Anglo French Drugs Unlisted Share

₹555

*Average Price as per 5 May, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

1384

NO OF SHARES

1234067

EPS

-99

SALES

95.2

INDUSTRY PE

0

DIVIDEND

1.5

DIVIDEND YIELD

0.06

PE

-26.93

PB

1.93

PS

3.46

MARKET CAP

329

EQUITY

1.23

PAT

-12.34

MESSAGE

2023-24

OVERVIEW

Anglo-French Drugs & Industries Limited (AFDIL), established in 1942, is a leading pharmaceutical company known for pioneering single vitamin injections and B-complex combinations in India. Acquired by the Kanoria Group in 1985, AFDIL expanded into manufacturing with a WHO-GMP-approved facility in Bangalore, capable of producing 1,500 million tablets annually. The company offers over 300 products across segments like nutraceuticals, CNS, skin, and respiratory care. AFDIL is recognized for its commitment to quality, innovative R&D, and affordable healthcare solutions, operating through divisions such as AFD Pharma, Hospicare, Optima, and Export.

Name | Anglo-French Drugs & Industries Ltd |

Registration Date | 1/2/1923 |

Category | Indian Non- Government Company |

Industry | Pharma |

Registered Address | Peenya,Bengaluru, Karnataka,560058 |

Business Segment

AFD Pharma

Specializing in products tailored for an aging population, AFDIL focuses on wellness and immunity. Its extensive portfolio includes immunity boosters, fertility support, liver health supplements, women’s health solutions, and general wellness products.

Hospicare

Hospicare focuses on products for orthopedic and general health, leveraging strong ties in the institutional and surgical markets. It aims to become a trusted partner for doctors, offering high-quality, affordable pharmaceutical solutions. Notable products include Afdical Advance Tablets, Anglogesic Plus Gel, and Cartitone Tablets.

Export

Since its inception in 1997 with product registrations in Russia, the export division has expanded to 16 countries across Eastern Europe, Southeast Asia, and Africa. Evolving from a trading model to a marketing-focused approach, the company has a strong presence in Belarus, Mauritius, and Myanmar, supported by dedicated field teams. It offers a diverse range of APIs, including vitamins and antibiotics, and is recognized for consistently exceeding international customer expectations in pharmaceutical exports.

Optima

Optima collaborates with Recova Pharma Expo Pvt. Ltd. to distribute AFDIL’s extensive range of over 350 products throughout India. Specializing in the production of generic medicines, Optima ensures that affordable healthcare solutions are accessible across various therapeutic segments nationwide.

Trading

The Trading division specializes in supplying high-quality raw materials, particularly vitamins and APIs, to pharmaceutical manufacturers. With expertise in sourcing both locally and internationally, it partners with leading institutions and manufacturers in India. Acting as a formulator, supplier, and distributor, the division offers a broad range of APIs, including vitamins (C, B5, B6, B12), antibiotics (Azithromycin, Cefixime, Ceftriaxone), and other compounds like Metronidazole, Diclofenac Sodium, and Pantoprazole Pellets.

Product Portfolio

AFD Pharma & Hospicare

- AFD Shield

- Livocumin

- Neugracia

- AFDICAL ADVANCE Tablets

- Lyber – M

- CARTITONE Tablets

- L-STYLE Tablets

- KAL-D3 Tablets

AFD Export

- Tedyvit Vitamin B Complex Gummies*: Complete B vitamins with choline and inositol.

- Tedyvit Multivitamin & Minerals Gummies*: Suitable for all age groups.

- Freshitol Hand Sanitizer*: 72% alcohol, kills 99.9% of germs, hydrates skin, leak-lock protection.

Management

Industry overview

India stands as a significant global force in the pharmaceutical industry, renowned for its cost-effective manufacturing and skilled labor. As the leading producer of generic medicines, India fulfills a large share of the global demand for vaccines and generic drugs, particularly in markets such as the US and UK. The industry's expansion, akin to that of Anglo-French Drugs & Industries Limited (AFDIL), has been fueled by domestic expertise, cost efficiency, and international growth. Despite facing challenges such as limited R&D investment and regulatory pressures, there are considerable opportunities for growth in exports, generic drug production, and research and development.

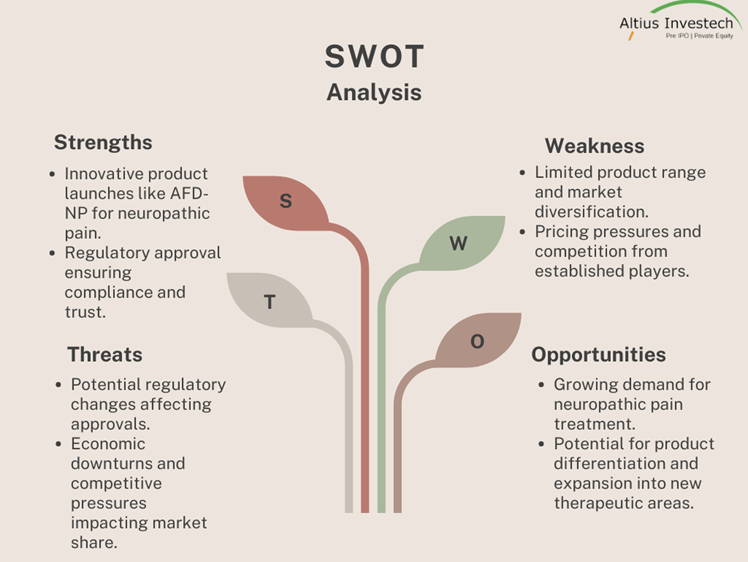

SWOT Analysis

INSIGHT

Financial Highlights

₹ in crores

Particulars | FY 2023-24 | FY 2022-23 | decrease % |

Revenue from Operations | 100 | 110 | -9.3 |

EBTDA | -7.29 | 256 | _ |

Profit after Tax | -12.34 | 191 | _ |

EPS | -99 | 1478 | |

Peer Comparison

Particulars | Anglo French Drug &Industries LTD. | Pfizer Ltd (standalone) | Sanofi India | Procter & Gamble Health Ltd (standalone) |

Revenue | 100 | 2374 | 29,164 | 12480 |

PAT | -12.34 | 551 | 603 | 229 |

EPS | -99 | 121 | 261.78 | 138 |

EBITDA | -9.14 | 824 | 887 | 343 |

Share price (August 21,2024) | 3299 | 6,130 | 7,132 | 5,201 |

MCAP | 407.00 | 28,031 | 16,406 | 8705 |

P/E Ratio | -33.32 | 183 | 33.4 | 40.46 |

P/S Ratio | 4.08 | 12 | 1 | 0.7 |

P/B Ratio | 2.38 | 20 | 24 | 16 |

Book value per share | 1384 | 302 | 298 | 324 |

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Abhay Kanoria Family Trust represented by Mr. Abhay Kanoria | 54.37 % |

| Ninaad Finance And Properties Pvt Ltd | 9.99 % |

| Life Insurance Corporation of India | 6.97 % |

| Other | 28.67 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe