Boat Unlisted Share Prices

₹785

*Average Price as per 4 December, 2024

Fundamentals

FACE VALUE

1

BOOK VALUE

42.36

NO OF SHARES

96146300

EPS

-8.24

SALES

3117.6

INDUSTRY PE

0

DIVIDEND

0

DIVIDEND YIELD

0

PE

-194.05

PB

37.75

PS

4.93

MARKET CAP

15373.79

EQUITY

9.6

PAT

-79.6

MESSAGE

2023-24

OVERVIEW

Genesis

Boat is a Delhi-based start-up that was started in 2016 by Aman Gupta and Sameer Mehta. The co-founders pumped in ₹15 lakh each and set sail their bootstrapped journey by selling mobile cables and chargers. Now it sells a wide variety of fashionable electronic goods ranging from travel chargers and premium cables to headphones, earphones, speakers. The company is steadily growing and extending its services to millions of ‘boAtheads’ (A term the company uses for all its consumers and brand ambassadors).

Timeline of Boat Unlisted Share

2016: Founded in 2016 and launched a wide range of earphones and headphones

2018: Raised Investment from Fireside Ventures

2019: Set up "Boat labs" - Inhouse R&D team

2020: Became Number 1. earwear brand in India (by volume)

2021: Launched Made in India wireless earphones and wireless neckband)

2022: #3 earwear and smartwatch brand globally based on volumes

2023: Reached milestone of 1 million Made in India products

Management

Aman Gupta - Executive Director, Co-Founder & CMO

·BCom from Delhi University, Chartered Accountant, MBA -ISB

·Ex- Citibank, Ex-KPMG, Ex-Harman International

Sameer Mehta - Chairman, Executive Director, Co-founder & CPO

·School - St. Xavier’s Mumbai, BCom NM College

·Co-founded Imagine Marketing Limited - the parent company of Boat

An Overview

·Secured dominant position in global audio and wearable Market and ranked second worldwide following Apple.

·Boat maintained a dominant position in the overall Indian market with a 29.7% share.

·Boat registered over 2x growth in its scale for two consecutive fiscal years: FY21 and FY22 and increased by 18% in FY-23.

·Boat’s revenue from operations shot up 2.2X to Rs 2886 crore during FY-22 as opposed to Rs. 1314 Cr in FY21.

·In FY-23 Net sales zoomed to nearly INR 3400 Cr on growth in Wearables, Audio Categories.

Focus on Make in India

· Before covid 0% of its products were made in India but now 70% of boAt products are made in India. The company aims to make 90 percent of its products in India in the next two years. Infact Boat announced that they manufactured 1 crore products in India in 2022.

· Boat has been working with several manufactures in India especially with Dixon Technologies being the primary partner. Through their R&D team at boAt labs and Kaha Technologies, they are developing the next generation of products.

· Covid has been a wake-up call for the electronics industry that is overly dependent on China and this JV with Dixon has been a big boost for boAt to innovate at a faster pace and develop a more cost-effective way of manufacturing in India itself.

Product Portfolio

INSIGHT

Financial Insights

(All Figures in

crores)

Particulars | FY-23 | FY-22 |

Total Income | 3403 | 2886 |

PAT | (129) | 69 |

EPS | (13.40) | 5.10 |

While Boat continues to maintain market leadership and profitability in audio segment, it invested in building out its wearables business, a relatively newer but now a sizeable product line for the company (and a large market opportunity), via sales, marketing and pricing-related investments, due to which near term profitability has been impacted given the conscious strategic calls made by the management.

Geography wise Split

(All Figures in crores)

Particulars | FY-23 | FY-22 |

Within India | 3239 | 2871 |

Outside India | 122 | - |

Total | 3361 | 2871 |

Segment wise revenue

(All Figures in crores)

Particulars | FY-23 | FY-22 |

Audio | 2351 | 2276 |

Wearables | 902 | 515 |

Others | 109 | 80 |

Total | 3361 | 2871 |

Boat winning the market share race

Boat secured dominant position in global audio and wearable Market and ranked second worldwide following Apple.

Boat maintained a dominant position in the overall Indian market with a 29.7% share.

Channels

Along with developing and growing their product portfolio, Boat have also expanded their presence across online and offline channels to widen their distribution footprint. India’s large and fast-growing e-commerce ecosystem and its enabling infrastructure allows digital-first brands to instantly cater to over 90% pin codes across India (Source: RedSeer Report). Their digital- first approach has enabled them to rapidly penetrate their target markets.

Valuations

Boat raised INR 500 Crores from Warburg Pincus and Malabar Investment Advisors at a valuation 11500 crore in October 2022 (last round) which leads to a price of around 1150-1200 per share.

Recently Mama Earth another D2C brand just like boat listed in the market at a P/S sales ratio of 6.6.

Accordingly,

Revenue of Boat : 3403 crores (FY-23)

Number of shares outstanding: 14 crores

Revenue per share: 243

Current Price (30 Dec,2023) : 1200

Price to sales ratio: 4.9

Share Price Journey of Boat Unlisted Share

Following the company's IPO filing in January 2022, boat shares were first offered on the unlisted market at a price of ₹1,225 per share. In September 2022, the share price had a 40% fall to 740 per share as the firm opted to postpone its initial public offering (IPO) plans because of the volatile market conditions. After hitting a low of ₹705 in June 2023, the share price has risen sharply by around 80% to ₹1275 per share in Jan 2024. Are you considering purchasing unlisted shares of Boat? Read this blog to find out if they are a good investment.

Boat Unlisted Share IPO Plans

· Boat had previously filed for an IPO in January 2022

IPO Size : 2000 crore (1100 Crore OFS, 900 Crores Fresh isssue)

· Boat deferred its first public offering (IPO), mostly due to its intention to raise 500 crore in capital from its existing investors. The unstable global market that was impacted by inflation, recession, and the Russia-Ukraine war was also another factor in the IPO withdrawal.

· Recently Aman Gupta - the co-founder of Boat had told the media that they may go for an IPO by FY25-FY26.

SECONDARY NAME

ISIN

CDSL

NSDL

INDUSTRY

SECTOR (READ ONLY)

SHARE HOLDINGS

| Name of Shareholder | Holdings |

|---|---|

| Sameer Mehta | 39.93 % |

| Aman Gupta | 39.93 % |

| South Lake Investment Ltd | 19.26 % |

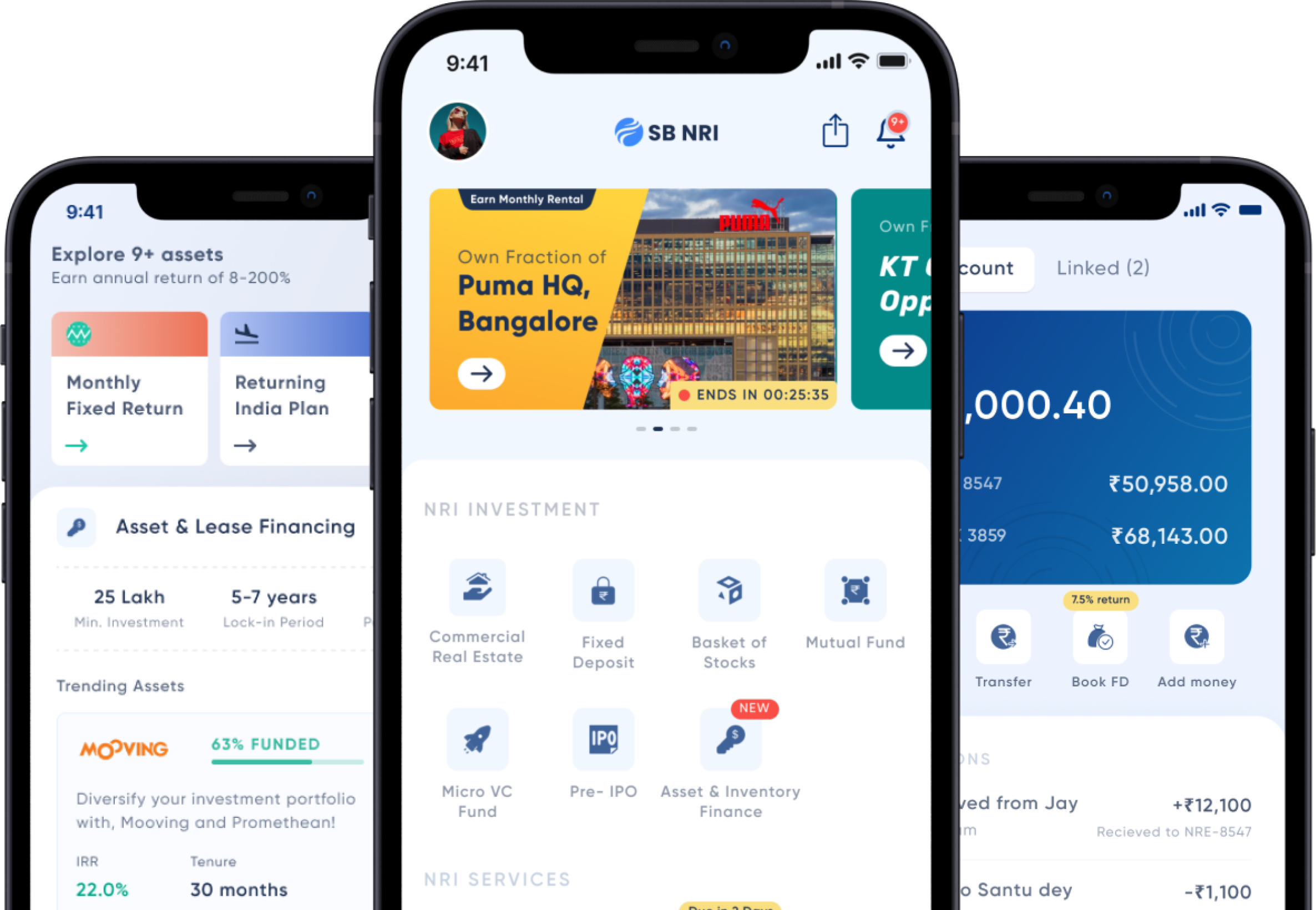

NRIs invest Before IPO via SB NRI

We're different. SB NRI is the first of it's kind platform built for NRIs offering digital Investment plans.

Schedule a CallTrusted by 1,000s of NRIs spread across the Globe