Anheuser Busch Inbev Unlisted Share

₹313

*Average Price as per 25 April, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

6.43

NO OF SHARES

408580000

EPS

-7.45

SALES

3354.5

INDUSTRY PE

108.77

DIVIDEND

0

DIVIDEND YIELD

0

PE

-80.4

PB

93.16

PS

7.3

MARKET CAP

24473.94

EQUITY

616.58

PAT

-677.3

MESSAGE

OVERVIEW

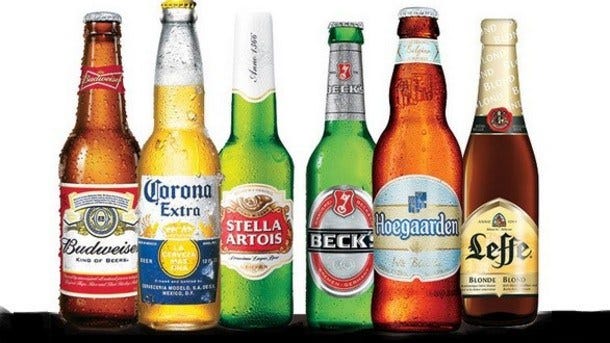

Anheuser-Busch InBev, initially named SABMiller India Ltd., emerged in 1988 from Belgium, rapidly gaining ground in the Indian market. Over the years, it evolved into a multinational brewing corporation renowned for its diverse portfolio of beverages, with a particular emphasis on globally recognized beer brands such as Budweiser, Corona, and Stella Artois. Continual innovation drives the company's success, with regular introductions of new beer varieties and packaging innovations to maintain its competitive edge in the global market. Moreover, Anheuser-Busch InBev prioritizes sustainability, investing in initiatives like water conservation and eco-friendly brewing techniques. Its sustained growth and profitability stem from strategic acquisitions and a steadfast commitment to financial performance, solidifying its position as a dominant player in the global beer industry.

Company Name | Anheuser-Busch InBev India |

Scrip Name | SAB Miller |

Sector | Breweries & Distilleries |

What does Anheuser Busch Inbev Own?

Anheuser Busch Inbev owns a large number of popular beer brands around the world, including:

| Beck’s |

| Budweiser |

| Busch |

| Corona |

| Elysian |

| Franziskaner |

| Goose Island |

| Löwenbräu |

| Michelob |

Anheuser-Busch InBev’s Diversification Strategy in India

Anheuser-Busch InBev, renowned for beer brands like Budweiser and Corona, is expanding beyond beer categories in India. With a focus on gin, rum, whiskey, and non-alcoholic products, the company aims to capitalize on market growth. Since 2021, it has introduced products like Budweiser Magnum Double Barrel Whiskey and Hoegaarden gin variants. This diversification strategy, built on a consumer-centric approach, aims to strengthen market presence in existing markets like Telangana and Maharashtra while entering new markets like Mumbai and Pune. Supported by 10 manufacturing units and a robust distribution network Anheuser-Busch InBev is poised for strategic expansion beyond its traditional beer offerings.

Flagship Brand: Budweiser

Budweiser is the flagship brand of Anheuser-Busch beers. The name came from the Budweis region of Bohemia, which is now known as České Budějovice in Czechia. That location is where the beer was originally brewed. For decades, the brand’s Bud Light had been the best-selling beer in America, though the top spot in beer sales was taken over by Modelo Especial in 2023.

INSIGHT

Key Strengths of Anheuser-Busch InBev:

- Market leadership with a vast portfolio of over 500 beer brands.

- Ownership of iconic beer labels like Budweiser, Stella Artois, and Corona.

- Diverse range of global, local, and craft beers catering to various consumer preferences.

- Extensive global distribution network ensuring widespread accessibility.

- Benefits from economies of scale in production, distribution, and marketing.

- Prioritization of innovation and regularly introducing new products.

- Strategic acquisitions driving growth and market dominance.

- Recognized for impactful marketing campaigns and sponsorship agreements.

- Dedication to sustainability initiatives enhancing corporate image and operational efficiency.

- Diversified shareholding structure contributing to overall strength of the company.

Key Weaknesses of Anheuser-Busch InBev:

- Complex organizational structure.

- Exposure to diverse regulatory landscapes.

- Heavy reliance on alcoholic beverages.

- Saturation in key beer markets.

- Challenges in brand management.

- Shifting consumer preferences towards healthier alternatives.

- Vulnerability to economic downturns.

- Complexity in managing global supply chain.

Financials

₹(in crores)

Particulars | FY 2019 | FY 2020 | FY 2021 |

Net Revenue | 3,167.20 | 3,354.50 | 2,845.30 |

EBITDA | (67.90) | (372.50) | (397.60) |

Profit After Tax | (304.60) | (677.30) | (705.30) |

In 2018, the company undertook a significant strategic decision by liquidating its associate company, Anheuser Busch InBev Breweries Private Limited. This move likely had profound implications for the company's operations and financial standing.

Over the three fiscal years from 2019 to 2021, the company's financial performance exhibited varying trends. Net revenue experienced a minor fluctuation, with a 5% increase from FY 2019 to FY 2020 followed by a 16% decrease in FY 2021. However, EBITDA showed a more pronounced negative trend, with losses widening by 485% from FY 2019 to FY 2021. Similarly, the profit after tax (PAT) saw a significant deterioration, with losses escalating by 132% over the same period.

Anheuser-Busch InBev : Competitors

Anheuser-Busch InBev’s Market Dominance Fueled by Premium Brands in India

Anheuser Busch Inbev asserts its market dominance and consistent market share growth, driven by the increasing demand for its premium brands. India, the fourth largest market for Budweiser by volume, plays a significant role in the company’s global operations. Notably, Anheuser Busch Inbev generated nearly a third of its sales from premium brands in India two years ago, highlighting the success of its optimization strategy in the Indian market.

Anheuser Busch Inbev IPO Plans

Anheuser-Busch InBev’s IPO plans for its Asian subsidiary, Budweiser Brewing Company APAC, were ambitious but ultimately suspended due to market conditions. Initially targeting a valuation of $70 to $80 billion, the company aimed to raise $8 to $10 billion, but institutional demand fell short. The IPO was intended to help Anheuser-Busch InBev address its significant debt, but the company faces challenges in China’s beer market, where competitors like Carlsberg and Heineken are gaining ground with premium offerings and strategic partnerships. As of now, there’s uncertainty about whether Anheuser-Busch InBev will proceed with the IPO or explore alternative strategies to address its financial challenges.

Anheuser Busch Inbev Unlisted Share Price Journey

The unlisted share price reached a 52-week low on March 21, 2023, at Rs. 313 and a 52-week high on January 16, 2024, at Rs. 430. The unlisted share price as of February 2024 is Rs. 430.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| AB Inbev Asia B V | 63 % |

| Anheuser Busch Inbev Breweries Private Limited | 34.77 % |

| Sabmilier India Holdings | 1.3599999999999999 % |

| Austindia Pty Limited | 0.4 % |

| Other | 0.47 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe