Assam Carbons Unlisted Share

₹230

*Average Price as per 9 May, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

181

NO OF SHARES

2755600

EPS

29.85

SALES

62.5

INDUSTRY PE

27.15

DIVIDEND

3

DIVIDEND YIELD

0.78

PE

12.9

PB

2.13

PS

1.7

MARKET CAP

106.09

EQUITY

2.76

PAT

8.23

MESSAGE

2023-24

OVERVIEW

1. Assam Carbon Products Ltd (ACPL) is a leading Indian manufacturer of carbon and graphite-based products. The company operates in the industrial components sector, providing essential components for various industries like railways, cement, steel, sugar, mining, power generation, and petrochemicals.

2. ACPL offers a wide range of products, including carbon brushes, current collectors, seals, bearings, and specialty graphite items, catering to the diverse needs of its customers.

3. It was established in 1963 for manufacturing of Carbon brushes in the Industrial Estate at Bamunimaidan, Guwahati, Assam.

Products

Assam Carbon Products Ltd. manufactures various kinds of products

1. Electrical Products

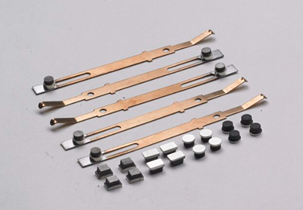

Assam Carbon Products Limited (ACPL) produces Carbon blocks across different grades. The company offers a comprehensive selection of Carbon brushes designed for both Fractional Horse Power (FHP) motors and heavy-duty DC motors and generators. ACPL’s traction product line includes railway pantographs, current collectors, and SIG contacts.

2. Mechanical Products

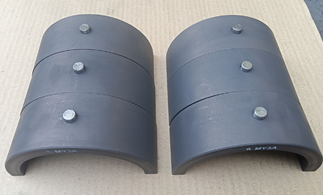

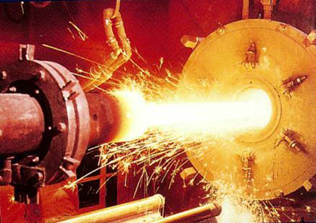

Assam Carbon Products Limited (ACPL)'s Mechanical Carbon Division specializes in producing Carbon seal rings, bearings, vanes, and thrust pads. Their machining facility near Hyderabad is equipped with cutting-edge technology to deliver precision-finished products. Meanwhile, the Speciality Graphite Division offers customized solutions for industries such as Diamond Tool manufacturing, Optical fiber production, Hard metal sintering, and Electronics.

3. Graphite Products

Assam Carbon Products Ltd. manufactures a diverse range of products, categorized into three main groups:

- Hi-Temp Insulators

- Fuel Cells

- Heating Elements

- Casting Dyes

- Lubricating Blocks

- Other specialized products

4. Aegis Ring

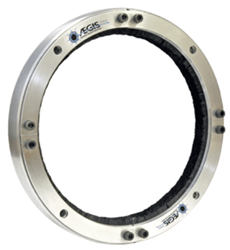

Aegis Conductive Microfiber Shaft Ground Brush is a product designed to protect motor bearings from electrical damage. It achieves this by safely diverting harmful electrical currents away from the bearings and into the ground. This innovative brush utilizes a proprietary technology called Electron Transport Technology, which employs conductive microfibers to create a low-resistance path for these damaging currents. By effectively channeling the electricity, the Aegis brush significantly extends the lifespan of the motor.

Management:

1. Mr. Rakesh Himatsingka | Chairman

- Mr. Rakesh Himatsingka is a Mechanical Engineer from BITS Pilani, India.

- Since 1975, Mr Himatsingka has been an integral part of the growing Carbon business in India and is Chairman-Managing Director of India Carbon Limited, one of India’s leading producers of Calcined Petroleum Coke.

- He had also been, inter alia, director of Morganite Electrical Carbon Ltd, Swansea, UK, from 1992 to 2003.

2. Mrs. Anita Himatsingka | Director

- Mrs Anita Himatsingka graduated in English (Honours) from Jesus and Mary College, India.

- Mrs. Himatsingka has worked across multiple platforms in an administrative capacity. She is the Executive Director of ICL Flora Exotica heading the production and domestic sales of indigenously grown Orchid flowers and plants from 1992-94.

- Mrs Himatsingka also served as President of Ladies Study Group (Kolkata), Indian Chamber of Commerce.

INSIGHT

Industry Outlook:

Core Industries

- ·ACPL primarily serves industries that require robust, durable, and electrically conductive components. These sectors heavily rely on carbon and graphite-based products for their operations.

- Mining, Steel, Cement, Railway, and Power: These industries are ACPL's core markets. They utilize carbon brushes, current collectors, and other components for heavy machinery and electrical equipment. These components endure harsh conditions and contribute to efficient operations.

- Petrochemical: This sector employs carbon and graphite products for various applications, including heat exchangers, seals, and valves. ACPL's components help to withstand the corrosive and high-temperature environments of this industry.

Limited Involvement

- Agriculture: While ACPL's core products might not have direct applications in agriculture, there could be potential for indirect involvement. For instance, carbon brushes might be used in agricultural machinery or equipment.

- Paper: Similar to agriculture, direct involvement of ACPL's products in the paper industry might be limited. However, carbon brushes or other components could find applications in paper mill machinery.

- Water: ACPL's products are not typically associated with water treatment or management. However, there could be potential applications in water pumping or purification equipment.

- Automobile: ACPL's focus is primarily on industrial applications. While carbon brushes are used in electric vehicles, the scale of ACPL's involvement in this sector is likely minimal.

- Sugar: ACPL's carbon brushes and other components are crucial for the heavy machinery used in sugar mills, making it a core sector for the company.

ACPL's primary focus lies in industries that demand high-performance carbon and graphite components to withstand harsh operating conditions. While there might be potential applications in other sectors, the company's core strength and market presence are in mining, steel, cement, railway, power, and petrochemical industries.

FY24 Performance

| Particulars (in Crore.) | FY24 | FY23 | Y-o-Y Growth |

| Total Income From Operations | 64.32 | 56.78 | 13.28% |

| PBT | 11.55 | 9.53 | 21.20% |

| PBT Margin | 17.96% | 16.78% | - |

| PAT | 8.23 | 6.33 | 30.02% |

| PAT Margin | 12.80% | 11.15% | - |

| EPS | 29.87 | 22.97 | 30.02% |

Quarterly Performance

(₹ Crores)

| Particulars | 3 Months ended 31.12.2024 | 3 Months ended 30.09.2024 | 9 Months ended 31.12.2024 |

|---|---|---|---|

| Total Income from Operations | 15.98 | 18.42 | 50.33 |

| Net Profit/(Loss) before Tax, Exceptional and/or Extraordinary Items | 3.02 | 4.49 | 10.09 |

| Net Profit/(Loss) before Tax (after Exceptional and/or Extraordinary Items) | 3.02 | 4.49 | 10.09 |

| Net Profit/(Loss) after Tax (after Exceptional and/or Extraordinary Items) | 2.07 | 3.21 | 7.00 |

| Total Comprehensive Income for the period (Profit/(Loss) after tax & other Comprehensive Income) | 2.07 | 3.21 | 7.00 |

| Equity Share Capital | 2.76 | 2.76 | 2.76 |

| Earnings per Share (₹ 10/- each) - Basic | 7.44 | 11.67 | 25.37 |

| Earnings per Share (₹ 10/- each) - Diluted | 7.44 | 11.67 | 25.37 |

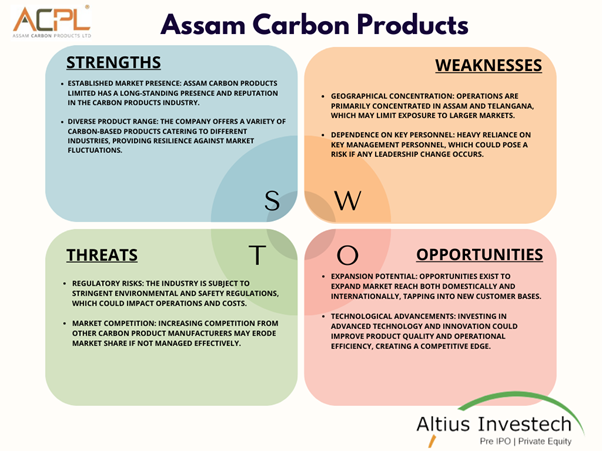

SWOT Analysis:

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Shaurya Veer Himatsingka | 31.53 % |

| Rakesh Himatsingka | 28.9 % |

| Anita Himatsingka | 6.82 % |

| Assam Industrial Development Corporation Ltd | 3.63 % |

| Maalika Himatsingka | 3.27 % |

| Other | 25.85 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe