

INDUSTRY PE

0

DIVIDEND

0

DIVIDEND YIELD

0

PE

33.96

PB

3.02

PS

3.34

MARKET CAP

2880.07

EQUITY

75.99

PAT

85

MESSAGE

2023-24

OVERVIEW

Established in 1981, Bharat Hotels Limited is a leading hospitality enterprise in India renowned for its luxurious accommodations and impeccable service under the esteemed brand name of "The Lalit".

- Properties: Manages 12 luxurious hotels, palaces, and resorts across India

- Total Rooms: Offers a total of 2,261 rooms

- Mid-Market Segment: Operates two hotels under The Lalit Traveler brand, catering to mid-market clientele

- Dining: Boasts a portfolio of 45 restaurants, bars, and bakery outlets, including renowned names like 24/7, Baluchi, and Kitty Su

- Event Facilities: Provides 50 banquet and conference halls for various events and gatherings

- Services Beyond Hospitality: Offers outdoor catering services, education and training programs for hospitality professionals, and aircraft charter services.

Product Portfolio

Hotel Operations:

- Sale of rooms and apartments

- Food and beverages (e.g., 24/7, Baluchi, OKO Restaurant, The LaLiT Boulangerie)

- Banquet rentals

- Telecommunication services

- Laundry services

- Business center facilities

- Health center services

- Other related services (e.g., Kitty Su nightclubs, The LaLiT Food Truck Company)

Subsidiary/Associate

| Company Name | Type |

|---|---|

| Jyoti Limited | Subsidiary |

| PCL Hotels Limited | Subsidiary |

| Lalit Great Eastern Kolkata Hotel Limited | Subsidiary |

| Prima Hospitality Private Limited | Subsidiary |

| Kujjal Hotels Private Limited | Subsidiary |

| The Lalit Suri Educational and Charitable Trust | Associate |

Awards & Recognitions

| Hotel/Property | Award/Recognition |

|---|---|

| The LaLiT New Delhi | 1. Food for Thought Fest Award Jury’s Favorite by South Asian Association for Gastronomy. 2. Star Partners Award 2022 3. Travellers’ Review Award by Goibibo. |

| The LaLiT Resort & Spa Bekal | Best Ayurvedic Spa by Global Spa Awards 2022. |

| The LaLiT Grand Palace Srinagar | 1. Best Heritage Hotel in the Domestic Hotels category by Travel 2. Leisure India’s Best Awards 2022. |

| The LaLiT Great Eastern Kolkata | The Bakery received the Intach Culinary Heritage Award. |

INSIGHT

Consolidated Financial Highlights

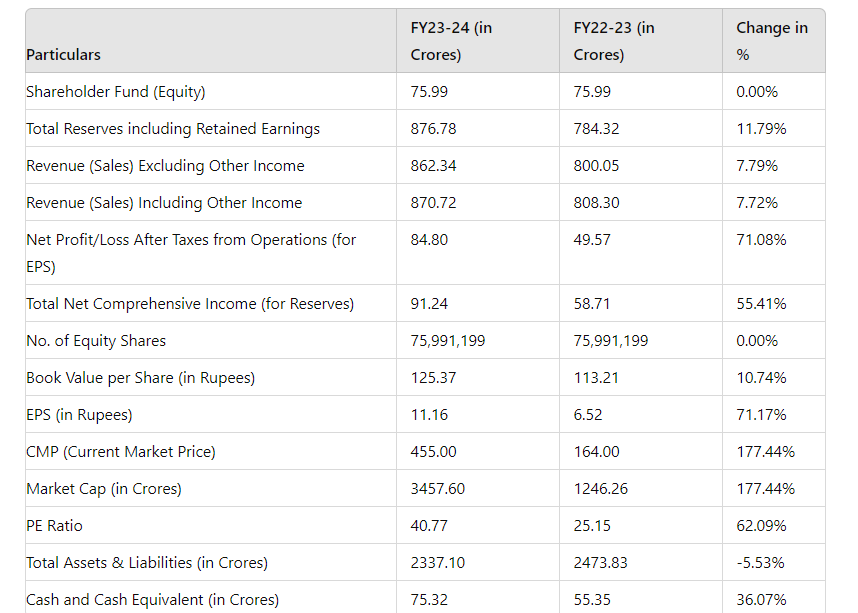

- The company achieved a commendable 7.79% growth in revenue, reaching ₹862.34 crores from ₹800.05 crores last year. This steady increase reflects their strong market presence and effective business strategies

- A standout achievement is the 71.08% surge in net profit, climbing to ₹84.80 crores from ₹49.57 crores. This remarkable improvement underscores their operational efficiency and ability to generate significant returns.

During the fiscal year 2022-23, Bharat Hotels Limited experienced a gradual improvement in business during the first six months, followed by a substantial revival in the second half, driven by successful vaccination programs, border reopening, and removal of travel restrictions. The company achieved one of its best revenue figures, reflected in its revenue and EBITDA numbers, although recovery from COVID-19 losses will take time. Additionally, the company raised funds through the issuance of 1,10,000 Non-Convertible Debentures via private placement, utilizing the proceeds to repay existing debt and clearing all loans from financial institutions.

Revenue Breakup

₹ in crore

| Particulars | as of 31st March 2023 |

| Room rentals | 433.17 |

| Food and beverage | 237.91 |

| Liquor and wine | 48.57 |

| Banquet and equipment rentals | 24.23 |

| Other services (including service charge income) | 23.48 |

| Membership programme revenue | 5.11 |

| Traded goods | 0.34 |

| Total | 772.81 |

Hotel Industry Overview

The hotel industry in India stands as a vibrant and dynamic sector, deeply intertwined with the nation’s cultural richness, economic vitality, and burgeoning tourism landscape. With a diverse tapestry of landscapes ranging from majestic mountains to pristine beaches, and a heritage that spans millennia, India beckons travelers from across the globe. The hotel industry in India is poised for significant growth, driven by several key factors such as increasing tourism, rising disposable incomes, and evolving consumer preferences. By 2024, the Indian hotel market is expected to reach a revenue value of US$9.13 billion, with a projected compound annual growth rate (CAGR) of 5.41% from 2024 to 2028.

Market Dynamics

Steady Revenue Growth: Fueled by domestic and international tourism, the hotel market experiences continuous revenue growth, driven by increasing business travel and leisure tourism.

User Base Expansion: Anticipated growth in the hotel market's user base to 64.74 million by 2028 mirrors the rising trend of travel and accommodation usage among Indian consumers.

Shift to Online Bookings: The rise of online travel agencies (OTAs) sees a significant shift towards online bookings, projected to constitute 61% of total revenue by 2028, owing to their convenience and accessibility.

Average Revenue per User (ARPU): Forecasted ARPU of US$167.80 signifies the average annual spending per user on hotel accommodations, reflecting sustained consumer demand.

Growing Tourism: India's economic growth and increasing disposable incomes stimulate domestic travel, alongside its rising popularity as a global tourist destination.

Business Travel: Major cities like Mumbai, Delhi, Bangalore, and Hyderabad witness a surge in business travel, bolstering demand for premium hotel services.

Urbanization: Rapid urbanization prompts hotel establishment not only in metropolitan cities but also in emerging Tier-II and Tier-III cities, catering to diverse traveler preferences.

Technology Integration: Integration of technology, such as online booking platforms and smart room amenities, enhances guest experiences and operational efficiency.

Focus on Sustainability: With a growing emphasis on eco-friendly practices, many hotels adopt green initiatives to reduce environmental impact, reflecting an industry-wide commitment to sustainability.

Bharat Hotels: Key Strenghts

- Long Track Record in the Hotel Industry.

- Financial and Operational Improvement.

- Robust Financial Structure.

- Geographical Diversification.

Bharat Hotels: Key Weaknesses

- High debt and leveraged capital structure.

- Vulnerability of revenues to inherent industry cyclicality, economic cycles and exogenous events.

- Regional trends in tourism and competition risk.

Peer Comparison

₹ in crore

| Particulars | Bharat Hotels Limited | EIH Limited | Indian Hotels Co Limited |

| Net Revenue | 808 | 2,019 | 5,810 |

| EBITDA | 364 | 600 | 1805 |

| Profit | 50 | 329 | 1053 |

| Market Cap | 2,577 | 28,469 | 86,559 |

| Share Price (as on 24.04.2024) | 345 | 460 | 608 |

| P/E (M.cap/Profit) | 52 | 86.53 | 82.20 |

ESOP

In an effort to incentivize and retain key employees, Bharat Hotels Limited introduced the “Bharat Hotels Employees Stock Option Scheme 2017.” This scheme is designed to reward employees and align their interests with the long-term success of the organization. During the year 2018, the company granted a total of 700,600 stock options to eligible employees. This initiative reflects Bharat Hotels Limited’s commitment to recognizing and rewarding the contributions of its employees, thereby fostering a culture of ownership and accountability within the organization.

Dividend

In view of business losses and the imperative to preserve cash, Bharat Hotels Limited has opted not to propose any dividend to the shareholders for the Financial Year 2022-23.

IPO Plans

Bharat Hotels Limited filed a DRHP for an initial public offering (IPO) with the market regulator, SEBI, on June 28, 2018, but has yet to proceed with the IPO as of 2024. The company had aimed to raise approximately Rs. 1,200 crore through a new issue at that time. However, it appears that the IPO plans have been delayed or put on hold. As of now, there has been no indication from the company regarding any re-filing of the DRHP or a potential timeline for the IPO.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Deeksha Holding Limited | 40.42 % |

| Mr. Jayant Nanda | 26.32 % |

| Dr. Jyotsna Suri | 9.55 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe