Arch Pharmalabs Unlisted Share

₹99

*Average Price as per 23 May, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

15.31

NO OF SHARES

151923100

EPS

123.05

SALES

706.07

INDUSTRY PE

0

DIVIDEND

0

DIVIDEND YIELD

0

PE

1.05

PB

8.43

PS

2.78

MARKET CAP

1959.81

EQUITY

151.92

PAT

1869.44

MESSAGE

OVERVIEW

The Arch pharmalabs company operates in two main areas: Products and Services. The Products segment focuses on manufacturing and selling APIs and Intermediates to both innovator and generic pharma companies in domestic and international, including regulated, markets. Over time, the company has expanded its offerings to include CRAMS (Contract Research and Manufacturing Services), which presents significant growth opportunities.

They presently have 8 manufacturing facilities across India. All these 8 manufacturing facilities are multipurpose with reactor capacities of around 1200 K.

Name | Arch Pharmalabs ltd |

Type of Entity | Public Limited Indian Non-Government Company |

Listing status | Unlisted |

Date of Incorporation | 2 Apr, 1993 |

Industry | Pharma |

Segments | API Manufacturers,Contract Research |

RegisteredAddress | Andheri (E) , Mumbai- 400072, Maharashtra |

Product Portfolio

API Manufacturing

| Therapeutic Category | Product(s) |

|---|---|

| Antigout | Ursodeoxycholic Acid (UDCA) |

| Lipid Lowering | Atorvastatin Calcium (Amorphous/Crystalline) |

| Antiplatelet | Clopidogrel Bisulphate (Form I/II) |

| Antihistamine | Cetirizine Dihydrochloride |

| Anti-Cancer | Docetaxel, Gemcitabine, Irinotecan, Paclitaxel Hydrochloride |

| Expectorant | Bromhexine Hydrochloride |

| Antidepressant | Milnacipran |

| Anticonvulsant | Felbamate |

| Antiparkinsonian | Entacapone, Benztropine Mesylate |

| Antibacterial | Nitrofurantoin |

| Anesthetic | Prilocaine |

| Analgesic | Flupirtine Maleate, Diclofenac Sodium, Mefenamic Acid, Meloxicam, Piroxicam, S (+) Ibuprofen, Nabumetone |

Intermediate Manufacturing

| Intermediate | End Use |

|---|---|

| Antiviral Agents | |

| Boc CK, Boc CA, S,S-Epoxide, Boc Amine, Boc Nitro, Amino Sulphonamide Compound | Darunavir |

| Boc-R,S-Alcohol, R,S-Epoxide, MOC-L-tert-Leucine | Atazanavir |

| Cholesterol/Acid Derivatives | |

| CDCA | Ursodeoxycholic Acid |

| 7-KLCA | Ursodeoxycholic Acid, Obeticholic Acid |

| Statins | |

| ATS-5, ATS-8, ATS-9, ATV-1, DKT3 | Atorvastatin Calcium |

| D-5/BHA-4 | Rosuvastatin |

| Antibiotics | |

| CMIC Chloride | Cloxacillin |

| DCIMC Chloride | Dicloxacillin |

| FCIMC Chloride | Flucloxacillin |

| PMIC Chloride | Oxacillin |

| ENC | Nafcillin |

| NFHDA | Mecillinam, Pivmecillinam |

Contract Services

CRAMS

- Arch Pharmalabs expanded into Contract Research and Manufacturing Services (CRAMS).

- Provides full services from process development to commercial manufacturing (US/EU compliant).

- Utilizes proprietary bio-catalytic and enzymatic technologies for efficient production.

- Focuses on NCE synthesis, complex product manufacturing, and on-patent API production.

- Partners with innovator firms to secure long-term contracts and deliver customized solutions.

- Aims to be a high-value global player through strategic acquisitions and specialized services.

Management

Industry Overview

The Indian pharmaceutical industry, valued at ₹4.15 lakh crore in 2024, is growing at 11-12% CAGR and projected to reach ₹6.64-7.47 lakh crore by 2028. A global leader in APIs, CRAMS, and generics, it’s expanding in emerging markets, driven by AI, biotech, and the PLI scheme. However, it faces challenges like regulatory compliance, cost pressures, and IP concerns.

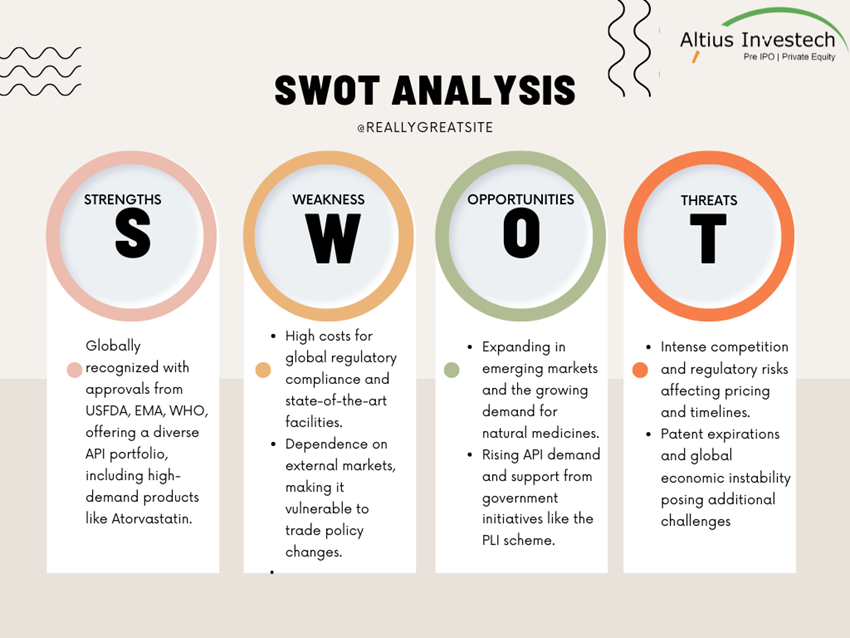

SWOT Analysis

INSIGHT

Financial Highlights

Particulars | FY 2023 | FY 2022 |

Revenue | 1,344 | 1,314 |

EBITDA | 183 | 182 |

Profit after tax | 122 | 52 |

EPS | 8.02 | 3.41 |

PAT Margin | 9% | 4% |

Peer Comparison

Particulars | Arch Pharmalabs ltd.. | Gujarat Themis Biosyn Ltd | Hikal ltd | Aarti Drugs Ltd |

Revenue | 1,344.16 | 155 | 2028 | 2718 |

EBITDA | 182.85 | 80 | 263 | 308 |

Profit after tax | 122.12 | 58 | 78 | 166 |

EPS | 8.02 | 40 | 6 | 18 |

Book value per share | 15.31 | 18.50 | 96.30 | 128 |

Share Price | 129 | 335 | 347 | 554 |

MCAP | 1975 | 3653 | 4,262 | 5094 |

P/E Ratio | 16 | 67 | 63 | 39 |

P/S Ratio | 0.10 | 2.16 | 0.17 | 0.20 |

P/B Ratio | 8.43 | 18.10 | 3.60 | 4.32 |

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe