India Exposition Mart Unlisted Share

₹149

*Average Price as per 4 December, 2024

Fundamentals

FACE VALUE

5

BOOK VALUE

27.91

NO OF SHARES

74094000

EPS

3.13

SALES

194.7

INDUSTRY PE

0

DIVIDEND

1.25

DIVIDEND YIELD

1.08

PE

37.06

PB

4.16

PS

4.41

MARKET CAP

859.49

EQUITY

37

PAT

23.26

MESSAGE

2023-24

OVERVIEW

India Exposition Mart Limited (IEML) is a premier state-of-the-art integrated exhibition and convention centre located in Greater Noida,renowned for its technology-driven, world-class facilities and safety standards suitable for hosting international business-to-business exhibitions, conferences, congresses, product launches, and promotional events. As per the VMR Report, India Exposition Mart Limited ‘s exhibition and convention centre is divided into two distinct areas: the exhibition area and the showroom or mart area.

Services

| Security |

| Food & Beverage |

| Electricity Supply |

| Banking and Foreign Exchange Services |

| Helipad |

| Medical Facilities |

| Utility Kit |

| Housekeeping Services |

Mission: India Exposition Mart Limited aims to spur economic growth through seamless global interactions, fostering sustainable development and progress.

Facilities: India Exposition Mart Limited offers top-tier amenities including spacious exhibition halls, conference rooms, and VIP suites, ensuring a conducive environment for all participants.

Commitment to Excellence: India Exposition Mart Limited upholds rigorous standards of excellence in event logistics and customer service, striving to exceed expectations at every turn.

Sustainable Practices: India Exposition Mart Limited prioritizes sustainability through eco-friendly measures such as energy-efficient lighting and waste management, contributing to a greener future.

Global Reach: Strategically situated in Greater Noida, India Exposition Mart Limited serves as a gateway to one of the world's largest consumer markets, attracting domestic and international participants for prestigious events.

Subsidiary Companies

Name | State | Incorporation Year | Paid Up Capital |

Expo Digital India Private Limited | Uttar Pradesh | 2021 | 10.51 Lakhs |

INSIGHT

Key Strengths of India Expo Centre & Mart

- Established Track Record: India Expo Centre & Mart has a strong brand recognition and an established track record since 2006, hosting leading exhibitions like Auto Expo and IHGF Delhi Fair.

- Domain Expertise: The company's ability to understand market trends and customer preferences helps maintain high standards and adaptability across various sectors, reducing exposure to sector-specific fluctuations.

- World-Class Infrastructure: Located in Greater Noida, the Expo Centre offers top-notch amenities, connectivity, and services like banking, security, parking, and uninterrupted power supply, with ISO certifications.

- Strong Relationships: With 24 venue booking contracts and an order book worth ₹1,215.23 million, the company maintains long-term relationships with exhibition organizers, ensuring predictable revenue streams.

- Professional Management: The experienced management team brings extensive industry knowledge and relationships, ensuring continued growth and development.

- Global Connections: Being associated with leading industry associations like UFI, CII, and ICCA provides visibility, networking opportunities, and eligibility for organizing government events.

Segment Wise Performance The revenue break-up by Industry Vertical is provided as under:

Financials

₹(in crores)

Particulars | FY 2023 | FY 2022 | FY 2021 |

Revenue from Operation | 217.075 | 42.87 | 13.304 |

EBITDA | 104.81 | 8.55 | (13.40) |

Profit After Tax | 69.578 | (2.29) | (16.48) |

Earning per share | 9.59 | (0.24) | (2.22) |

The Compound Annual Growth Rate (CAGR) for revenue from operations from FY 2021 to FY 2023 is approximately 1.79%, indicating steady growth in operational revenue. EBITDA shows a significant CAGR of about 8.77%, reflecting notable improvement in operational profitability. Profit After Tax exhibits a CAGR of around 1.58%, signaling a gradual enhancement in bottom-line performance and financial stability. Additionally, Earnings Per Share (EPS) demonstrates a CAGR of approximately 3.40%, suggesting an upward trend in earnings available to shareholders on a per-share basis over the analyzed period.

Fiscal Success Drives Interim Dividend Declaration

Strong fiscal performance led to an interim dividend of 1.25 per equity share (25 percent) declared by the company on July 5, 2023, distributed based on shareholders' holdings as of June 30, 2023.

IPO Plans

DRHP Filed - 3rd March, 2022

Fresh Issue - 450 Crore

OFS - 11,210,659 equity shares.

India Exposition Mart Ltd's IPO: Fundraising and Growth Strategy

India Exposition Mart Ltd plans to raise Rs. 600 crore through an IPO, consisting of a fresh issue of Rs. 450 crore and an offer-for-sale (OFS) of up to 1.12 crore equity shares. Notable OFS participants include Vectra Investments, MIL Vehicles & Technologies, and others. The company may also consider a private placement of up to Rs. 75 crore. Emkay Global Financial Services is the sole book-running lead manager, and Kfin Technologies is the registrar to the offer. The IPO aims to fund capital expenditure for infrastructure expansion (Rs. 316.91 crore), debt repayment (Rs. 17 crore), and general corporate purposes. Overall, the IPO plan reflects India Exposition Mart Ltd's strategy to leverage public funding to support its growth initiatives, enhance infrastructure, and strengthen its financial position for future endeavors.

Recent News

International Tourism Expo in Greater Noida: Promoting India’s Global Appeal at India Expo Mart

An International Tourism Expo, supported by Informa Markets and the Union Ministry of Tourism, is slated for February 22 to 24(2024) at Greater Noida’s India Expo Mart. Expecting over 1,500 exhibitors and 800 buyers from 120 Indian cities, the event aims to enhance India’s tourism industry and global presence. This underscores India Expo Mart’s stature as a premier venue for hosting such significant international events, cementing its role in India’s exhibition industry.

INDIA EXPOSITION MART LIMITED UNLISTED SHARE PRICE JOURNEY:

The unlisted share price reached a 52-week high on March 1, 2023, at Rs. 149 and a 52-week low on November 9, 2023, at Rs. 146. The unlisted share price demonstrated stability, fluctuating within a narrow range between Rs. 146 and Rs. 149 over the past year, and currently stands at Rs. 148 as of February 2024.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Vectra Investments Private Limited | 22.75 % |

| Greater Noida Industrial Development Authority | 2.16 % |

| Vikas Kumar Agarwal | 2.12 % |

| Overseas Carpets Limited | 1.74 % |

| Other | 71.23 % |

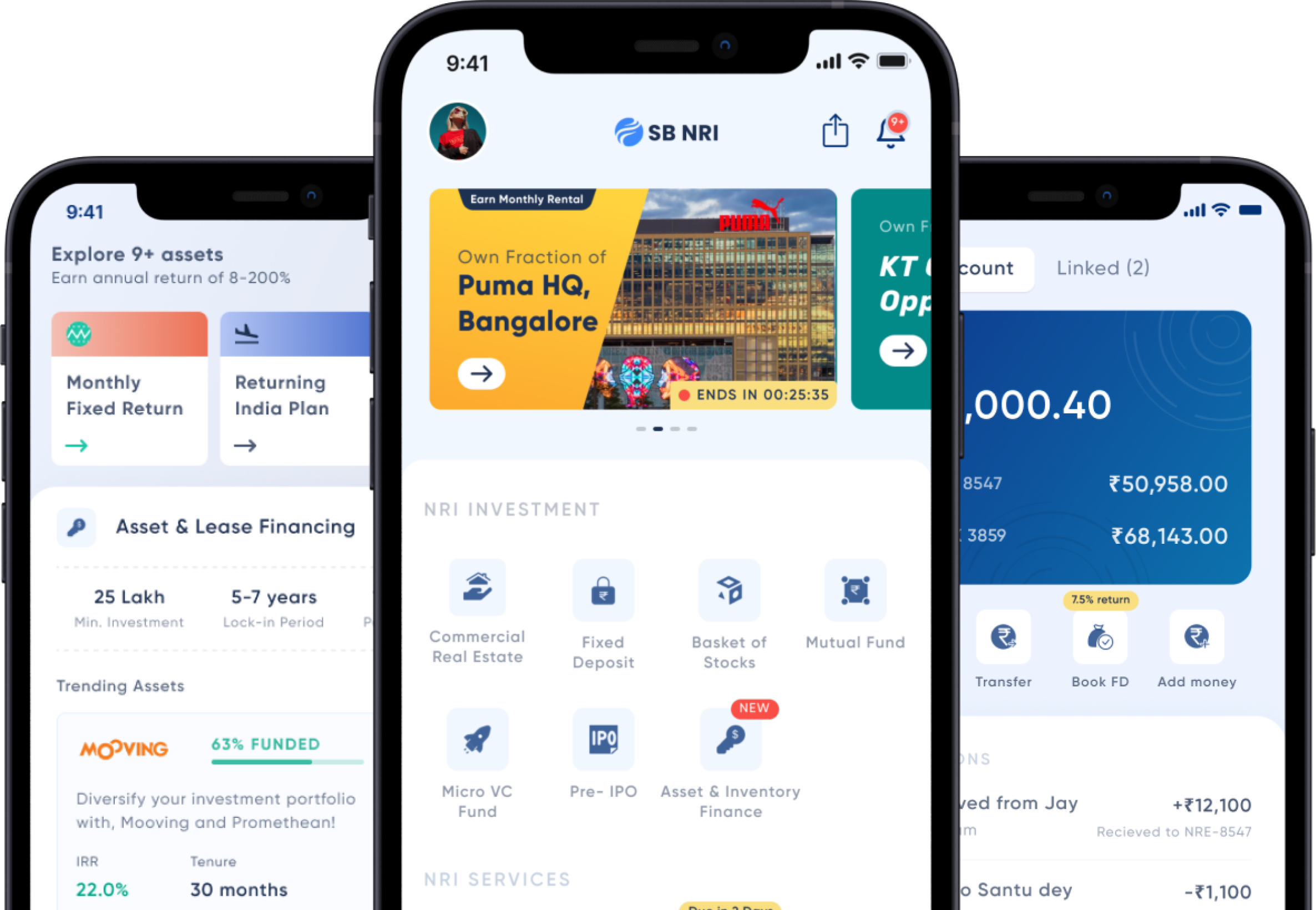

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe