A V Thomas Unlisted Share

₹19222

*Average Price as per 30 April, 2025

Fundamentals

FACE VALUE

10

BOOK VALUE

7896.6

NO OF SHARES

456540

EPS

1415

SALES

1079.13

INDUSTRY PE

79.44

DIVIDEND

350

DIVIDEND YIELD

0.97

PE

25.44

PB

4.56

PS

1.52

MARKET CAP

1643.54

EQUITY

0.45

PAT

64.61

MESSAGE

2023-24

OVERVIEW

- A.V. Thomas and Company Limited, a family-owned business established in 1935, has grown into a diversified conglomerate operating in consumer products, trading, dairy, and logistics. Their flagship tea brand, AVT Premium, is a leading player in the Indian market.

- The company offers comprehensive roofing solutions through its trading division and a range of dairy products under the AVT Dairy Sure brand.

- Their logistics division provides end-to-end solutions for importers and exporters worldwide.

- AVT's success is attributed to their ability to identify opportunities, forge strong partnerships, and maintain a commitment to quality and ethical business practices.

Products & Services:

- Consumer Products (which includes Tea, Coffee, Cardamom, Milkshakes, Ghee, Dairy Whitener). The Company has branded beverage business operations mainly in South India and exports to Middle East.

- Roofing Materials (which includes GI Sheets, Pipes and Profiled Sheets). The Company has a pipe manufacturing facility at Perundurai, Erode, Tamil Nadu and Roof Profiling units in the states of Tamil Nadu & Kerala and sells primarily in India through independent distributors.

- The company has a Logistics Division which is into the service of Clearing House Agency.

Key Management:

1. Mr. Ajit Thomas | Executive Chairman

- Mr. Thomas graduated with a Bachelor of Science degree, from Loyola College, Chennai.

- Mr. Thomas has served on the Madras Chamber of Commerce, Spice Board of India, and was the President of the United Plantations Association of South India in its Centennial year.

- He is also an angel investor.

2. Mr. Dilip Thomas | Executive Vice Chairman

- Mr. Dilip Thomas is an industrialist and has rich experience in Plantations, Finance and Business Management and Posesses considerable knowledge in Plantation Industry.

- Dilip Thomas is known for his expertise in the trading sector and his contributions to the growth and success of the A.V. Thomas Group. He likely plays a significant role in managing the company's relationships with suppliers, customers, and other stakeholders within the trading division.

- He is also a well-known golf administrator and has received the ‘Lifetime contribution to Golf Award at the Golf Industry Association.

INSIGHT

Industry Overview:

1. Tea & Coffee business: The Indian tea and coffee industry is a significant contributor to the country's economy, known for its high-quality products and rich history. As the world's largest producer and consumer of tea, India accounts for approximately 28% of global tea production. The Indian tea industry has historically experienced steady growth, with an average annual growth rate of around 3-4%. However, recent years have seen fluctuations due to factors such as global economic conditions and changes in consumer preferences. The Indian coffee industry has witnessed more rapid growth, with an average annual growth rate of around 6-7%. This growth is primarily driven by increasing domestic consumption, particularly in urban areas, and expanding exports.

2. Spice business: The Indian spice processing market is a significant contributor to the country's economy, driven by the nation's rich culinary heritage and global demand for Indian spices. India is a major producer and exporter of a wide range of spices, including turmeric, chili, cumin, coriander, and cardamom. The market is estimated to be worth around USD 10 billion, with annual growth rates of approximately 5-7%. India's spice processing industry is characterized by a mix of large-scale organized players and small-scale traditional processors.

3. Dairy Business: India is a major producer of milk, with annual milk production exceeding 200 million tonnes. The dairy industry contributes significantly to the country's economy, providing livelihoods for millions of farmers and supporting various value-added dairy products. The market is estimated to be worth around USD 80 billion, with annual growth rates of approximately 5-7%. The Indian dairy market is characterized by a mix of organized and unorganized players, with organized players gaining market share through investments in modern dairy farming practices and processing facilities.

4. Roofing Material: The Indian roofing material market is estimated to have reached a size of approximately USD 12 billion in 2023. The market is projected to grow at a CAGR of 6-7% during the forecast period of 2024-2028. The growing demand for roofing materials, coupled with the increasing awareness of quality and sustainability, is expected to drive the market's growth in the coming years.

5. Logistics business: The Indian CHA market is a dynamic and competitive industry, with a market size estimated at USD 2.5 billion in 2023. The market is driven by the growing volume of international trade and the increasing complexity of customs regulations. CHAs play a crucial role in facilitating customs clearance, documentation, and compliance for imported and exported goods. Despite the challenges posed by competition and regulatory changes, the CHA market is expected to continue growing at a rate of 6-7% during the forecast period of 2024-2028.

Shareholder’s holding more than 5% shares:

Name | No. of shares held | % of total shares |

Mr. Ajit Thomas | 2,26,992 | 49.72% |

Mr.Dilip Thomas | 1,57,020 | 34.39% |

Segment-wise Revenue:

Particulars | Consumer Products | Roofing Materials | Others | Total |

Total Revenue | 803 Crs. | 258 Crs. | 18 Crs. | 1079 Crs. |

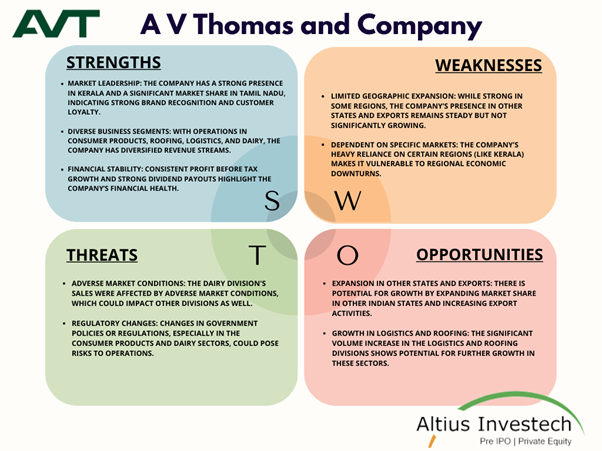

SWOT Analysis:

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Ajit Thomas | 45.22 % |

| Dilip Thomas | 33.39 % |

| AVT Holdings Private Ltd | 2.93 % |

| Sheila Sebastian Thomas Victor | 1.26 % |

| Pamela Mohan | 1.26 % |

| Other | 15.94 % |

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe